On-chain information reveals the massive Ethereum traders have been including to their holdings not too long ago, an indication that might be bullish for the ETH worth.

Ethereum Massive Holders Netflow Has Turned Constructive Not too long ago

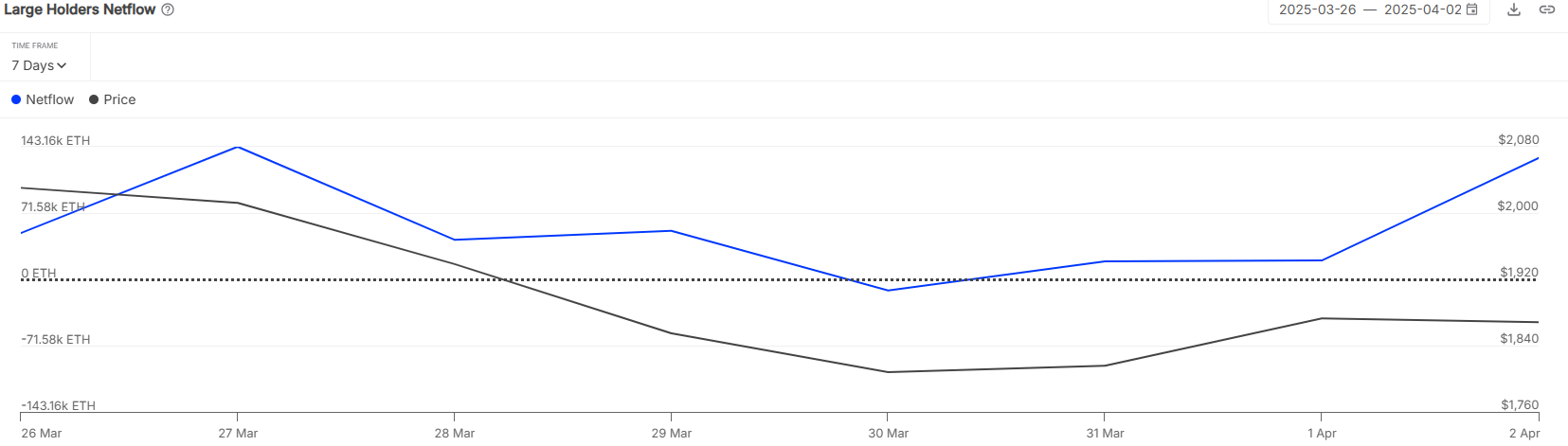

In a brand new post on X, the market intelligence platform IntoTheBlock has talked concerning the development within the Large Holders Netflow for Ethereum. This metric measures the web quantity of the cryptocurrency that’s transferring into or out of the wallets managed by the Large Holders.

The analytics agency defines three classes for traders: Retail, Traders, and Whales. Members of Retail maintain lower than 0.1% of the availability of their stability, that of Traders between 0.1% and 1%, and that of Whales greater than 1%.

On the present trade charge, 0.1% of the ETH provide, the cutoff between Retail and Traders, is price over $214 million, a really substantial quantity. Because of this the addresses who’re capable of qualify for Traders are already fairly massive, not to mention those that have made it to the Whales.

As such, the Massive Holders, the precise cohort of curiosity within the present dialogue, consists of each of those teams. Thus, the Massive Holders Netflow retains observe of the transactions associated to Traders and Whales.

When the worth of this metric is optimistic, it means the big-money traders on the community are receiving a web variety of deposits to their wallets. Then again, it being beneath the zero mark suggests these key holders are taking part in web promoting.

Now, right here is the chart shared by IntoTheBlock that reveals the development within the Ethereum Massive Holders Netflow over the previous week:

The worth of the metric seems to have been optimistic in latest days | Supply: IntoTheBlock on X

As is seen above, the Ethereum Massive Holders Netflow has remained virtually totally within the optimistic territory for the interval of the graph, which means that the Traders and Whales have been accumulating. On the second of the month alone, these key entities loaded up on a web 130,000 ETH (about $230 million).

The web inflows for the Massive Holders have come whereas the cryptocurrency has been declining, so it’s doable that this cohort believes the latest costs have been providing a worthwhile entry into the asset. It now stays to be seen whether or not this accumulation can be sufficient to assist ETH attain a backside or not.

In another information, the Ethereum fee is all the way down to the bottom stage since 2020 this quarter, because the analytics agency has identified in one other X post.

The modifications that occurred in key ETH metrics in the course of the first quarter of 2025 | Supply: IntoTheBlock on X

Following a pointy drop of 59.6%, the Ethereum complete transaction charges is all the way down to $208 million. In response to IntoTheBlock, this development is “primarily pushed by the fuel restrict improve and transactions transferring to L2s.”

ETH Worth

Ethereum noticed restoration above $1,900 earlier within the week, however it appears bullish momentum has already run out because the coin’s again to $1,770.

Seems like the value of the coin has plunged not too long ago | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.