Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The on-chain analytics agency Glassnode has highlighted the $97,000 to $98,000 zone as an necessary one for Bitcoin. Right here’s why.

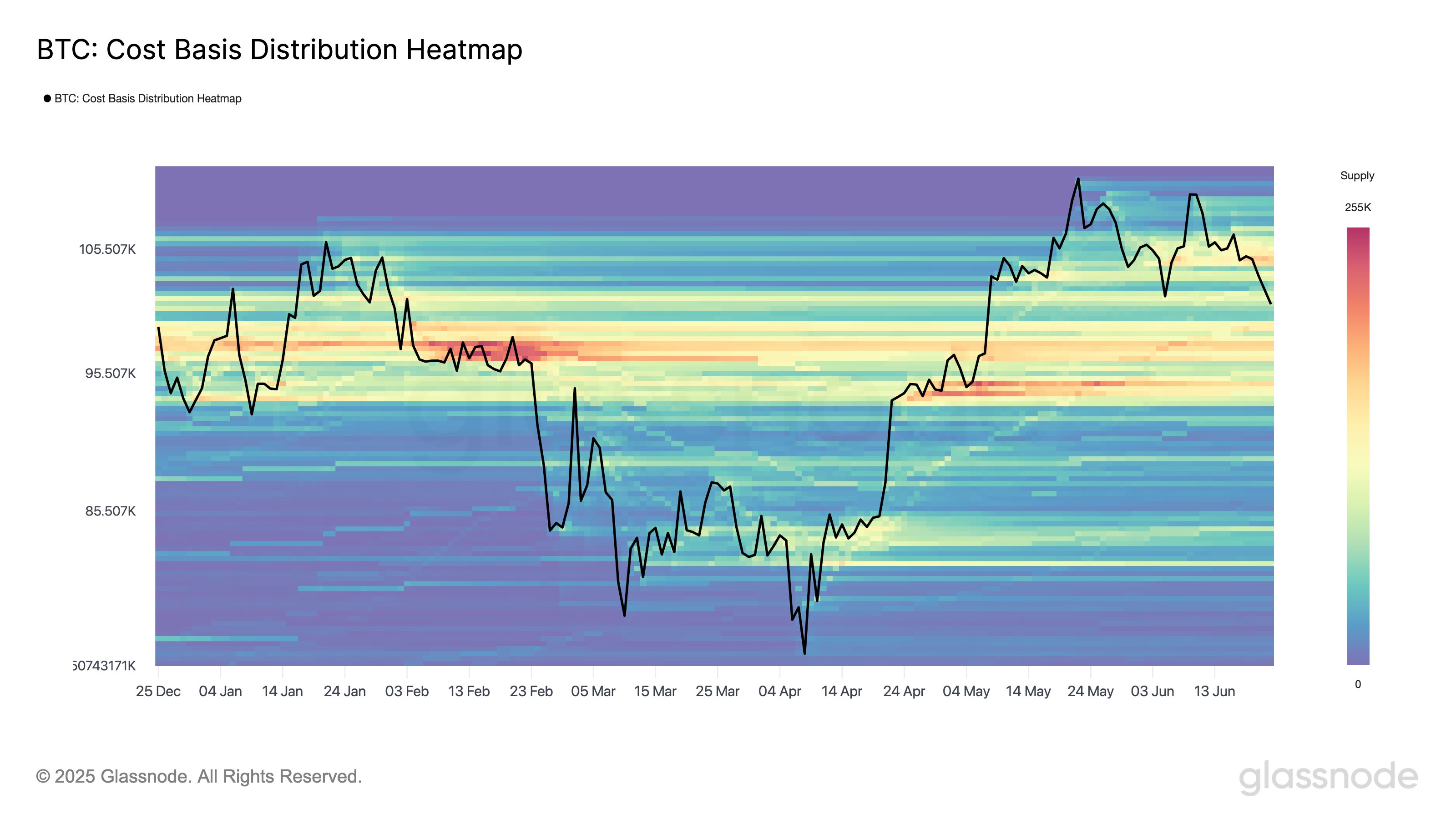

Bitcoin CBD Suggests Construct Up Of Provide In This Vary

In a brand new post on X, Glassnode has mentioned a couple of doubtlessly important zone for Bitcoin based mostly on the Price Foundation Distribution. The Cost Basis Distribution (CBD) is an indicator that measures the quantity of the BTC provide that traders final bought or transferred on the numerous worth ranges.

As is seen within the above graph, there’s a dense provide zone situated between $97,000 to $98,000. Typically, traders are fairly delicate to retests of their value foundation, so a considerable amount of them (or alternatively, just a few massive holders) having their acquisition stage inside a slender vary may make retests of it important for Bitcoin.

Associated Studying

When the temper available in the market is bullish, holders can react to retests of their value foundation from above by shopping for extra. They might accomplish that believing that the identical stage would find yourself proving worthwhile once more sooner or later and the retrace is only a ‘dip.’

The cryptocurrency suffered a plunge yesterday and practically touched this area. Since then, nevertheless, issues have circled for the asset and it has gained a ways over it as soon as extra.

Within the occasion that the decline does proceed, which is probably not too surprising given the volatile geopolitical situation in the mean time, the zone may find yourself appearing as the subsequent true pivot for Bitcoin, in keeping with the analytics agency.

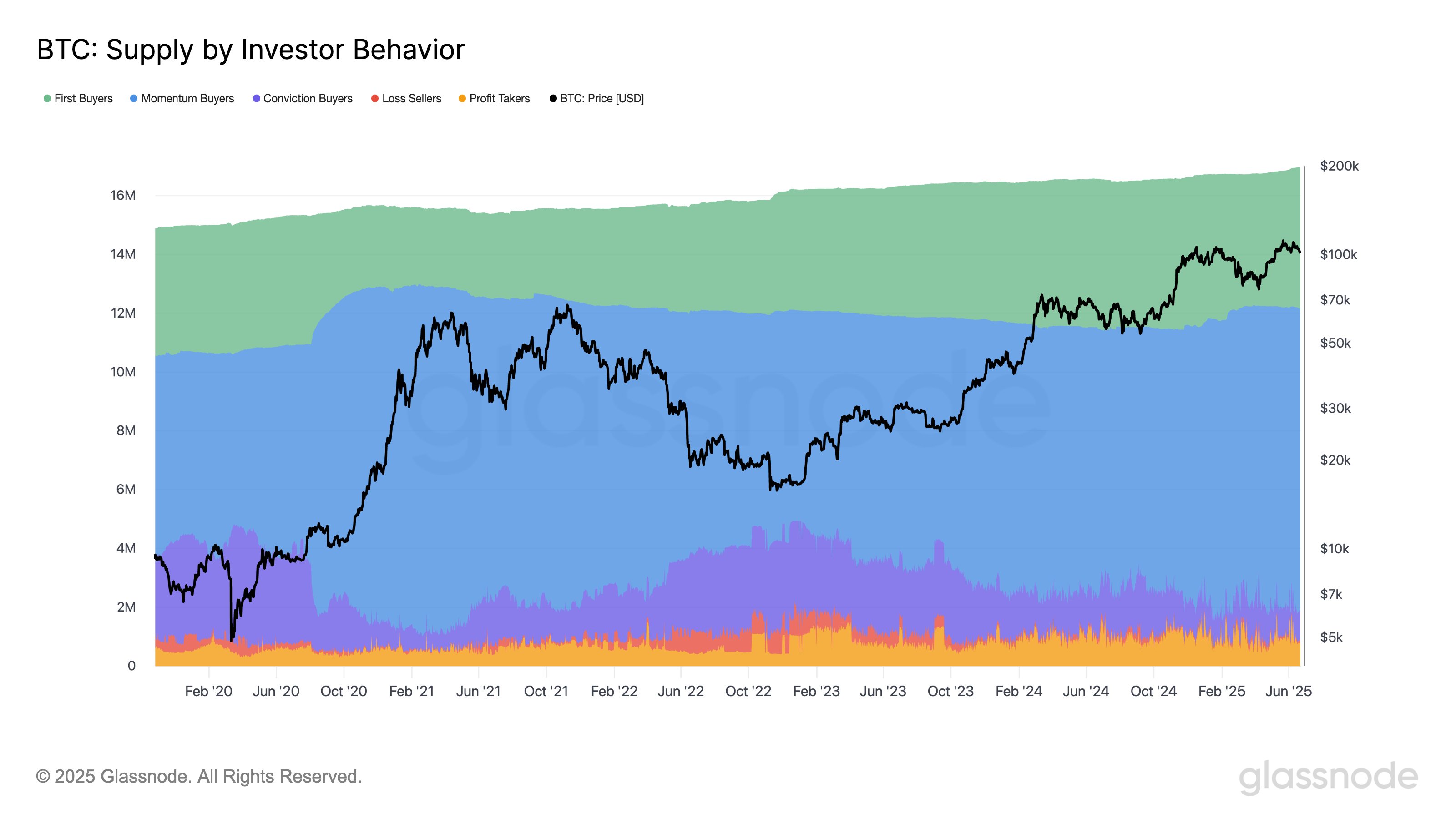

Whereas the CBD tells us the place the cryptocurrency’s provide is concentrated, it doesn’t include any details about who purchased or offered at these worth ranges. Glassnode’s behavioral cohorts, investor teams divided on the premise of their habits, clear up this downside.

Here’s a chart that exhibits the development within the Bitcoin provide held by these holder cohorts over the previous few years:

There are 5 of those habits teams. First Patrons (inexperienced) embody the traders who’re shopping for Bitcoin for the very first time. As displayed within the chart, the provision of this group has been on the rise, indicating recent demand has been coming in.

Momentum Patrons (blue) are people who capitalize on market momentum by shopping for throughout uptrends. On the other spectrum are the Conviction Patrons (purple), who purchase regardless of falling costs.

Lastly, there are the Loss Sellers (purple) and Revenue Takers (yellow), who correspond to traders exiting at a loss and revenue, respectively. In the course of the previous couple of weeks, the previous cohort has seen a rise of 29%, an indication that weak arms have been capitulating.

Associated Studying

That stated, the analytics agency has famous, “Conviction Patrons additionally elevated, suggesting sentiment isn’t collapsing. Some are reducing losses – others are actively decreasing their value foundation.”

BTC Value

On the time of writing, Bitcoin is floating round $103,900, down greater than 4% within the final seven days.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com