Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price slipped to $105,235 right now, dropping 1.5% over the previous 24 hours and falling 4.2% within the final week. Some market watchers see this dip as a pause earlier than a significant transfer. Based on their charts, Bitcoin could possibly be gearing up for an additional steep acquire.

Associated Studying

Historic Patterns Level To Rebound

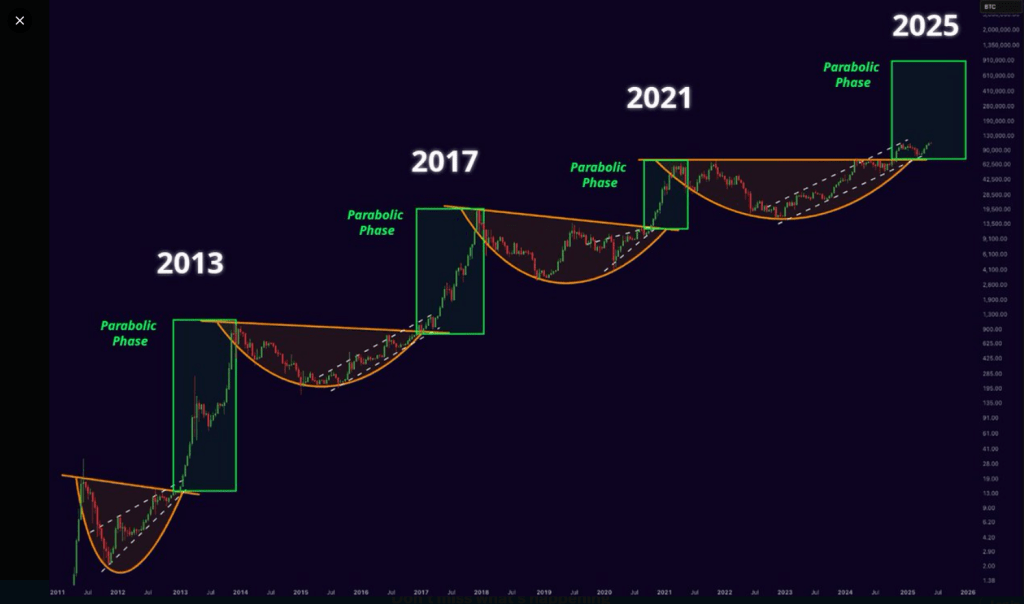

Primarily based on reviews from the analyst generally known as “Mister Crypto,” rounded-bottom formations and ascending triangles have marked each massive Bitcoin rally. In 2013, when Bitcoin was buying and selling underneath $10, it spent months in a easy, curved base earlier than breaking out and climbing previous $1,000.

The same sample confirmed up in 2017. After practically three years of sideways motion, the value lastly exploded towards $20,000. The final cycle in 2021 additionally adopted the identical playbook, with virtually 4 years of constructing a large base earlier than capturing as much as practically $70,000.

Bitcoin will go parabolic.

This time gained’t be completely different! pic.twitter.com/0fEMMMclbD

— Mister Crypto (@misterrcrypto) May 29, 2025

Mister Crypto’s chart means that the interval after 2021 has shaped one other base. If historical past performs out the identical method, his forecast factors to a breakout in 2025 that would ship Bitcoin as excessive as $900,000—a 760% rise from right now’s stage.

Analyst Charts Re-Accumulation

Based on charts shared by one other analyst, Bitcoin typically strikes in levels. First, there’s an preliminary “leg up” that indicators the shift from deep accumulation right into a rising bull pattern. Then, the value settles right into a sideways “re-accumulation” section earlier than the ultimate run.

From 2019 via 2021, Bitcoin adopted this path intently. Analysts word that from late 2023 into mid-2025, Bitcoin appears to be in that very same re-accumulation section. If this unfolds as in previous cycles, the following massive upswing might push Bitcoin into the $270,000–$350,000 vary earlier than any parabolic spike comes into view.

Lengthy-Time period Holders Maintain Including Cash

On-chain knowledge reveals long-term holders (addresses that haven’t moved their cash in over 155 days) are nonetheless piling on. Between March 3 and Could 25, 2025, these holders elevated their total provide by practically 1.40 million BTC.

That pushed long-term holdings from 14,354,000 BTC to fifteen,739,400 BTC. In earlier bull markets—like these in 2013, 2017, and 2021—long-term holders typically offered throughout the rallies to lock in revenue.

Associated Studying

Immediately, although, they appear content material to carry. If giant pockets of Bitcoin stay off exchanges, fewer cash can be found for brand new patrons. That would tighten provide and make sharp strikes extra possible as soon as demand picks up.

Wanting Forward In Unsure Market

Bitcoin has misplaced momentum lately, however many analysts really feel these dips gained’t final. At $105K area, the value sits under final week’s ranges.

Primarily based on reviews, some see that as wholesome consolidation earlier than a much bigger run. Others warn that world rates of interest, regulation, and macro elements might sluggish issues down.

Featured picture from Pexels, chart from TradingView