Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

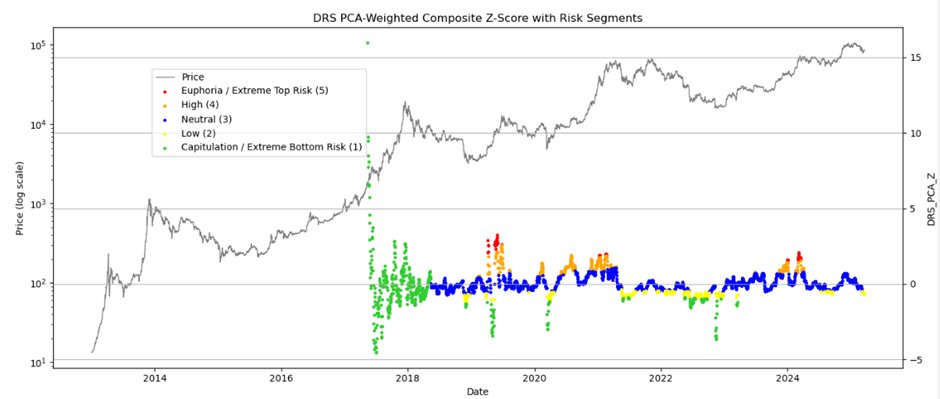

Actual Imaginative and prescient Chief Crypto Analyst Jamie Coutts has sounded a stark warning for Bitcoin within the months forward. Citing his new Bitcoin Derivatives Threat Rating (DRS) mannequin, Coutts contends the main cryptocurrency’s worth faces one in every of two sharp outcomes: a extreme downturn or a surge to new all-time highs (ATH).

Bitcoin’s Q2 Outlook

In commentary shared by way of X at the moment, Coutts highlights his “first go” on the DRS mannequin, noting that the market’s most up-to-date occasion of “Cat 5 euphoria” in Q1 2024 was adopted by a pullback of solely round 30%. He contrasts this with a comparable episode in 2019, which noticed a 50% decline—widening to 70% if the COVID shock is accounted for.

Associated Studying

“Trying again at Q1 2024’s Cat 5 euphoria—which I flagged again then (in February 2024)—I’m nonetheless shocked the pullback was solely -30%. The one related transfer outdoors a cycle high was in 2019, with a 50% drop (70% when you issue within the COVID shock),” he explains.

Coutts emphasizes that 2019 is a greater barometer for present market situations than 2021. The rationale, he observes, is that the 2019 rally preceded a significant world liquidity growth. By 2021, Bitcoin had already appreciated 12x off its lows whereas worldwide liquidity grew by 30%, reflecting a vastly completely different macro atmosphere.

Associated Studying

Assessing the market’s current danger degree, Coutts factors out that Bitcoin’s DRS metric has slid into the “low-risk quantile,” a zone he says provides minimal predictive energy for future costs. “So, the place are we now? Bitcoin’s DRS is within the low-risk quantile—the place predictive energy is low. If Bitcoin has peaked, we must always anticipate a brutal bleed decrease,” he cautions, earlier than including that the potential of a rebound stays excessive.

World Liquidity On The Rise

Coutts then underscores world liquidity’s potential to set off one other Bitcoin rally. He believes an upcoming inflection level in world liquidity—pushed by the necessity to stimulate closely indebted economies—will possible gasoline the derivatives market, which he calculates to be 4 instances larger than the spot market.

“That’s not my outlook although. World liquidity is able to inflect that can re-invigorate the derivatives market (4x Spot), probably jettisoning Bitcoin to new ATHs by Could (or finish of Q2 for further padding).”

One other key perception from Coutts facilities on the Global Liquidity Index, which he says has been in contraction for an unprecedented stretch. “This marks the longest contraction of the World Liquidity Index in Bitcoin’s historical past—three years and counting (measured from the height). Earlier tightening episodes (2014–2016 and 2018–2019) lasted < 2yrs. How for much longer will this go on?”

He argues {that a} renewed injection of liquidity is inevitable, mentioning that governments—particularly these with debt-to-GDP ratios exceeding 100%—can be hard-pressed to refinance if nominal GDP lags behind rising curiosity prices. “The fiat, fractional-reserve, debt-based system will implode with out liquidity injections. The spice should circulate.”

At press time, BTC traded at $87,703.

Featured picture created with DALL.E, chart from TradingView.com