Solana (SOL) is buying and selling round key ranges after reaching a neighborhood excessive of $184, struggling to carry help above the $170 zone. This worth area is shaping as much as be a pivotal battleground, as bulls intention to increase the rally whereas some analysts warn of an incoming retracement. Optimism stays sturdy throughout the market, with altcoins gaining momentum alongside Bitcoin and Ethereum. Nevertheless, conflicting views persist, with a number of merchants cautioning that Solana could also be overheated within the brief time period following its latest surge.

Supporting the bullish narrative, new knowledge from Glassnode exhibits that Solana could also be present process a development reversal. After months of realized cap outflows, SOL’s 30-day capital inflows have turned constructive, presently rising at a gradual charge of 4–5%, a tempo just like that of XRP. This uptick in capital influx signifies renewed demand getting into the ecosystem, hinting that buyers could also be positioning for additional upside.

Because the broader crypto market heats up, Solana’s skill to remain above the $170 degree will probably be essential in figuring out short-term direction. A confirmed maintain might pave the best way for a push towards new highs, whereas a breakdown would possibly set off a deeper retrace.

Renewed Demand And Key Resistance Outline Subsequent Transfer

Solana is presently buying and selling above a important demand zone, displaying energy because it holds firmly above the $170 degree. Nevertheless, to substantiate the continuation of a sustained bullish rally, SOL should break and shut decisively above the $185 resistance degree. This area has acted as a robust ceiling in latest worth motion, and reclaiming it will doubtless unlock the momentum wanted for additional beneficial properties.

The present rally throughout the broader crypto market, together with Bitcoin and Ethereum, has fueled optimism {that a} bigger bullish section could also be underway. For Solana, this might mark the beginning of a robust development reversal after months of volatility and uncertainty. Importantly, on-chain knowledge helps this bullish case.

According to Glassnode, Solana has reversed its unfavourable realized cap flows, with its 30-day capital inflows now again in constructive territory. These inflows are rising at a charge of roughly 4–5%, comparable to what’s presently being noticed in XRP.

This shift alerts a return of investor confidence and renewed demand inside the Solana ecosystem. Such metrics are important, as they replicate precise capital commitments fairly than simply speculative sentiment. If momentum continues and SOL reclaims the $185 degree, it might set off an aggressive breakout and lead the altcoin sector greater.

The following few days will probably be essential for Solana. Holding above help whereas trying to interrupt resistance might outline the construction of the following main transfer. A profitable push greater would help the concept Solana just isn’t solely recovering however doubtlessly main the following section of altcoin enlargement. Merchants and buyers alike are watching intently as this key take a look at unfolds.

Solana Finds Assist Above 200-EMA However Faces Resistance Close to $181

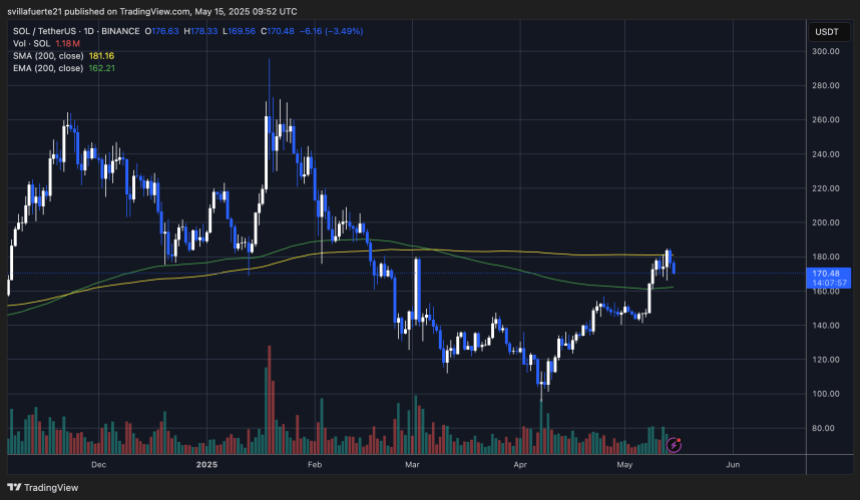

Solana is presently buying and selling at $170.48 after a pointy pullback from the latest native excessive close to $184. As proven on the chart, the value briefly pushed above each the 200-day EMA ($162.21) and SMA ($181.16), two key technical indicators intently watched by merchants. This transfer signaled energy however was shortly met with promoting strain just under a big resistance zone close to the $185 degree — the identical area the place a number of failed makes an attempt have occurred previously.

Regardless of the latest 3.5% each day drop, the value motion stays bullish so long as SOL holds above the 200EMA. The upper low construction stays intact, and the latest retrace might be seen as a wholesome consolidation if bulls defend this vary. A sustained transfer above the 200SMA at $181.16 would doubtless set off a contemporary wave of bullish momentum and open the door for a push towards the $200-$220 space.

Quantity stays elevated, suggesting lively participation, although a drop in shopping for curiosity could sign warning. If the $162 zone fails to carry, a deeper retrace towards $150 is feasible. For now, all eyes are on whether or not SOL can reclaim $181 with energy and set the stage for a sustained breakout.

Featured picture from Dall-E, chart from TradingView