Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

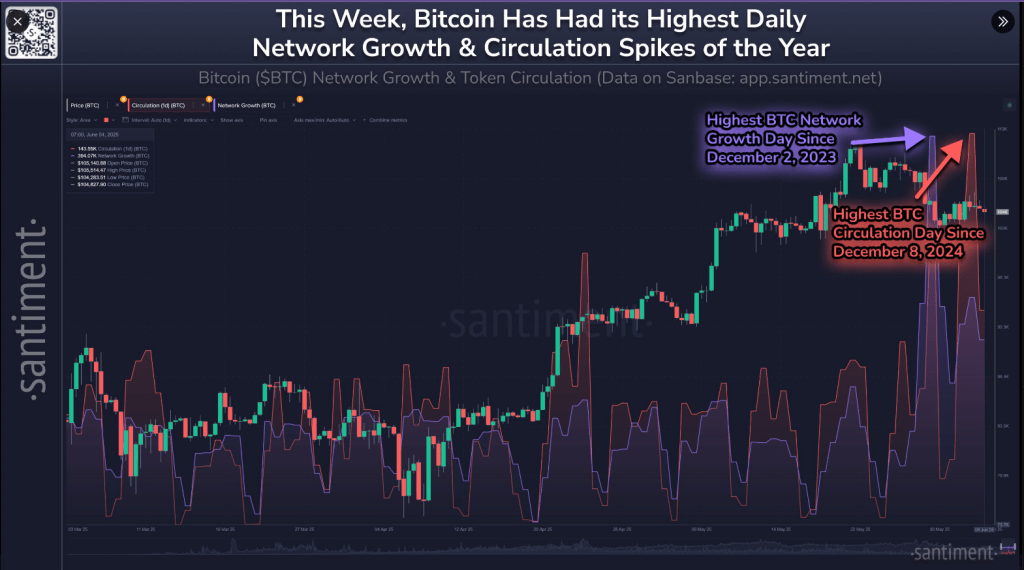

Bitcoin’s value has barely moved within the final week, however different indicators level to rising exercise on the community. On June 5, Bitcoin traded round $104,300, down 0.50% in 24 hours and off 2.5% over the previous seven days. But knowledge exhibits extra individuals are becoming a member of the community, and extra cash are being handed round.

Associated Studying

Pockets Creation Soar

In keeping with Santiment, on Might 29 practically 557,000 new wallets appeared. That was the best quantity since December 2023. It means 1000’s of individuals are opening wallets regardless that value has stayed just below $105,000.

Folks usually open new wallets to ship and obtain bitcoins however they by some means come throughout the concept by new sources, elevated talks amongst pals or create easy curiosity. In any case, an elevated pockets holding certainly signifies a a lot wider utilization.

📊 Bitcoin’s on-chain exercise has seen sharp rises this week as its value hovers just under $105K:

📈 Might twenty ninth: 556,830 new $BTC wallets created (Highest since December 2, 2023)

🔄 June 2nd: 241,360 cash circulated (Highest since December 8, 2024)

Progress in a community’s… pic.twitter.com/2DxknVXrKT

— Santiment (@santimentfeed) June 5, 2025

Elevated Token Motion

On June 2, over 241,360 BTC modified fingers. This was deemed the busiest day since December 2024. Studies from Santiment recommend that top coin turnover normally coincides with elevated visitors.

Merchants may be transferring cash out and in of exchanges, or traders could possibly be shifting wallets. Large swings in each day token motion can level to a shift in sentiment—individuals both on the brink of purchase or promote.

Proper now, it principally seems to be like extra customers are sending cash to one another, which retains the community busy even when value sits nonetheless.

Large Holders Step In

Knowledge from IntoTheBlock exhibits that enormous holders—usually referred to as “whales”—are stocking up. Their coin inflows jumped by 145% over the past seven days, and by 214% over the previous 30 days.

When large gamers load up, it might tighten provide on exchanges. That makes it harder for brand new consumers to get in with out driving value increased. If whales maintain shopping for at this price, it might result in extra upward strain on value as soon as on a regular basis traders step in once more.

Associated Studying

Mid Tier Buyers Purchase

It’s not simply the actually large holders including cash. Wallets holding between 10 and 10,000 BTC added greater than 79,000 BTC in only one week. Which means these mid-tier holders picked up round 11,320 BTC per day on common.

As of June 2, they held over 13 million BTC in complete. When each large whales and these mid-level holders maintain stacking, it additional cuts down the variety of cash floating on exchanges. Fewer cash accessible usually imply any shift in demand might transfer value extra.

Featured picture from Imagen, chart from TradingView