Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a thread on X, enterprise cycle analyst Tomas (@TomasOnMarkets) explains the place the worldwide economic system presently stands and what which means for threat property, together with Bitcoin. Describing what he phrases a “brief and shallow” full enterprise cycle that began in 2023, pale in 2024, and bottomed out in early 2025, Tomas believes this fleeting cycle was masked partly by a weak Chinese language economic system and a quickly strengthening greenback.

He explains, “The overall gist of the idea was that we noticed an irregular, ‘brief and shallow’ full enterprise cycle over current years that suppressed conventional PMI measures each within the US and globally.”

In line with Tomas, his evaluation depends on 4 real-time measures of the worldwide economic system, which he tracked in inverted trade-weighted greenback index, Baltic Dry Index, 10-year Chinese language Authorities bond yields, and the copper/gold ratio. By changing these particular person knowledge factors into rolling yearly z-scores, he created an “equal-weighted composite z-score” he calls the International Economic system Index (GEI).

He notes, “You may see clearly right here that the GEI was underwhelming to the upside in 2023 and 2024 (didn’t attain the ‘enterprise cycle peaking zone’). After which fell to ranges sometimes correlated with the tip of a enterprise cycle in late 2024/early 2025 (‘enterprise cycle troughing zone’).”

This composite measure appeared to guide US Manufacturing PMI knowledge previous to the disruptive occasions of 2020, and Tomas highlights that relationship by shifting the GEI ahead by six months. He observes a break within the sample across the 2020 pandemic and the next large-scale central financial institution interventions, but nonetheless sees the likelihood that GEI’s current rebound signifies a brand new “recent” enterprise cycle taking maintain, doubtlessly peaking round late 2026 or 2027. “Based mostly on historic precedent,” he writes, “this new enterprise cycle may fairly be anticipated to peak round late 2026/2027.”

He additionally addresses the interaction between GEI, equities, and PMIs, remarking that the inventory market normally leads enterprise survey measures however tends to lag the GEI. “If we peel again the layers of the onion, we discover the inventory market typically leads PMI measures however typically lags the GEI, so it lives someplace within the center, more often than not,” he says. He factors out that the S&P 500 just lately slipped into unfavourable year-over-year territory, which he sees as typical of end-of-cycle worth habits. “The S&P 500 has now hit what would traditionally be a suitable ‘finish of enterprise cycle bottoming stage.’”

The Implications For Bitcoin

Bitcoin, nevertheless, stays the wildcard. Tomas acknowledges that the leading-lag relationship of the GEI, inventory market, and PMIs may usually apply to most threat property, but this time round, Bitcoin seems to be deviating from its regular volatility in relation to the macro atmosphere. “The piece of the jigsaw that doesn’t appear to suit in any respect (by historic precedent) is Bitcoin,” he writes.

He acknowledges that it has up to now resisted typical “finish of enterprise cycle” drawdowns, and he speculates on whether or not “Bitcoin has simply grown up and turn into much less unstable and fewer delicate to enterprise cycle swings — doubtlessly due to ETFs and better institutional curiosity.” But he additionally entertains the likelihood that Bitcoin may merely be lagging the inventory market. Regardless, “if Bitcoin continues its historic relationship with the enterprise cycle,” Tomas warns, “this might most likely obliterate the ‘4 yr halving cycle’ idea for Bitcoin worth motion.”

Tomas concludes by cautioning that if the worldwide economic system index fails to keep up its current bounce and as a substitute rolls over to a brand new low, the outlook may flip extra bearish, particularly if so-called tariff headwinds worsen. He speculates that a part of the rebound seen in copper/gold and delivery charges in early 2025 might have been frontloaded by tariff bulletins, hinting that the restoration in these metrics won’t be as sturdy because it seems on the floor.

Nonetheless, the important thing takeaway from his perspective is that equities and the broader enterprise cycle look like in late-stage territory, and if his evaluation holds, a brand new cycle may start quickly — one which runs lengthy sufficient to postpone any significant Bitcoin peak till late 2026 and even 2027, calling into query any assumptions concerning the enduring validity of Bitcoin’s four-year halving cycle.

“One other level to notice is that the GEI is presently signaling the beginning of a brand new enterprise cycle, which may fairly be anticipated to peak in late 2026/2027. If Bitcoin continues its historic relationship with the enterprise cycle, this might most likely obliterate the ‘4 yr halving cycle’ idea for Bitcoin worth motion,” Tomas concludes.

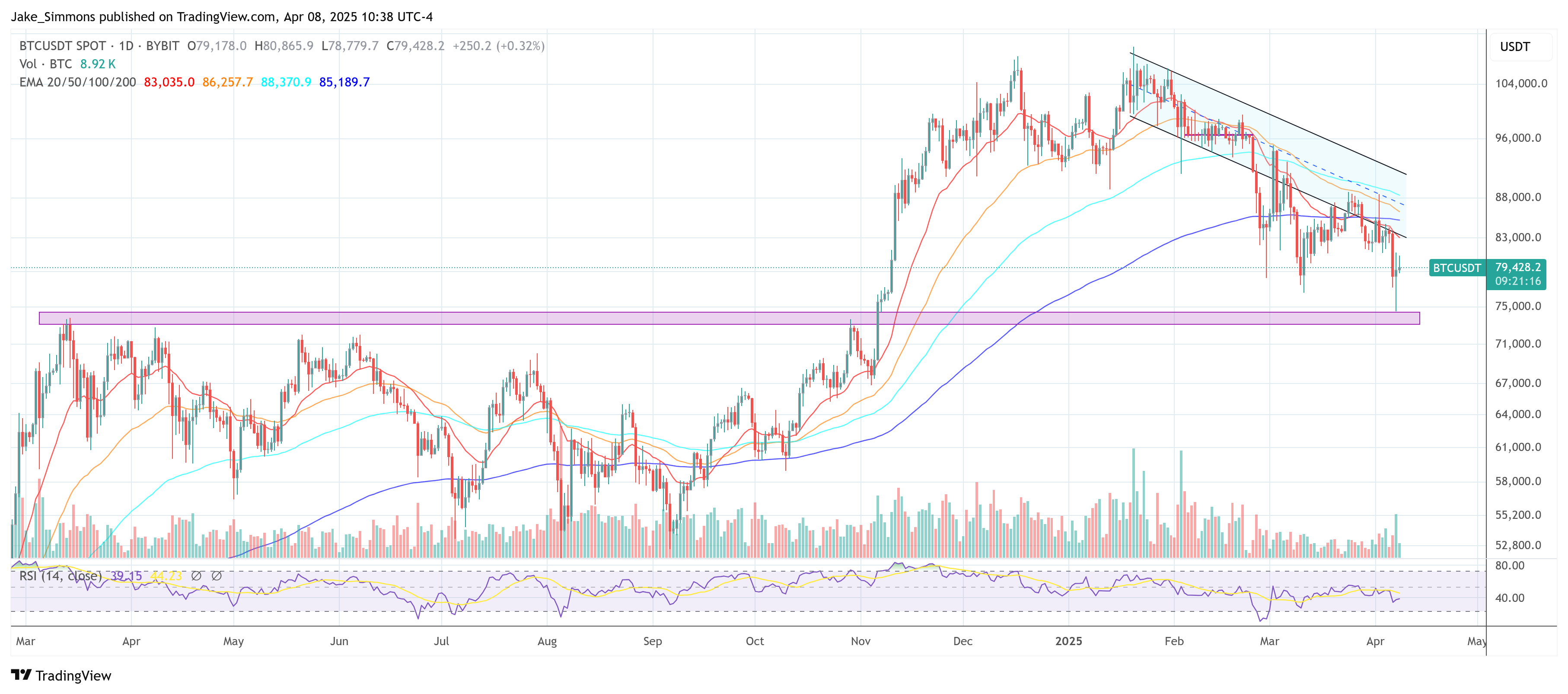

At press time, BTC traded at $79,428.

Featured picture created with DALL.E, chart from TradingView.com