Political Instability Shakes Turkey’s Monetary Panorama

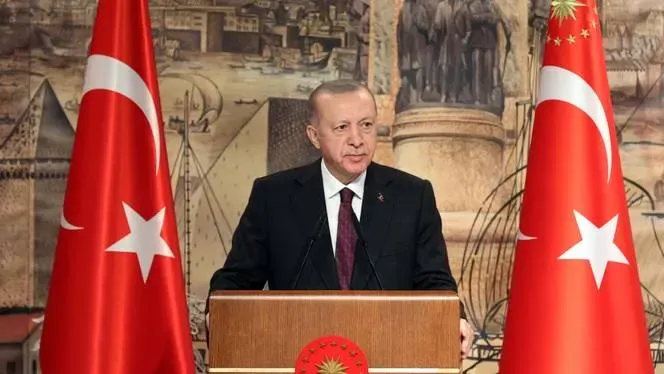

Turkey’s monetary system is experiencing unprecedented turmoil following the arrest of a key political rival to President Recep Tayyip Erdogan. The Turkish lira (TRY) has plummeted to historic lows in response, triggering widespread investor nervousness. The dramatic depreciation of the lira underscores the inherent vulnerability of fiat currency throughout occasions of political disaster and financial uncertainty. As belief in conventional monetary techniques erodes, many Turkish residents are in search of different shops of worth to guard their wealth.

Political instability has traditionally performed a serious position in shaping market sentiment, and Turkey is not any exception. When governments crack down on opposition figures, implement restrictive insurance policies, or reveal financial mismanagement, markets are likely to react swiftly. The lira’s fast decline has reignited discussions round foreign money stability, financial insurance policies, and the long-term viability of fiat foreign money in nations present process political strife.

The present disaster additionally displays broader issues about Turkey’s financial trajectory. Persistent inflation, excessive exterior debt, and controversial financial insurance policies have already strained the Turkish financial system. The latest political occasion has exacerbated these current tensions, accelerating capital flight as traders search refuge in belongings that may keep worth amid turbulent circumstances. This situation reinforces the vital query: can world traders and on a regular basis residents proceed to belief fiat in politically unstable areas?

How Geopolitical Occasions Drive Capital Flight to Bitcoin

All through historical past, monetary instability brought on by political occasions has pushed traders towards different asset lessons. Historically, gold has been the safe-haven asset of selection, offering stability throughout financial downturns. Nevertheless, lately, Bitcoin (BTC) has emerged as a contemporary different attributable to its digital nature, shortage, and borderless accessibility.

Bitcoin’s attraction as a hedge in opposition to inflation and foreign money devaluation has grown considerably in economies grappling with political and financial crises. In nations experiencing fast foreign money depreciation—resembling Venezuela, Argentina, and now Turkey—traders and on a regular basis residents are more and more turning to Bitcoin instead monetary system, free from governmental management. The decentralized nature of Bitcoin makes it a very enticing choice for these in search of monetary autonomy in unstable environments.

Not like fiat currencies, which might be manipulated by central banks and authorities insurance policies, Bitcoin operates on a decentralized blockchain, proof against extreme cash printing and arbitrary financial interventions. As Turkey’s monetary instability unfolds, Bitcoin serves as a dependable retailer of worth for these trying to protect their wealth in opposition to the eroding buying energy of the lira.

Binance Sees Unprecedented Bitcoin-TRY Buying and selling Quantity

In response to the lira’s sharp decline, a big spike in Bitcoin buying and selling quantity has been noticed throughout cryptocurrency exchanges, notably on Binance. The Bitcoin-Turkish lira (BTC/TRY) buying and selling pair has skilled an unprecedented surge as Turkish traders scramble to transform their devaluing foreign money into Bitcoin.

This phenomenon just isn’t distinctive to Turkey; comparable spikes in Bitcoin buying and selling quantity have been recorded in different nations dealing with fiat foreign money crises. For instance, in Venezuela, hyperinflation decimated the bolivar, driving native demand for Bitcoin as a hedge in opposition to financial catastrophe. Likewise, in Argentina, the place inflation has remained persistently excessive, residents have more and more turned to cryptocurrencies as a method of preserving buying energy. In each instances, Bitcoin has provided monetary resilience in extraordinarily unstable macroeconomic environments.

The growing BTC/TRY commerce quantity displays the rising mistrust in Turkey’s centralized monetary system. Turkish traders and companies are in search of methods to guard their financial savings from additional depreciation, and Bitcoin gives a viable different that permits them to retain worth whereas avoiding restrictive capital controls. This shift highlights the transformative position Bitcoin performs in economies scuffling with financial instability and authorities overreach.

Funding Methods Amid Geopolitical Chaos

For seasoned traders, geopolitical crises current each dangers and alternatives. Understanding world market dynamics and the consequences of political turmoil on asset costs might be instrumental in making knowledgeable selections throughout unsure occasions.

The continuing decline of the Turkish lira serves as a reminder of the broader pattern of fiat foreign money debasement all over the world. As central banks resort to inflationary insurance policies and political instability weakens belief in financial techniques, Bitcoin continues to achieve traction as a long-term hedge in opposition to foreign money threat. Buyers who acknowledge these patterns typically make use of strategic approaches to leverage alternatives arising from geopolitical chaos.

One efficient funding technique includes carefully monitoring buying and selling quantity developments, analyzing authorities insurance policies, and assessing general market sentiment. As Bitcoin adoption rises throughout monetary crises, early traders can place themselves to capitalize on growing demand. Moreover, diversifying into different crypto belongings resembling stablecoins and decentralized monetary merchandise can present additional safety in opposition to volatility.

Past hypothesis, Bitcoin’s position in wealth preservation can’t be neglected. It gives monetary freedom to people dwelling in unstable areas, permitting them to retailer worth and conduct transactions past the attain of restrictive monetary establishments. Turkish traders in search of options to the lira are recognizing Bitcoin as greater than a speculative asset—it’s an important instrument for financial survival.

For these following a contrarian investor mindset, the present turmoil in Turkey presents a defining second. Traditionally, monetary crises have served as pivotal turning factors for asset reallocation, and Bitcoin’s growing relevance in Turkey might mark a big shift within the nation’s monetary panorama.

Conclusion: A Turning Level for Turkish Buyers?

The arrest of Erdogan’s political opponent and the following financial instability might show to be a watershed second for Turkish traders and monetary markets. The fast decline of the lira has strengthened the dangers related to centralized financial insurance policies and political unpredictability.

As confidence within the Turkish monetary system erodes, Bitcoin is rising as a viable different for people and companies in search of financial stability. The surge in BTC/TRY buying and selling quantity is a testomony to rising demand for decentralized belongings that supply safety in opposition to inflation, devaluation, and governmental restrictions.

Going ahead, the broader implications of Turkey’s disaster might prolong past nationwide borders, influencing world perceptions of fiat reliability and accelerating the adoption of digital belongings. Ahead-thinking traders who act swiftly in response to Turkey’s growing demand for monetary independence might place themselves advantageously within the evolving monetary panorama.

Whereas the speedy future stays unsure, Bitcoin’s resilience amid financial hardship highlights its enduring worth. As Turkey navigates financial and political turbulence, Bitcoin stands as a beacon of economic sovereignty, enabling residents to reclaim management over their wealth in an more and more unstable world.