Bitcoin mining is a tricky enterprise. When one considers deploying financial assets to mine conventional commodities comparable to gold, copper or oil, prospecting for these assets within the area is at all times finished beforehand, to make sure that any capital invested in a mining undertaking is not going to be in useless. However because of the very nature of Bitcoin’s safety protocol, miners aren’t capable of prospect for something, since discovering a block is a purely statistical and random occasion. Since there are solely 144 blocks to be discovered per day, there isn’t a method to make sure that a miner’s work will probably be rewarded in a well timed vogue with out vital variability, until the miner has a substantial quantity of hash fee. A miner wants roughly 1.2% of the overall hashrate (roughly 10 Exahashes per second on the time of writing) to ensure constant payouts and considerably diminish its income variance. The CAPEX required to realize such an quantity of hashrate is so as of a whole lot of hundreds of thousands of {dollars}. Until a miner is a big enterprise that has an infinite flock of ASICS, he could have an issue in his fingers.

Pool mining was created to handle and resolve this subject. Let’s take a single miner, with a small however appreciable mining operation. Out of the 52560 yearly blocks, he’s anticipated to search out one, since he has 1/52560th of all of the hashrate of the community. In different phrases, he’s anticipated to search out one block each 12 months. However his electrical energy invoice comes due each 4 weeks, and if he was to attend for a complete yr paying payments earlier than getting some income by way of the door, he’d go bankrupt. Given this discrepancy between its ongoing prices and its revenues, an concept involves his thoughts. He units out to search out 499 different folks with an analogous sized operation, they usually strike a deal. As an alternative of everybody mining on their very own, the miner proposes to the others that all of them mine collectively as if they’re a part of the identical entity, splitting the mining rewards in response to every miner’s work each time somebody finds a block. If each miner has 1/52560th of all of the hashrate of the community, the five hundred miners collectively are anticipated to discover a block roughly two instances per week. With a pool mining method, each miner ensures that every one the trouble and laborious work they put in will probably be rewarded far more often. This fashion everybody will get to pay their payments each month, and by the tip of the yr, they’ve all successfully managed to keep away from chapter. However, there are nonetheless sources of variance inside those self same payouts.

Pool mining makes positive miners receives a commission far more often in comparison with solo mining. Nevertheless, it would not assure predictable payouts based mostly on the hashing energy that every miner has. This downside is usually referred to as the pool’s luck threat. Let´s return to the earlier instance. 500 miners with 1/52560th of the overall hashrate of the community every are anticipated to search out 500 blocks in a yr. However, they could discover 480. Or 497. Or 520. There isn’t any assurance that the pool will mine precisely 500 blocks in a yr. A Pool’s luck is calculated by dividing the variety of blocks discovered by the variety of blocks that was anticipated to be discovered based mostly on the overall hashrate of the pool. If a pool mines 480 blocks after they had been anticipated to mine 500, the pool’s luck was 95%. Pool luck may cause vital fluctuations in earnings over quick intervals. Nevertheless, luck tends to even out over time, and payouts will ultimately align with the anticipated distribution based mostly on the pool’s hash fee. Two further components contribute to the general variance in miners’ cost rewards, with the primary issue being extra vital than the second. The primary is transaction charges. These are likely to fluctuate significantly as witnessed in the previous few years. Transactions charges from the blocks that had been mined proper after the final halving represented greater than 50% of the overall block reward for the primary time in Bitcoin’s historical past. As of the writing date of this text, (block peak 883208), there have been a number of non-full blocks mined prior to now week, for the reason that mempool cleared for a number of events throughout these previous days. Fairly a leap in such a brief period of time. The second issue is expounded to the variance related to the time between blocks discovered by the community. When a block is discovered proper after one other, there may be much less time for transactions to construct up within the mempool, which results in decrease transaction charges in that block. Conversely, if a extra prolonged interval elapses between blocks, extra transactions will probably be broadcast, driving up transaction charges within the course of.

Uncertainty is painful. Particularly the place there may be substantial capital in danger. Thus, most miners discover worth in having extra predictable, secure and fewer unstable payouts to recoup the numerous quantity of capital deployed. That is the place a Full Pay Per Share payout scheme paid by swimming pools comes into play. FPPS works as a conventional insurance coverage product. A pure threat switch. No matter what number of blocks the miners of the pool collectively discover and what the transaction charges paid on them are, miners receives a commission by the pool based mostly on the anticipated worth of their hashing energy. The pool assumes all that threat. The predictability that FPPS offers to miners is unequalled by another methodology. Therefore, nobody needs to be shocked to study that FPPS is just about the usual these days on the subject of pool payouts, though not with out a vital price.

FPPS just isn’t a free lunch. To face up to any unhealthy luck interval and all of the dangers related to a FPPS payout scheme, swimming pools must have massive fats pockets. These excessive capital necessities price cash. And swimming pools aren’t charitable organizations. These excessive prices find yourself being paid by miners by way of greater pool charges. Like beforehand talked about, miners want to bear in mind the truth that an FPPS payout scheme works as an insurance coverage coverage. And insurance coverage insurance policies depend on counterparties. And typically, counterparties fail to honor their commitments when they’re most wanted, as witnessed again within the 2008 World Monetary Disaster. The miner should belief that the pool will fulfill their insurance coverage contract obligations. Positive, if the pool could be very massive in dimension, that threat could be very small certainly. Swimming pools may develop methods to dump this threat from their operations. However isn’t Bitcoin all about minimizing belief, counter-party threat and eliminating it if attainable? Seems to be just like the Bitcoin ethos hasn’t arrived but on the pool mining aspect of the protocol.

Moreover, any miner that receives FPPS rewards for his or her work should essentially forfeit any income associated to transaction price spikes. The FPPS payout system determines miner rewards by analyzing transaction charges from the earlier n blocks and calculating an “anticipated worth” for transaction charges. The pool then makes use of this calculation to determine how a lot to pay miners for the transaction price portion of their shares. Consequently, when transaction charges surge, the payout is made in response to what occurred prior to now, the place there isn’t a transaction charges spike in any respect. No should be a PhD in arithmetic to know that every one these rewards find yourself within the pool’s pockets slightly than the miners’ on this situation. Furthermore, even when there was a latest spike in transactions, swimming pools can not issue this into payout calculations. The chance of such a spike not being an outlier is nearly negligible. In different phrases, swimming pools haven’t any assure that the price spikes will probably be constant and frequent sooner or later. Due to this fact, they can not embody it in miner payouts with out risking chapter.

The unsustainability of the FPPS payout scheme

Having a more in-depth have a look at how the FPPS payout scheme is constructed, we will simply see that it’s like the trendy pension programs of many governments, unsustainable by design. FPPS because it stands at this time, will collapse below its personal weight quickly. As time goes by, transaction charges will signify an even bigger proportion of the overall payout to miners. This dynamic, alongside their inherent variability, will result in a big improve of the overall payout variance, thus growing the insurance coverage prices of FPPS swimming pools to infinity. In different phrases, because the Coinbase reward retains halving, the variance of the rewards within the block will improve considerably. If the variance will increase, so does the related threat of offering this insurance coverage product for miners. Thus, premiums for the insured must improve as properly. Because of this FFPS swimming pools will probably be taking further threat when compromising themselves to a set cost to miners. With extra dangers comes greater capital prices. The extent to which pool charges must rise for swimming pools to proceed offering a FPPS insurance coverage product stays to be seen. Solely insurance coverage actuaries can decide the exact quantity. One factor we already know for positive. It gained’t be low-cost, as a result of it already isn’t.

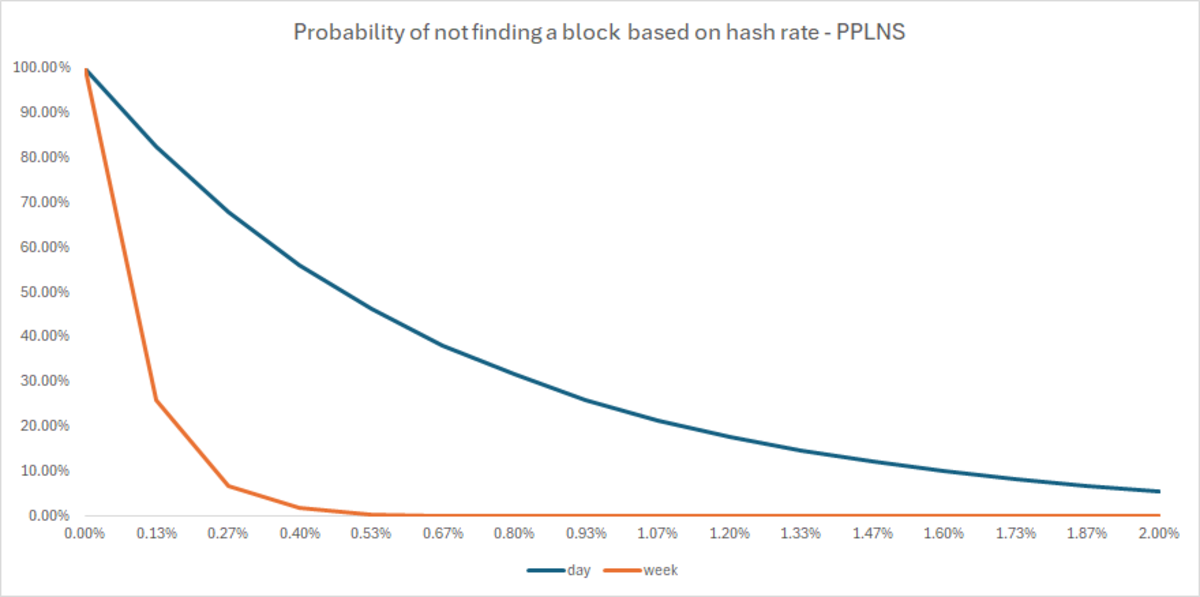

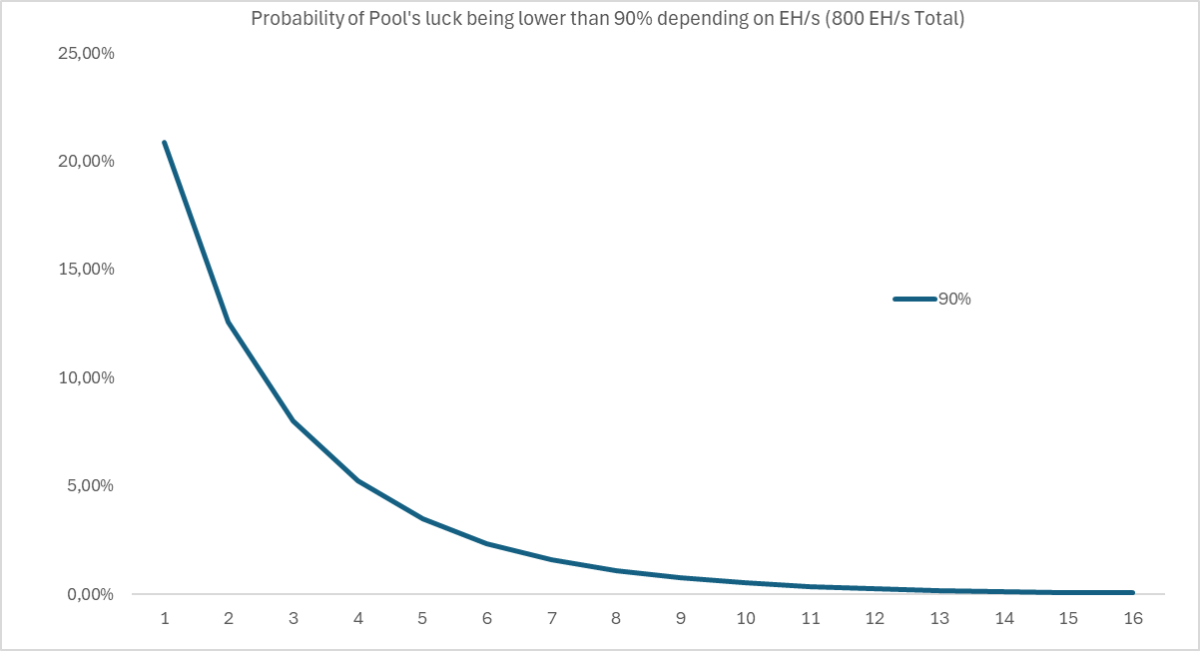

A a lot greater pool price for secure predictable payouts supplied by FPPS will make a PPLNS methodology reward methodology far more enticing for any miners that want to maximize their profitability, because the beforehand described dynamic of the altering composition of blocks is performed out. Underneath this scheme, miners are paid as soon as a block is discovered by the pool. When a block is discovered, the pool assesses what number of legitimate shares every miner contributed throughout a interval comprised of the final N blocks discovered by the pool and distributes payouts accordingly. This time window is usually known as the PPLNS window. The most important setback with this cost methodology is after all the danger related to the pool’s luck being below 100% and the danger that there is perhaps intervals when the pool doesn’t discover any block and because of this, miners don’t receives a commission. Nevertheless, a pool with only one% of the hash fee has solely a 0.0042% probability of not discovering a block inside every week, whereas the chances of the pool’s luck being decrease than 90% in a yr are roughly 1.09%.

Will there be a market quickly for FPPS pool companies at a excessive sufficient worth that compensates the pool for all of the variance related to the overall block rewards? Nobody can know for positive. One factor we all know. Pool charges must be huge. The income that miners must forfeit will simply be too massive to be value it to eliminate the danger related to not getting paid persistently in a well timed method. And as different extra mature gamers enter the bitcoin mining business, comparable to vitality corporations, one ought to anticipate different threat administration instruments to be available out there for miners to hedge all sorts of dangers. New modern pool cost schemes will most likely floor as these devices turn out to be extra obtainable to everybody.

Miners’ income and profitability will probably be considerably impacted by the dynamics described on this article. Exploring different pool cost schemes and threat hedging methods will probably be required for any miner that appears to maximise the profitability of their operation. The FPPS payout methodology would possibly nonetheless be useful for miners as of at this time. However as was beforehand defined, FPPS will quickly be buried in bitcoin’s historical past.

This can be a visitor publish by Francisco Quadrio Monteiro. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.