Bitcoin reached a new all-time high of $122,838 on July 14, however has since slipped right into a part of consolidation across the $118,000 degree. The current pause in upward momentum hasn’t dampened market sentiment, which stays firmly bullish. Based on Coinmarketcap’s Worry & Greed Index, Bitcoin continues to be at present sitting at a greed degree of 68. This sentiment, mixed with technical evaluation of the Logarithmic Development Curve (LGC), exhibits that Bitcoin continues to be on monitor for highly effective upward strikes.

Associated Studying

Greed Returns To The Market, However Not But Overheated

Bitcoin’s worth motion has spent the vast majority of the previous 48 hours holding above $118,000 after a wave of profit-taking befell simply after it peaked at $122,838. Nevertheless, on-chain knowledge exhibits an fascinating overview of Bitcoin traders.

Significantly, crypto analyst Axel Adler Jr. shared data from CryptoQuant exhibiting that the 30-day transferring common of the Worry and Greed Index has climbed again into the optimism zone, now sitting at 66.2%. Though sentiment surrounding the main cryptocurrency is at present in grasping territory, this degree is nicely beneath the 75% to 80% vary, which coincided with new worth highs in March 2024 and December 2025

The present 66% studying, whereas within the inexperienced degree, suggests there’s nonetheless room for bullish sentiment to develop earlier than the market enters a euphoric blow-off part. In essence, this metric exhibits that if Bitcoin continues to consolidate and push increased with out the sentiment getting into into excessive greed ranges between 75% and 80%, it should proceed on a sustainable push to new heights.

Bitcoin Re-Enters Resistance Zone On Development Curve

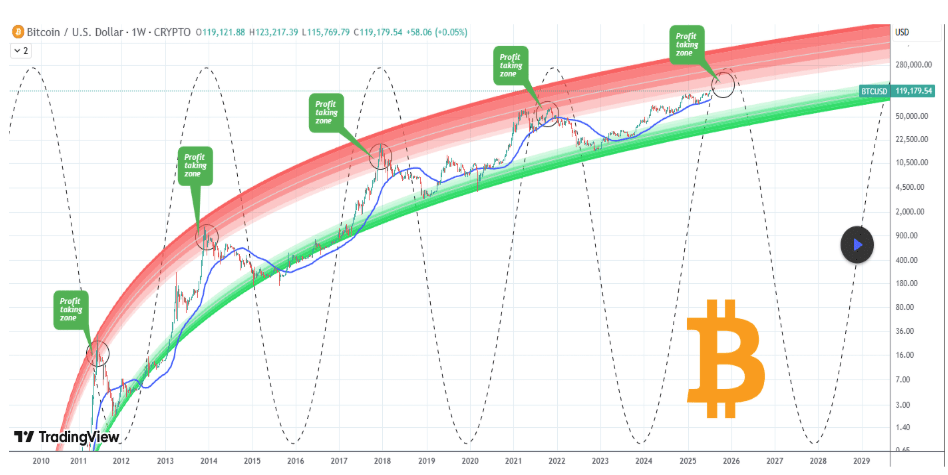

As talked about earlier, Bitcoin’s break above the $120,000 worth degree and its subsequent peak had been adopted by a wave of profit-taking. The pattern noticed Bitcoin’s worth right to $116,000 very briefly earlier than stabilizing round $118,000. Curiously, technical analysis of the weekly candlestick timeframe exhibits that Bitcoin re-entered the primary band of the Logarithmic Development Curve (LGC) resistance zone because it reached this worth peak.

This band, which is recognized as the sunshine pink area within the chart beneath, has at all times served because the profit-taking space in every of Bitcoin’s previous bull markets. Curiously, Bitcoin briefly tapped this space in December 2024 and January 2025 earlier than being rejected, in a sample much like that of January 2021’s first top in the previous bull cycle.

Image From TradingView: TradingShot

Principally, this indicator implies that Bitcoin is now at first of a ultimate build-up part. Based on crypto analyst TradingShot, who posted the evaluation on the TradingView platform, the final word prime for this cycle goes to be between October and November 2025. Relying on the timing and energy of things like anticipated US fee cuts in September, Bitcoin’s peak might land wherever between $140,000 and $200,000.

Associated Studying

On the time of writing, Bitcoin is buying and selling at $118,152.

Featured picture from Pexels, chart from TradingView