On-chain information reveals the Ethereum MVRV Ratio has seen a notable decline just lately. Right here’s what this might imply for the value, in keeping with historical past.

Ethereum MVRV Ratio Has Fallen To A Comparatively Low Stage Just lately

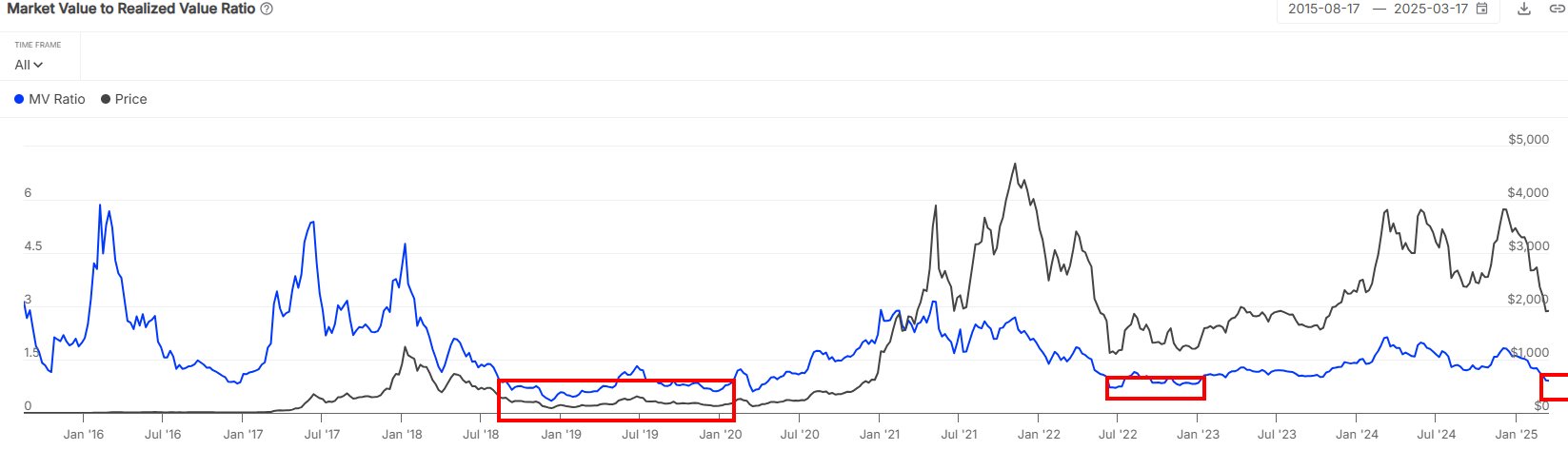

In a brand new post on X, the market intelligence platform IntoTheBlock has mentioned in regards to the newest pattern within the Market Value to Realized Value (MVRV) Ratio of Ethereum. The MVRV Ratio refers to an on-chain metric that measures the ratio between the market cap and realized cap of ETH.

Briefly, what this indicator tells us is how the worth held by the traders as an entire compares towards the funding that they initially made to buy their cash.

When the MVRV Ratio is larger than 1, it means the common holder may be assumed to be carrying a web unrealized revenue. Alternatively, the metric being underneath the cutoff suggests the general market is underwater.

Now, right here is the chart for the indicator shared by the analytics agency, that reveals the pattern in its worth for Ethereum over the previous decade:

The worth of the metric seems to have been sliding down in latest days | Supply: IntoTheBlock on X

As is seen within the above graph, the Ethereum MVRV Ratio has gone down just lately and crossed beneath the 1 mark, implying the ETH traders are actually in web loss. The explanation behind this shift available in the market naturally lies within the value crash that the cryptocurrency has confronted as a part of a sector-wide downturn.

At current, the ETH MVRV Ratio has a price of 0.9. IntoTheBlock has famous that the indicator doesn’t attain this stage typically, with typically solely the bear markets with the ability to pressure it this low.

An attention-grabbing sample emerges when trying on the previous value trajectory that adopted intervals of the indicator sitting at such lows. “Traditionally, MVRV ratios beneath 1 have coincided with favorable entry factors for ETH,” says the analytics agency.

One thing to notice, nevertheless, is that whereas the MVRV Ratio falling into this zone has certainly confirmed to be bullish for Ethereum, the impact doesn’t are usually rapid, with the cryptocurrency normally having to remain for prolonged intervals within the area earlier than a rebound happens.

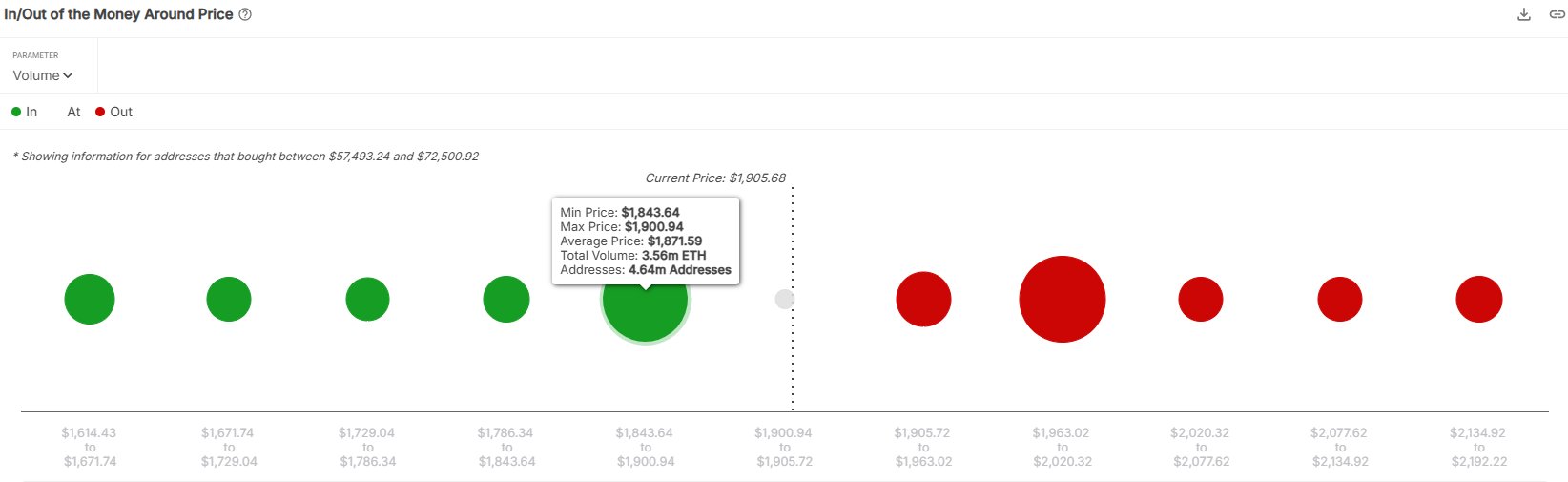

In another information, IntoTheBlock has identified in one other X post how a significant on-chain help block exists for ETH between the $1,843 and $1,900 ranges.

The fee foundation distribution throughout the assorted value ranges | Supply: IntoTheBlock on X

In on-chain evaluation, the power of any help stage is measured on the premise of how a lot of the availability was final bought by traders at it. The aforementioned value vary is especially dense when it comes to provide, as 3.56 million tokens of the asset had been purchased by 4.64 million addresses inside it.

“This accumulation suggests sturdy help, but when ETH slips beneath this vary, the chance of capitulation grows, as demand seems notably weaker past this stage,” says the analytics agency.

ETH Value

Ethereum is at present retesting the on-chain help zone as its value is buying and selling round $1,877.

Appears to be like like the value of the coin has gone stale just lately | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.