Ego Demise Capital’s portfolio reveals adoption metrics together with $1.5 billion in Lightning-powered buying and selling quantity, as Block shocks the business with their 9.7% Lightning Community yield.

Whereas bitcoin treasury corporations, debates about market construction payments, and strategic bitcoin reserve advocacy dominate the headlines in 2025, a development is quietly rising within the background: the success of Bitcoin expertise corporations.

More and more acknowledged as digital gold and a long-term retailer of worth, bitcoin is way over only a shiny rock in our on-line world. As a software program expertise, Bitcoin is programmable and has unlocked a brand new paradigm of funds, custody, settlement and buying and selling prospects.

Nonetheless, some critics level to the empty blocks on the Bitcoin base layer and traditionally low transaction charges as implicit proof that Bitcoin is failing as a medium of alternate. Others declare that the Lightning Community has did not get mainstream adoption and even argue that it suffers from important privateness issues. However the reverse could also be true.

New knowledge popping out of varied corporations all through the business is beginning to paint a distinct image. Maybe the Lightning Community has been so profitable in drawing transactions off chain and making them extra personal that it’s arduous to quantify success metrics with out corporations concerned sharing the info.

However, quite a lot of Bitcoin start-ups and firms utilizing bitcoin to construct out new monetary infrastructure are actually beginning to boast of their success metrics, claiming numbers that recommend there’s a robust product market match past treasury methods.

Jeff Booth, writer of The Price Of Tomorrow and co-founder of the Bitcoin-focused VC agency Ego Death Capital, instructed Bitcoin Journal he doesn’t “suppose most of the people has any clue with how briskly the Bitcoin ecosystem is rising.” Including that, “They carry on listening to treasury corporations this and politics that, and so they’re lacking the forest for the bushes.”

Beneath follows a abstract of varied corporations and initiatives demonstrating Bitcoin adoption in important numbers, lots of them throughout the Ego Demise Capital portfolio.

Block: Incomes Massive on Lightning and Bitcoin Funds

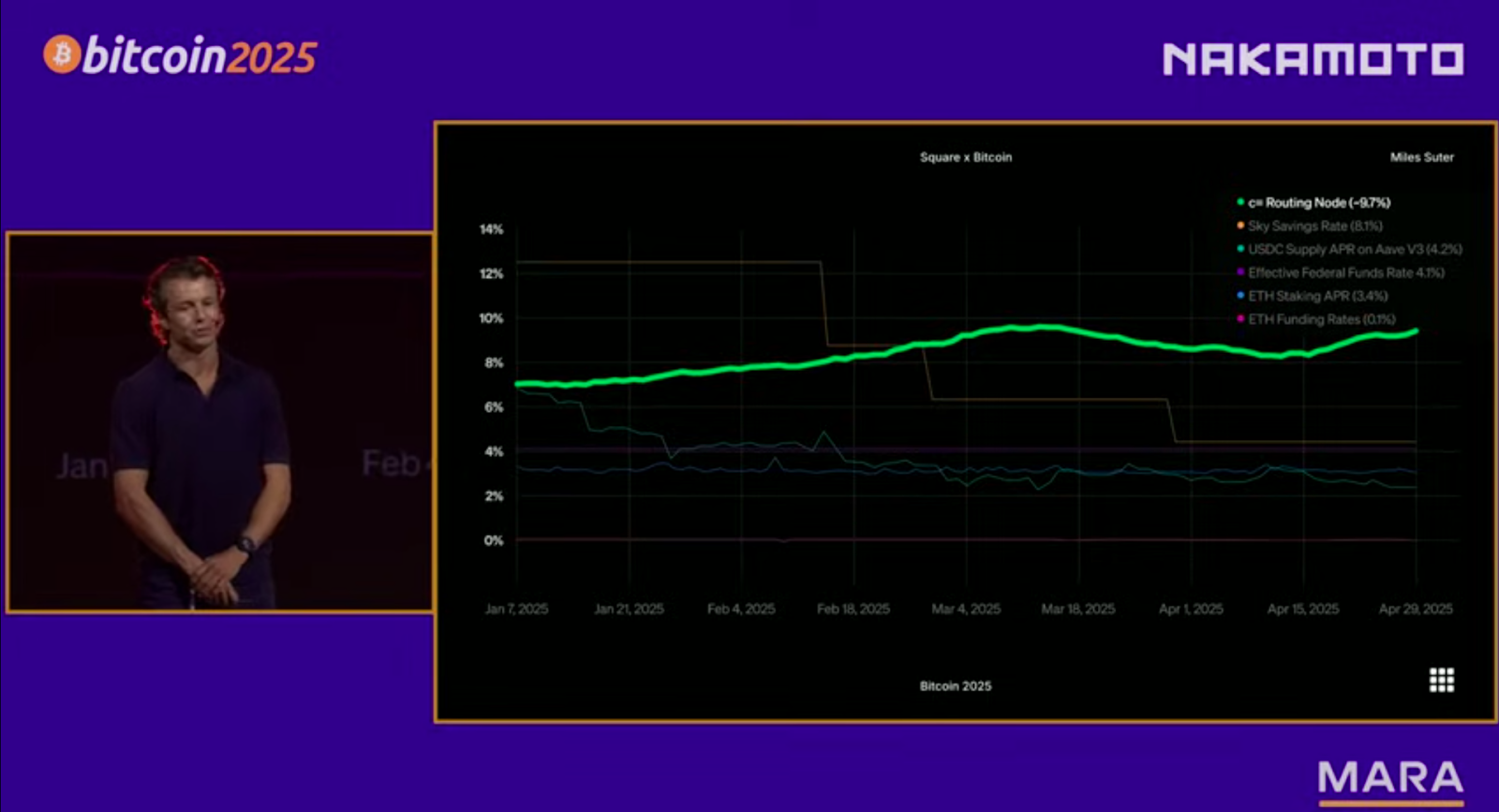

The distinction in views between the digital gold thesis and people who consider in Bitcoin as a funds expertise was most just lately seen at Bitcoin Vegas 2025 the place Block, the guardian firm of Money App, disclosed that they’re incomes 9.7% yield off their Bitcoin Lightning node.

Miles Suter, Bitcoin Product Lead at Block, told the live audience that “on the infrastructure layer, we’re incomes almost 10% bitcoin-on-bitcoin returns by effectively routing actual funds throughout the Lightning community. This isn’t yield from altcoin staking or reckless hypothesis; it’s from fixing arduous, real-time routing issues, and its actual bitcoin-on-bitcoin returns from our company holdings through supporting actual funds use circumstances.”

In addition to Block’s gorgeous 9.7% determine announcement, which stood out as one of the vital lasting impressions from the convention, Suter claimed that Money App ranks “among the many high bitcoin on-ramps within the U.S., accounting for almost 10% of on-chain block house at any time,” including that in 2024, its Lightning utilization grew 7x and one in 4 of their outbound Bitcoin funds are processed on Lightning. These numbers spotlight Block’s progress as a Bitcoin funds large, now maybe the commonest service provider funds terminal and shopper funds app that integrates bitcoin.

Ego Demise Capital

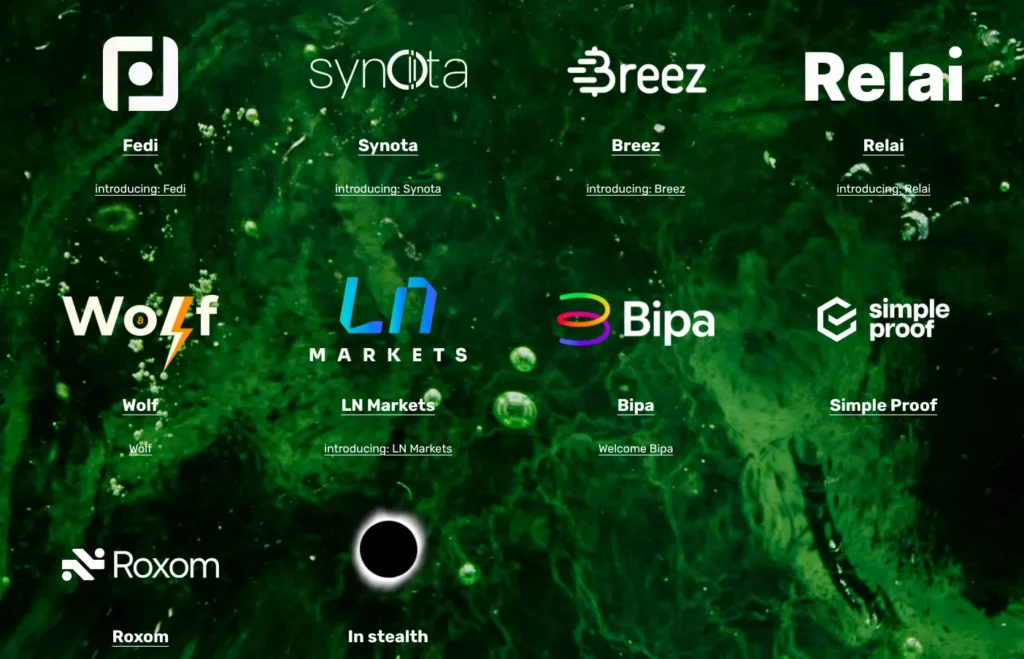

Ego Demise Capital has been investing in Bitcoin infrastructure start-ups since 2022, initially elevating a tactical 30 million greenback fund amid a growth in crypto and altcoin VC investments.

“After we first raised cash, we really focused 30 million as a result of the ecosystem at the moment was actually early. We realized we needed to lean into these corporations to assist them scale. There have been a variety of large crypto funds at the moment, however they had been spraying cash all over the place else. And it was largely the precise reverse of what we believed would occur on Bitcoin.” Sales space recalled that “Bitcoin was a protocol. It was creating in layers and it was early. And for those who realized that and leaned in to assist these corporations that had been creating within the layers, serving to the infrastructure be created, then you definitely would speed up that. You’ll speed up what we noticed Bitcoin being, a foreign money, a retailer of worth, a wholly new community.”

“We don’t have a failure in that fund,” Sales space mentioned of the agency’s first funding cohort, which included corporations like Breez, Relai, LN Markets, Fedi, Wolf and Easy Proof. “That fund is simply over three years outdated. It’s staggering. Plenty of these corporations, I feel three of these corporations are already worthwhile — and worthwhile in bitcoin phrases. So including bitcoin to their treasury every month and rising extremely quick.”

Breez: Powering a World Lightning Funds Community

Breez, based in 2018, is a self-custodial Lightning-as-a-service supplier that permits builders to combine Bitcoin funds into apps utilizing its open supply Breez SDK. By simplifying Lightning’s complexities, Breez has been driving widespread adoption throughout various industries.

“Over 40 apps have already carried out our SDK in manufacturing or beta since we launched it lower than 18 months in the past. Collectively, ~1.5 million customers now have entry to self-custodial, peer-to-peer bitcoin funds by way of these apps. These apps processed over $4.5 million in gross transaction quantity in 2024,” wrote Roy Sheinfeld, CEO of Breez, in a January 2025 blog post.

The “Bitcoin Funds Report” by Breez and 1A1z, released February 2025, added, “The Lightning Community now reaches over 650 million customers; pushed by integrations with mainstream merchandise, new developer instruments, and rising service provider adoption.” A month later Sheinfeld published that “Lightning Pay’s person base has been rising with customers transferring a billion sats month-to-month.” Moreover, Breez’s integration with Klever Pockets introduced Lightning to “100,000 month-to-month energetic customers,” as acknowledged in a December, 2024, weblog publish.

LN Markets: Lightning-Fueled Buying and selling Takes Off

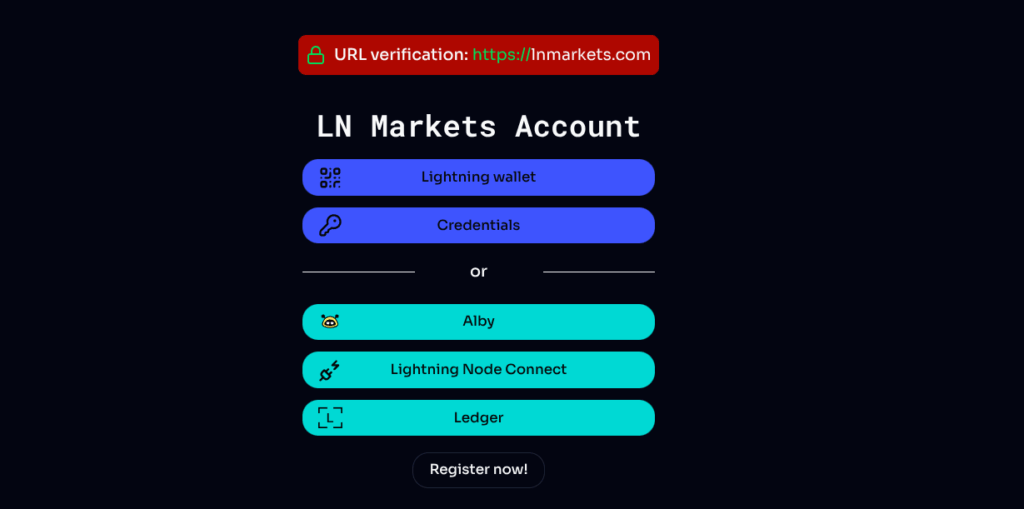

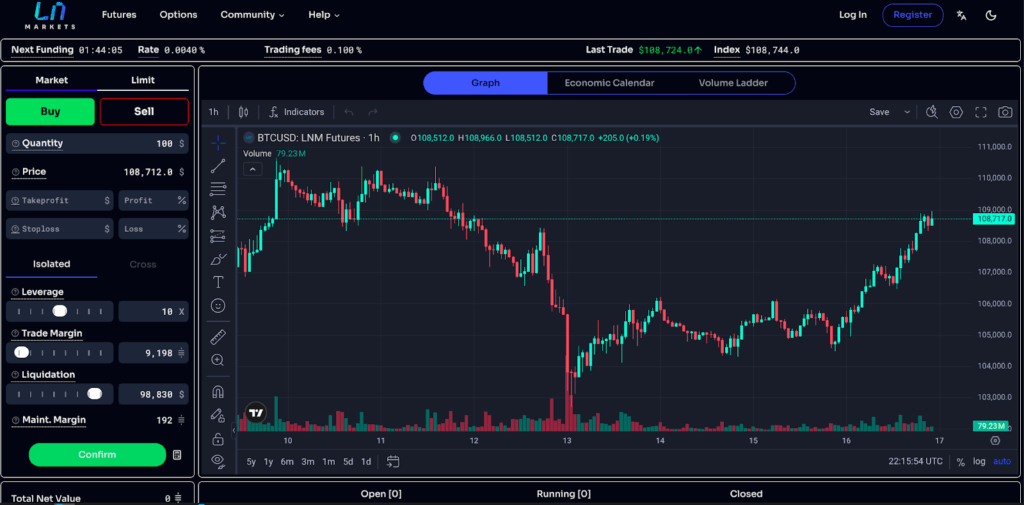

LN Markets, launched in 2020, is a Bitcoin-native derivatives buying and selling platform, leveraging the Lightning Community for immediate settlements and minimized counterparty threat.

Its Lightning-native login interface demonstrates they’re on the slicing fringe of Bitcoin applied sciences and unlocks person expertise options that differentiate it from most different superior buying and selling platforms. The quick cost rails that outcome from this deep integration with the Lightning Community unlock sooner settlement, decrease withdrawal charges and gives entry to smaller merchants all through the third world, with many customers in South America in nations like Mexico, Brazil and Colombia.

“Principally we’ve gone from 50 million in month-to-month buying and selling quantity to 1.5 billion final month in Could,” co-founder Romain Rouphael instructed Bitcoin Journal, including that they’ve gone from “one billion greenback yearly buying and selling quantity in 2023 to 6 billion final yr to 12 billion this yr.” Profitability can also be robust, with Romain stating, “We double our income every year and we double our EBITDA as effectively yearly,” and “We’re doing hundreds of thousands of Lightning transactions yearly” These figures spotlight LN Markets’ robust and energetic person base in addition to Lightning’s scalability.

The alternate focuses on Bitcoin derivatives like a perpetual futures contract and an choices platform, traded in opposition to an artificial greenback that when settled is paid out in Bitcoin.

Relai: Europe’s Bitcoin Neobank

Relai, a Swiss-based cell app based in 2020, streamlines bitcoin adoption for Europeans with a user-friendly, noncustodial pockets and brokerage service. Concentrating on newcomers, it emphasizes dollar-cost averaging and self-custody, making bitcoin financial savings accessible.

Julian Liniger, co-founder of Relai, instructed Bitcoin Journal “we are actually precisely 5 years into the market. We began in the summertime 2020, at this time we’re roughly 50 full-time staff, we’ve got raised round 20 million U.S. {dollars}, we’ve got greater than 500 thousand app downloads throughout Europe, and round 150,000 energetic customers.” He added that, “Final yr we did round half a billion of buying and selling quantity.”

Liniger says they anticipate to realize round one billion in buying and selling quantity in 2025 and “eight digits” in income.

Madeira: A Bitcoin Financial system in Motion

The Madeira Bitcoin project, launched on the scenic island, seeks to ascertain a thriving Bitcoin-native economic system, drawing inspiration from Bitcoin Seashore in El Salvador. Initiated with the assist of Jeff Sales space and Madeira’s president Miguel Albuquerque, the venture has adopted a bottom-up technique, encouraging retailers to just accept Bitcoin through the Lightning Community for quick, low-cost transactions and the associated advertising upside. This method capitalizes on Madeira’s tourism-driven economic system, the place Bitcoin’s effectivity outshines fiat techniques, doubtlessly driving natural progress.

“So, we went on Madeira and once we did the convention – in 2023” Sales space recalled of the initiative, “ It took me a yr to get 32 corporations to just accept Bitcoin. We had been fairly pleased with having 32 corporations onboard. Quick ahead a yr, I feel it’s over 250 corporations accepting Lightning in Madeira. You possibly can reside in a completely full round economic system in Madeira at this time.” Organizations like FREE Madeira assist companies onboard Bitcoin and preserve a BTCMap that whereas in all probability incomplete, provides you a way of the adoption, boasting 150 energetic Bitcoin retailers within the small European island.

Initiatives like Sovereign Engineering, a Bitcoin centric occasion for builders and entrepreneurs to improve their talent units and community add to the enchantment of the island, placing it on the map for top tech builders and entrepreneurs. The regulatory surroundings in Madeira additionally welcomes innovation, as a particular financial area throughout the euro zone, a growth which Sales space says “it’s wildly thrilling.”