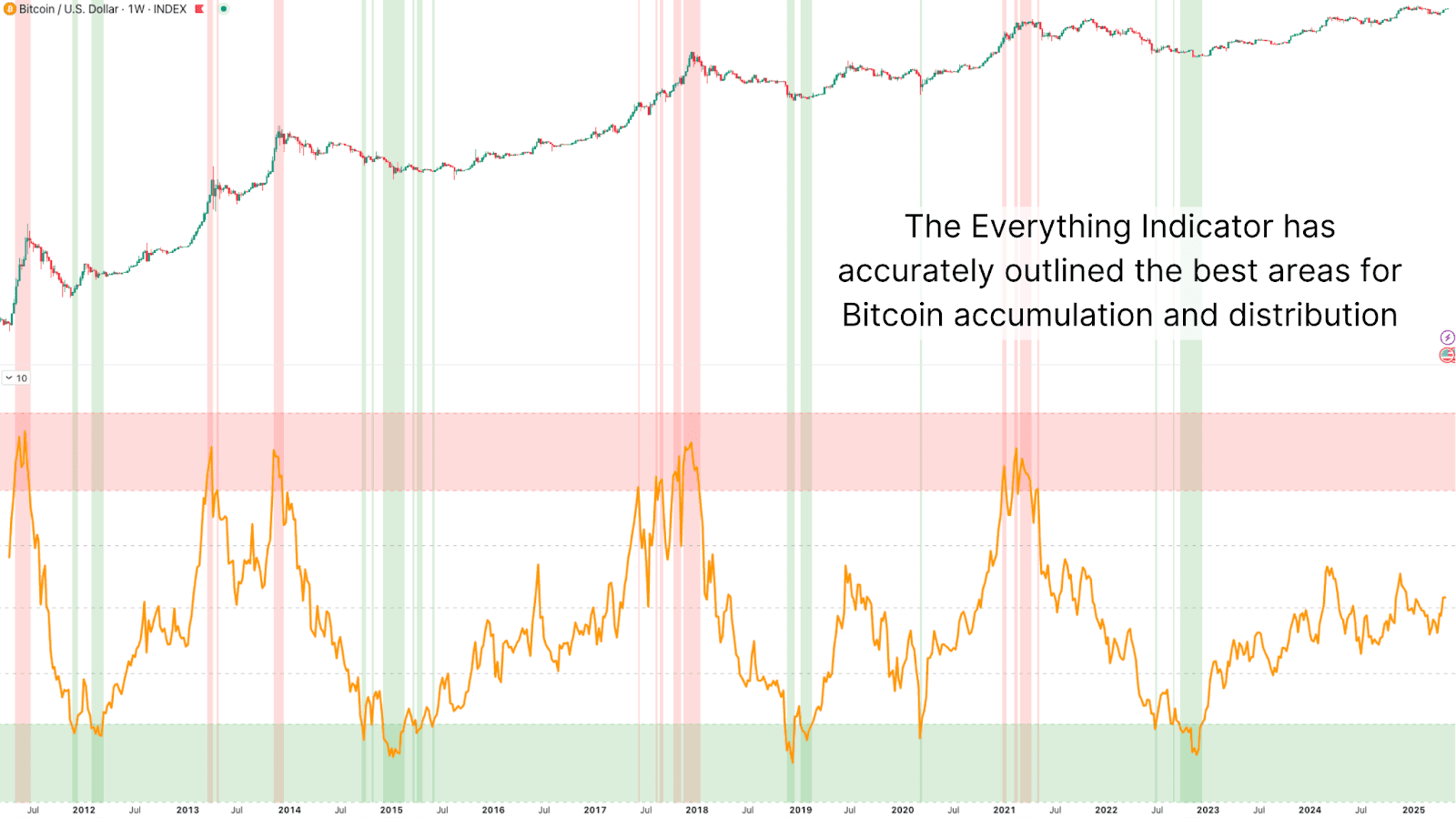

The Bitcoin All the pieces Indicator was designed to supply a complete view of all main forces impacting BTC worth motion, on-chain, macro, technical, and basic. Since its creation, it has confirmed remarkably correct at marking each cycle tops and bottoms. However at present, we take it a step additional.

On this article, we’ll discover how this already-powerful device may be upgraded with a easy modification to present extra frequent, actionable insights, with out compromising its core integrity. If you happen to’re in search of a high-signal strategy to strategy the Bitcoin market extra actively, this may be the metric you’ve been ready for.

What Is the Bitcoin All the pieces Indicator?

Initially constructed as a composite device, the Bitcoin Everything Indicator is constructed from a number of uncorrelated indicators:

Collectively, these knowledge factors are equal-weighted, not overfitted, creating an mixture rating that tracks broad BTC market dynamics. Importantly, it doesn’t depend on any single mannequin or indicator. As a substitute, it captures the confluence of a number of domains that collectively form Bitcoin price actions. Backtesting exhibits that the indicator persistently highlights macro turning factors, together with cycle tops and capitulation bottoms, throughout all main Bitcoin cycles.

Rare However Sturdy Alerts

Whereas correct, the unique All the pieces Indicator was inherently long-term. Alerts would solely seem each few years, marking the main inflection factors of every bull and bear market. For buyers seeking to purchase generational lows or scale out at macro tops, it was invaluable.

However for these aiming to be extra energetic, strategically DCA-ing, rotating capital, and even managing danger with mid-cycle exits, it supplied little day-to-day steering. The answer? Enhance sign decision with out sacrificing the macro integrity of the mannequin.

Including A Shifting Common

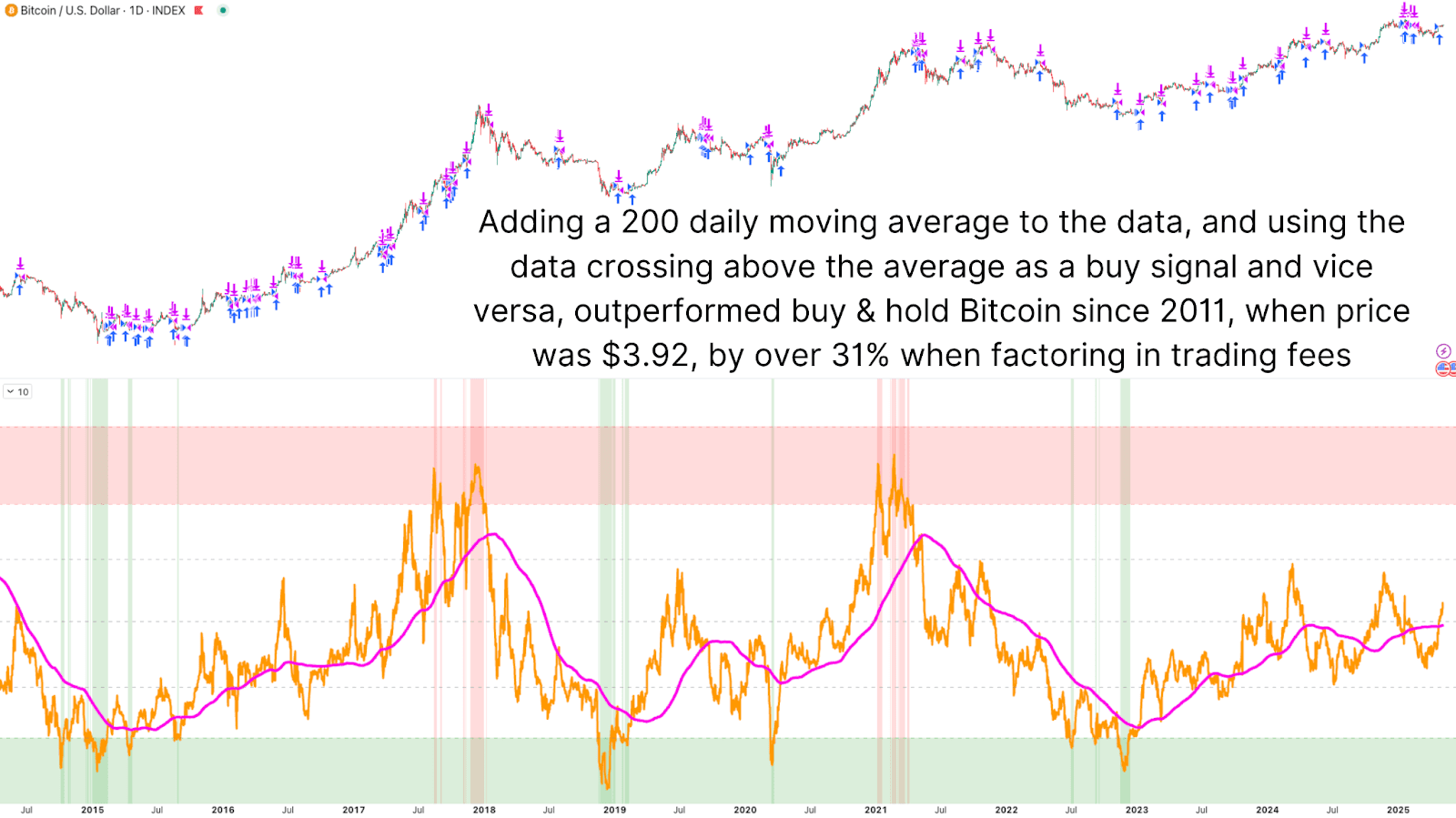

The development is elegantly easy: apply a transferring common to the All the pieces Indicator rating and search for crossovers. Simply as we do with price-based methods, we are able to deal with the indicator like a sign line and search for directional modifications.

By default, a 200-period easy transferring common was utilized. When the All the pieces Indicator crosses above this MA, it suggests that the majority elements, liquidity, community well being, sentiment, and technicals, are trending upward collectively. These crossovers sign bullish development initiation, providing earlier entries than ready for cycle lows alone. Conversely, a cross under the transferring common can function a de-risking or distribution sign, particularly when occurring at or close to beforehand recognized overheated zones.

Even with conservative buying and selling assumptions (elevated charges and slippage), this technique’s efficiency was putting. Backtests from Bitcoin’s early years, when BTC traded beneath $4, confirmed this crossover technique returning over 3.1 million p.c, dramatically outperforming easy buy-and-hold.

Elevated Sign Frequency

To accommodate extra energetic buyers, we are able to additional shorten the transferring common, down to twenty durations, for instance. This gives lots of of entry and exit indicators per cycle whereas retaining the unique logic of the indicator.

Even when utilizing the shorter-term sign, returns remained robust, and outperformance relative to holding BTC remained intact. This exhibits the device’s flexibility. It could actually now serve each long-term buyers in search of macro affirmation and energetic merchants who need to reply extra dynamically to market modifications.

Lowering the transferring common interval has key advantages, together with producing earlier indicators at market lows, extra frequent accumulation steering, common exit prompts throughout overheated circumstances, and elevated alternatives to keep away from extended drawdowns.

Conclusion

The Bitcoin All the pieces Indicator may now provide the most effective of each worlds: a high-integrity, all-encompassing view of market well being, and the pliability to supply frequent actionable indicators via a easy transferring common overlay. Even with real-world buying and selling friction, with charges and slippage, this technique has outperformed holding BTC over a number of timeframes, together with from way back to 2011.

So for those who’re already utilizing Bitcoin Journal Professional’s suite of indicators, now may be the time to take this one step additional. Add overlays. Modify transferring averages. Layer in bands and filters. The extra you adapt these instruments to your individual technique, the extra {powerful} and intuitive they’ll change into!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.