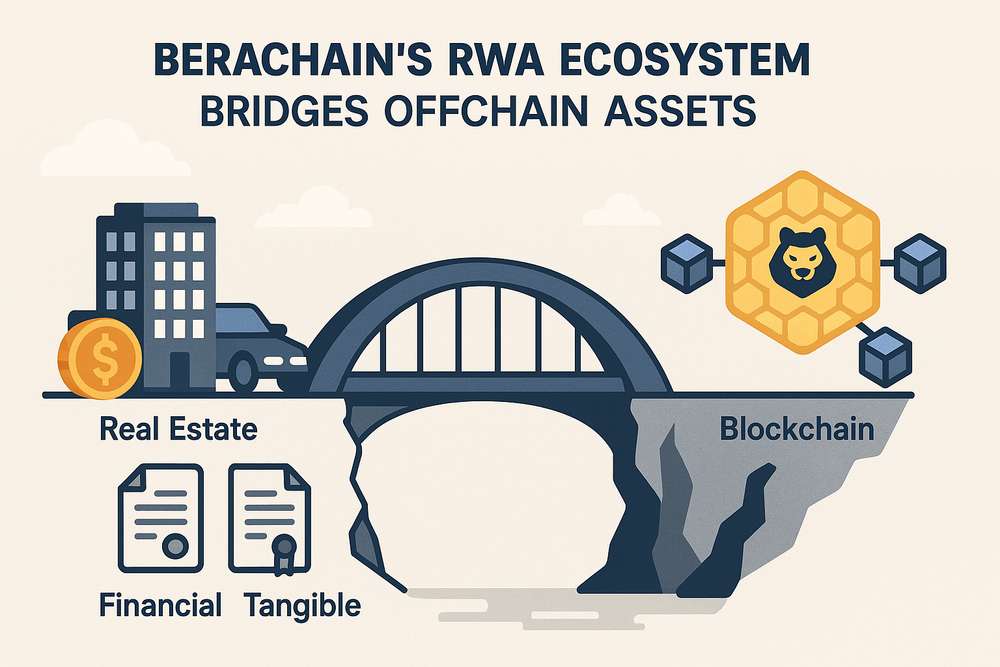

Berachain is pioneering Actual World Asset (RWA) tokenization by way of its novel Proof-of-Liquidity consensus, remodeling conventional belongings into blockchain-based devices. The Layer 1 blockchain’s ecosystem permits yield technology from tangible belongings like commodities and actual property, creating new alternatives for decentralized finance. This method merges conventional finance reliability with blockchain innovation.

Constructed on Cosmos SDK with EVM compatibility, Berachain’s structure uniquely positions it for asset tokenization. Its Proof of Liquidity Consensus (POLC) mechanism incentivizes deep liquidity swimming pools important for RWA buying and selling. Validators calculate vote weights by way of a consensus vault, distributing rewards to customers staking belongings like wBTC or USDC.

The ecosystem’s progress follows Berachain’s $100 million Sequence B funding spherical co-led by Brevan Howard Digital and Framework Ventures. This capital injection accelerates growth of RWA marketplaces the place customers tokenize offchain belongings for yield farming, as detailed in Berachain’s ecosystem highlight.

RWA Tokenization Mechanics

Berachain’s RWA infrastructure converts bodily belongings into tradable tokens by way of permissioned validators. Asset originators deposit collateral documentation into decentralized storage, triggering minting of consultant tokens. These tokens combine with Berachain’s cash markets for lending/borrowing towards real-world collateral.

Distinctive to the chain is the tri-token system supporting RWA operations: BERA (fuel token), HONEY (stablecoin), and BGT (governance token). This construction permits complicated monetary operations whereas sustaining asset-backed stability. Customers stake RWAs to earn BGT, which governs protocol parameters like loan-to-value ratios.

Technical Structure

Berachain’s EVM-identical design permits seamless deployment of Ethereum-based RWA protocols. The chain makes use of CometBFT consensus modified with POLC, the place liquidity suppliers obtain voting energy proportional to staked belongings. This Sybil-resistant mechanism ensures solely dedicated individuals affect governance.

Key technical parts embody:

- vAMM artificial liquidity swimming pools for RWA buying and selling pairs

- Cross-chain bridges for asset import/export

- Zero-knowledge KYC modules for compliant entry

Investor Backing

Berachain’s $100 million Sequence B attracted institutional heavyweights together with Polychain Capital and Hack VC. This funding fuels growth of RWA infrastructure, with Framework Ventures particularly citing tokenized actual property as a goal market. The funding underscores confidence in Berachain’s method to merging conventional finance with DeFi.

Investor participation extends past capital: Brevan Howard supplies experience in conventional asset tokenization, whereas Tribe Capital contributes alternate integration methods. This synergy positions Berachain to seize institutional RWA demand.

Ecosystem Purposes

A number of initiatives leverage Berachain’s RWA capabilities:

- Commodity tokenization platforms for gold and oil

- Actual property fractional possession markets

- Bill financing protocols

- Carbon credit score buying and selling programs

These functions exhibit Berachain’s versatility in representing numerous asset lessons. The chain’s throughput (10,000+ TPS) permits complicated RWA operations impractical on older networks.

Set up Coin Push cell app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

Berachain’s RWA focus may catalyze institutional DeFi adoption, probably unlocking trillions in conventional belongings. As tokenization requirements mature, Berachain’s technical structure positions it as a number one settlement layer for hybrid monetary devices bridging Web2 and Web3 economies.

- Proof of Liquidity Consensus (POLC)

- Berachain’s novel consensus mechanism that makes use of staked belongings to find out validator affect. It incentivizes liquidity depth whereas distributing rewards proportionally to contributors.

- Actual World Belongings (RWA)

- Tangible offchain belongings like actual property or commodities represented as blockchain tokens. These allow conventional belongings to take part in DeFi yield technology.

- Tri-Token System

- Berachain’s financial mannequin comprising BERA (fuel token), HONEY (stablecoin), and BGT (governance token). This construction helps complicated monetary operations whereas sustaining stability.

- vAMM

- Digital Automated Market Maker enabling artificial asset buying and selling with out full collateralization. This mechanism permits environment friendly worth discovery for illiquid RWAs.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your personal analysis earlier than making any funding selections.

Be happy to “borrow” this text — simply don’t overlook to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic based mostly in Amsterdam, the place he follows each twist and switch on the planet of cryptocurrencies and Web3.