Bitcoin seems poised for important upside motion following a powerful begin to 2025. Nevertheless, questions stay in regards to the market’s total well being and whether or not the present bullish momentum will be sustained over the approaching weeks and months. Right here, we’ll take an unbiased and data-driven look into the underlying numbers supporting our present pattern.

For a extra in-depth look into this subject, take a look at a latest YouTube video right here: Bitcoin Data Driven Analysis & On-Chain Roundup

Miner Restoration

The Puell Multiple, a measure evaluating miners’ day by day USD income to its yearly common, means that Bitcoin’s elementary community power stays sturdy. Traditionally, after a halving occasion, miner income experiences a big dip as a result of 50% block reward discount. Nevertheless, the Puell A number of lately climbed above the important thing worth of 1, indicating a restoration and a doubtlessly bullish part.

Earlier cycles present that crossing and retesting the worth of 1 usually precedes main value rallies. This sample is repeating, signaling sturdy market assist from mining exercise.

Substantial Upside Potential

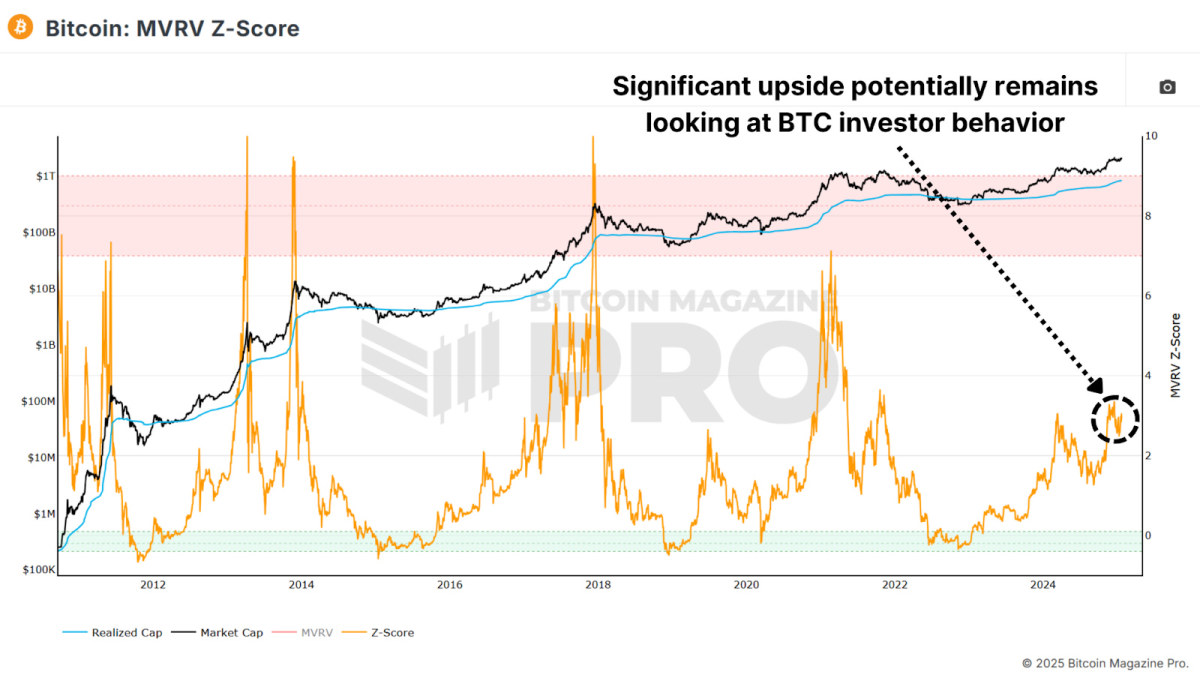

The MVRV Z-Score, a metric analyzing Bitcoin’s market worth relative to its realized worth, or common accumulation value for all BTC, suggests present values stay effectively under historic peak areas, outlining appreciable room for development.

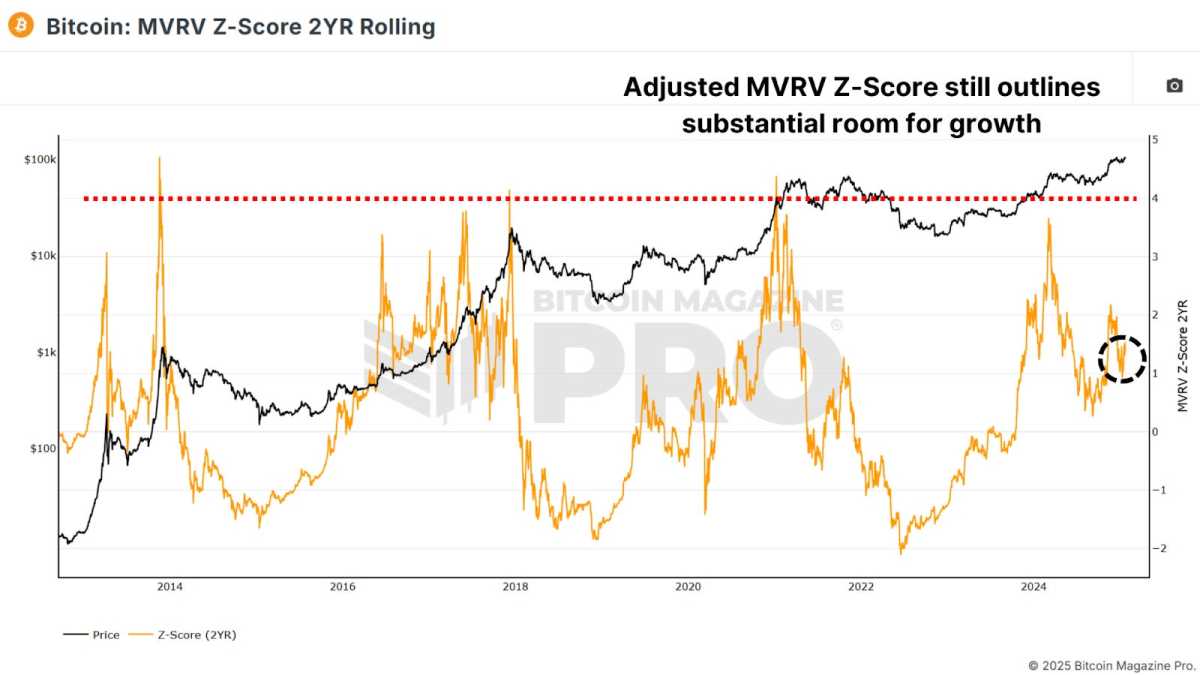

A two-year rolling version of the MVRV Z-Score, which adjusts for evolving market dynamics, additionally exhibits bullish potential. Even by this adjusted measure, Bitcoin is way from earlier cycle peak ranges, leaving the door open for additional value appreciation.

Related: We’re Repeating The 2017 Bitcoin Bull Cycle

Sustainable Sentiment

The Bitcoin Fear and Greed Index is at the moment at a wholesome and sustainable quantity of Grasping sentiment, indicating grasping however sustainable sentiment. Historic knowledge from the 2020-2021 bull cycle exhibits that greed ranges round 80-90 can persist for months, supporting extended bullish momentum. Solely when values strategy excessive ranges (95+) does the market sometimes face important corrections.

Community Exercise

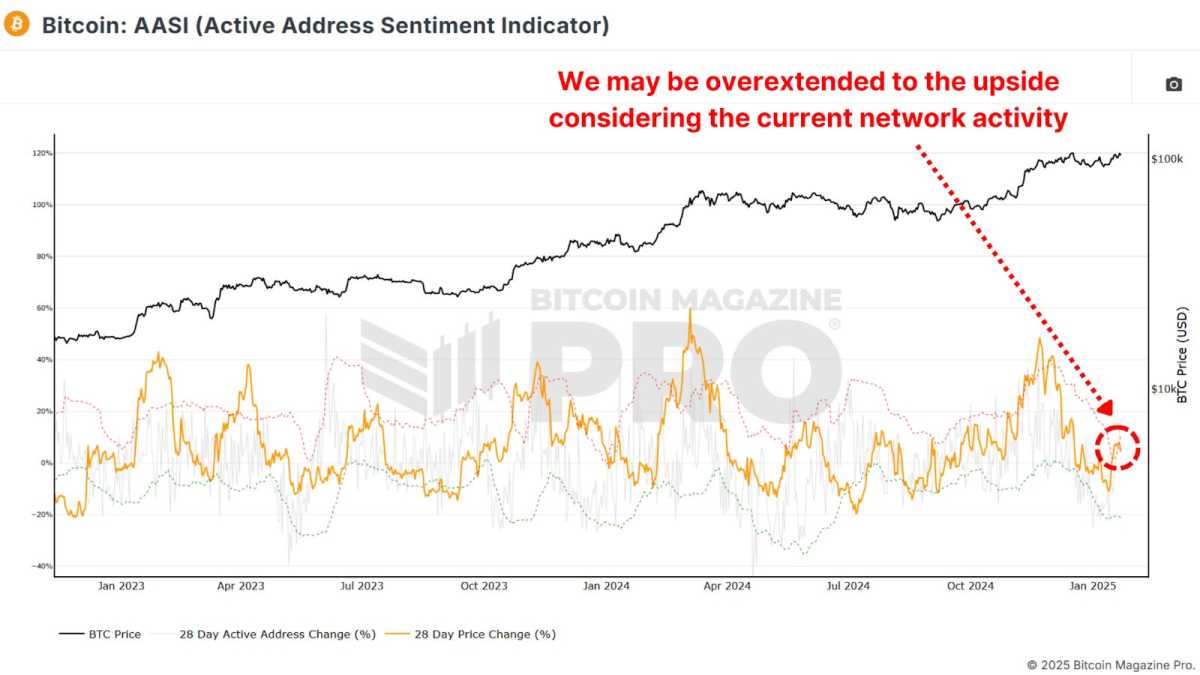

The Active Address Sentiment Indicator reveals a slight dip in community exercise, suggesting retail buyers have but to completely re-enter the market. Nevertheless, this could possibly be a optimistic signal, indicating untapped retail demand that may gasoline the subsequent leg of the rally.

Danger Urge for food Shifts

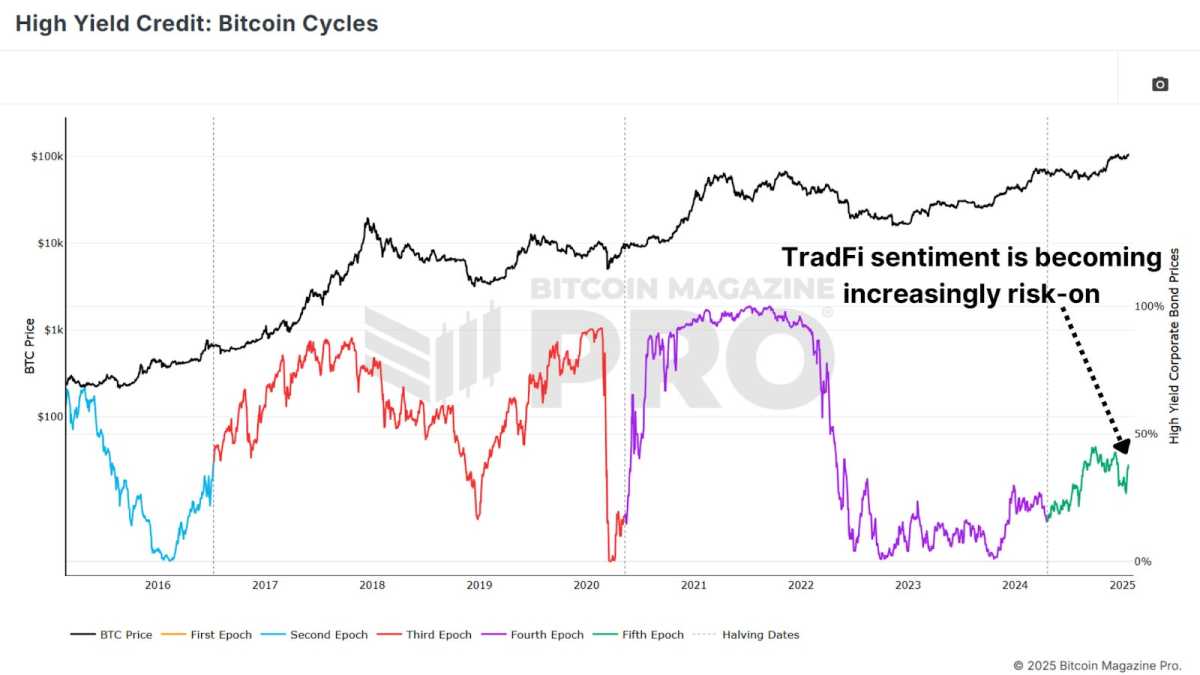

Conventional market sentiment is exhibiting bettering indicators. High Yield Credit urge for food is rising because the macro-economic atmosphere shifts to a extra risk-on outlook. company bonds that provide larger rates of interest as a consequence of their decrease credit score scores in comparison with investment-grade bonds. Traditionally, there was a powerful correlation between Bitcoin’s efficiency and durations of heightened international danger urge for food, which have usually aligned with bullish phases in Bitcoin’s value.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Bitcoin’s on-chain metrics, market sentiment, and macro perspective all level to a continuation of the present bull market. Whereas short-term volatility is at all times attainable, the convergence of those indicators means that Bitcoin is well-positioned to achieve and doubtlessly surpass our present all-time excessive within the close to future.

For extra detailed Bitcoin evaluation and to entry superior options like dwell charts, customized indicator alerts, and in-depth business stories, take a look at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.