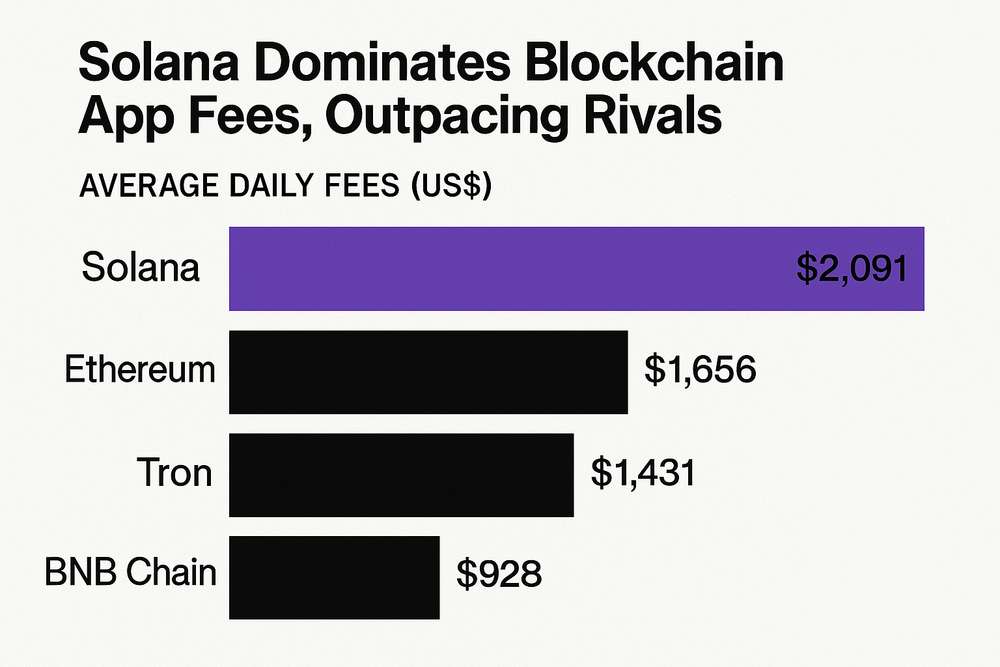

Solana has emerged as the highest blockchain for app charges, producing over $18 million previously 24 hours, surpassing rivals like Ethereum and Bitcoin. This surge underscores its rising dominance in high-speed, low-cost transactions, significantly in DeFi and NFT buying and selling. The platform’s hybrid proof-of-history and proof-of-stake mechanism permits 65,000+ transactions per second (TPS), far exceeding Ethereum’s ~1,000 TPS with Layer-2 options.

Whereas Ethereum stays the chief in decentralized functions and DeFi adoption, Solana’s payment construction—averaging $0.04 per transaction in Q1 2025—has attracted customers searching for cost-effective options. This payment discount of 24% from the earlier quarter highlights Solana’s concentrate on scalability and affordability.

Solana’s Surge in App Charges

Solana’s payment dominance stems from its excessive throughput and low-cost transactions, making it a hub for meme cash, DeFi protocols, and NFT marketplaces. In Q1 2025, its app income reached $1.2 billion, although DeFi TVL (Whole Worth Locked) dropped 64%, signaling challenges in retaining capital. Regardless of this, platforms like Jupiter, Raydium, and Orca proceed to leverage Solana’s pace for seamless person experiences.

Ethereum’s Ecosystem and DeFi Management

Ethereum maintains its place because the business titan in decentralized finance, with a strong ecosystem of over 4,000 dApps and a powerful developer group. Publish-Ethereum 2.0, its transition to Proof-of-Stake (PoS) improved vitality effectivity and scalability, although gasoline charges stay increased than Solana’s. Ethereum’s safety and first-mover benefit proceed to draw institutional buyers and long-term tasks.

Market Dynamics and Future Outlook

The competitors between Solana and Ethereum displays broader market developments. Solana’s low charges and excessive TPS cater to high-frequency merchants, whereas Ethereum’s ecosystem depth helps complicated good contracts. Under is a comparability of key metrics:

| Metric | Solana | Ethereum |

|---|---|---|

| TPS | 65,000+ | ~1,000 (with L2) |

| Avg. Charge | $0.04 | Greater (gasoline charges) |

| Ecosystem Focus | Excessive-speed buying and selling | DeFi, DApps |

| Key Strengths | Pace, affordability | Safety, ecosystem |

For merchants, platforms like Bitunix provide leveraged buying and selling on each SOL and ETH, enabling publicity to each ecosystems.

Regardless of Solana’s payment dominance, challenges persist. Its DeFi TVL decline raises issues about capital retention, whereas Ethereum’s safety and developer exercise stay unmatched. Solana’s latest partnerships, such because the Solana Saga smartphone and Helium community integration, goal to bridge blockchain with mainstream tech.

Set up Coin Push cellular app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

Market Influence and Future Traits

Solana’s payment management highlights its position in democratizing entry to blockchain functions. Nonetheless, Ethereum’s ecosystem resilience and safety guarantee its relevance. As each chains evolve, merchants and builders should weigh pace towards safety. Solana’s SOL token, at present buying and selling at $161.22, reveals optimism regardless of consolidation phases.

- TPS (Transactions Per Second)

- A measure of a blockchain’s processing capability. Greater TPS signifies sooner transaction settlement.

- TVL (Whole Worth Locked)

- The whole worth of belongings deposited in DeFi protocols, reflecting ecosystem exercise.

- DeFi (Decentralized Finance)

- Monetary companies constructed on blockchain, together with lending, buying and selling, and yield farming.

- NFT (Non-Fungible Token)

- Distinctive digital belongings representing possession of things like artwork or collectibles.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your individual analysis earlier than making any funding choices.

Be happy to “borrow” this text — simply don’t neglect to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic based mostly in Amsterdam, the place he follows each twist and switch on the earth of cryptocurrencies and Web3.