An analyst has identified how the 50-week shifting common (MA) of Bitcoin has traditionally acted as a type of magnet for the asset’s value.

50-Week MA Is Presently Located At $75,500 For Bitcoin

In a brand new post on X, analyst Ali Martinez has mentioned concerning the 50-week MA of Bitcoin. An “MA” is a technical evaluation indicator that calculates the common worth of any asset’s value over a given time period and as its identify suggests, strikes in time, updating its worth in line with the adjustments within the value itself.

Associated Studying

MAs may be helpful instruments for finding out long-term tendencies in an asset, as they easy out the value curve to take away any native deviations. An MA may be taken over any window of time, however there are some significantly in style decisions just like the 200-day.

Within the context of the present matter, the time-range of focus is the 50-week. Right here is the chart shared by the analyst, that reveals the development on this MA for Bitcoin over the previous decade or so:

As is seen within the above graph, Bitcoin has been approaching this line following the newest market downturn. The asset has beforehand proven a number of retests of this degree through the years.

“The 50-week shifting common has traditionally acted as a magnet for Bitcoin $BTC throughout development shifts,” explains Martinez. To date within the present cycle, the road has acted as assist for the cryptocurrency, serving to forestall the bull run from working out of steam.

At current, the 50-week MA is located at $75,500. Given the present trajectory of the asset, it’s attainable {that a} retest of the extent might find yourself going down as soon as extra. It solely stays to be seen, although, whether or not the extent would once more present assist to Bitcoin, or if it could usher within the bear market.

In another information, sentiment among the many US buyers has plummeted just lately, as CryptoQuant founder and CEO Ki Younger Ju has revealed in an X post.

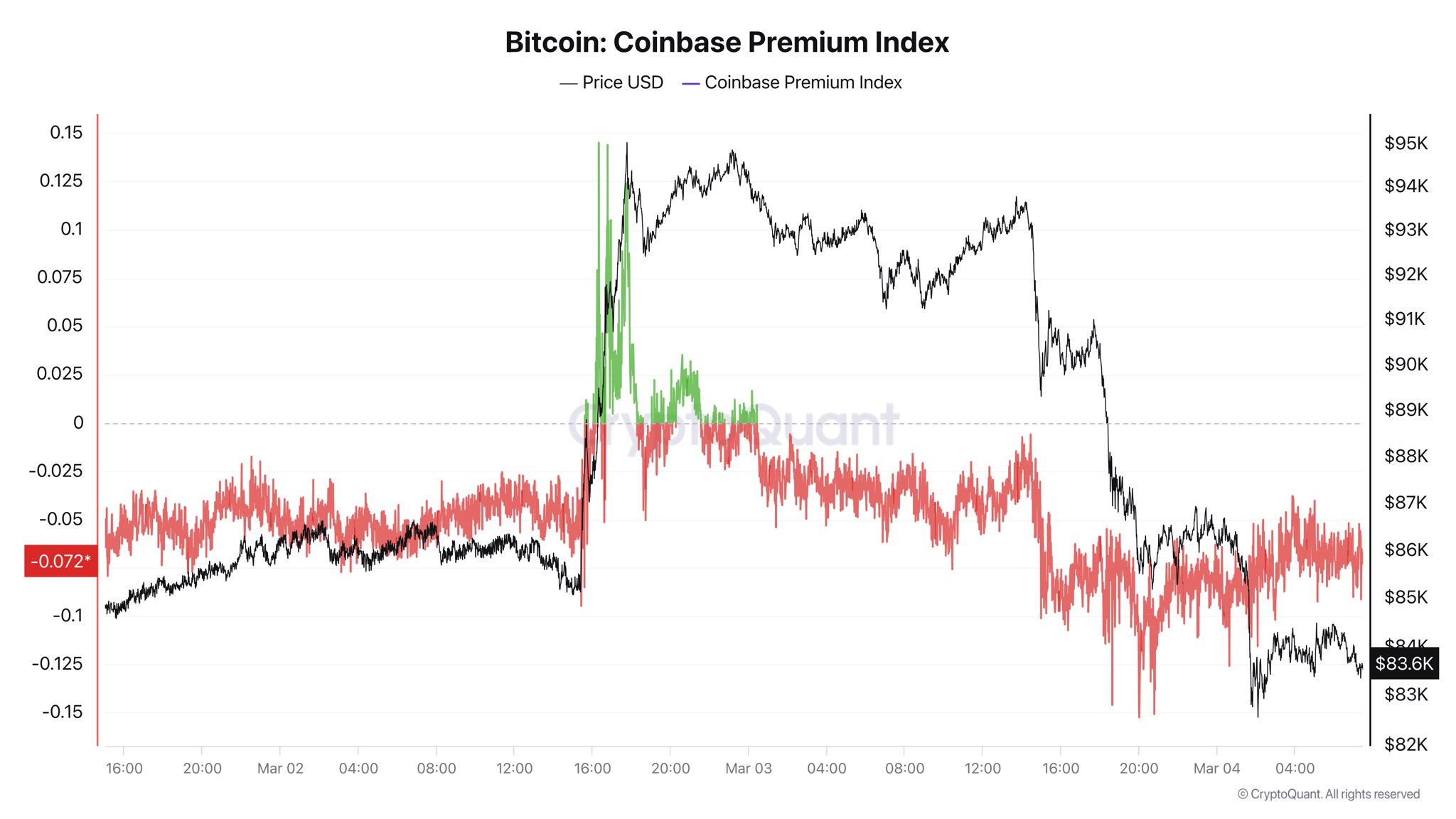

Within the chart, the info of the “Coinbase Premium Index” is displayed. This metric measures the distinction between the Bitcoin value listed on Coinbase (USD pair) and that on Binance (USDT pair).

The previous platform is especially utilized by American buyers, whereas the latter serves a world visitors, so the indicator’s worth primarily tells us about how the conduct differs between the 2 demographics.

Throughout the rally earlier, the Bitcoin Coinbase Premium Index spiked to a pointy optimistic degree, suggesting the US-based whales have been shopping for. Shortly after, although, it dipped again into the unfavourable and has since plunged deeper into the zone, implying customers on the alternate are performing some heavy distribution.

Associated Studying

“Bitcoin market will probably stay gradual till sentiment within the U.S. improves,” notes the CryptoQuant founder.

BTC Value

On the time of writing, Bitcoin is floating round $85,700, down greater than 4% during the last 24 hours.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com