Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

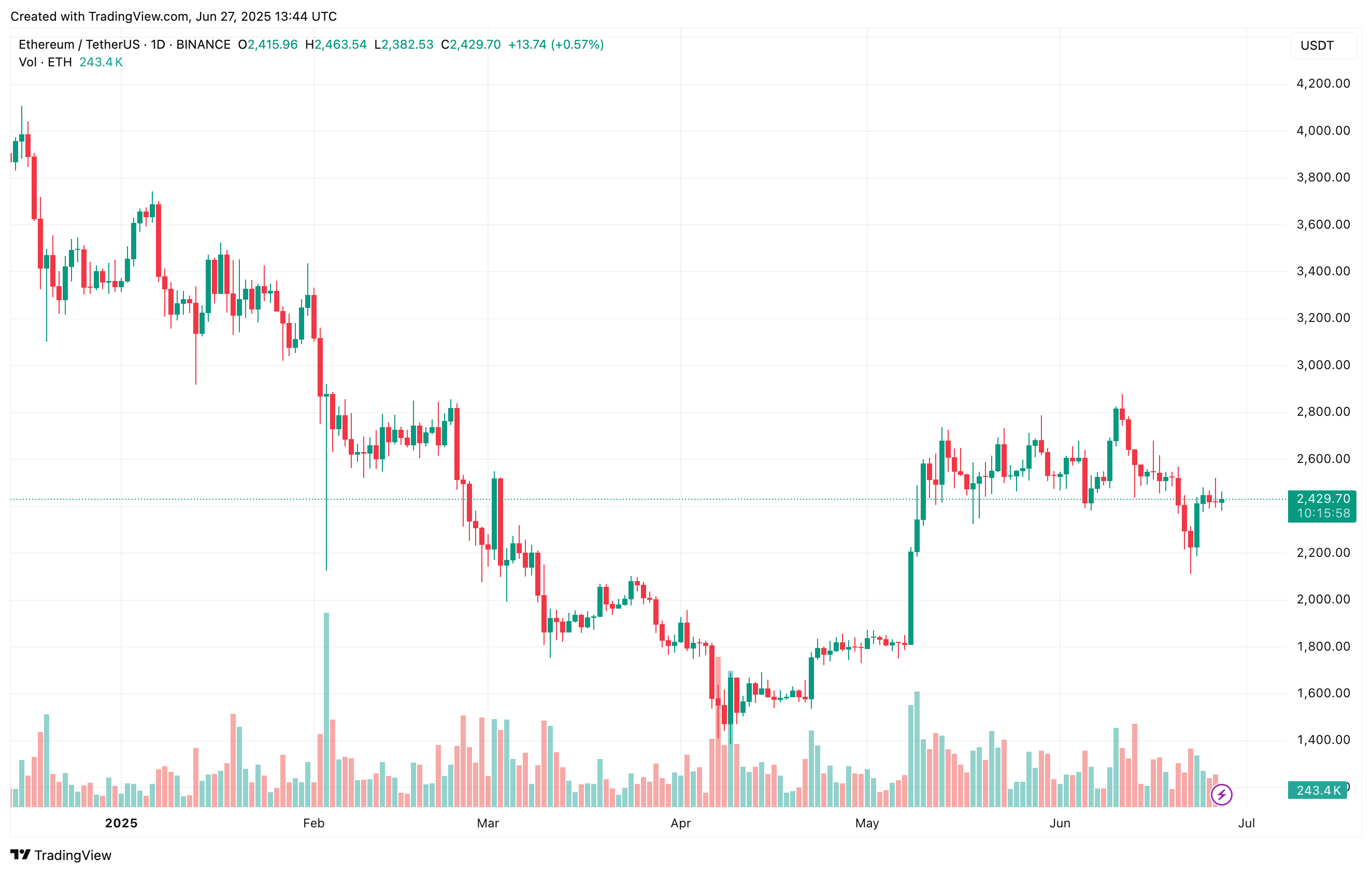

Ethereum (ETH) has recorded sturdy good points over the previous two weeks, rising from $2,111 on June 12 to $2,515 on June 25, reigniting hopes for a sustained bullish rally that might push the digital asset past the essential $3,000 degree.

Ethereum Rally Marked By Shift In Dynamics

In keeping with a latest CryptoQuant Quicktake put up by contributor Amr Taha, Ethereum’s newest rally has been accompanied by a notable shift in market dynamics – together with a flip to constructive funding charges, a possible quick squeeze, and an increase in ETH inflows to Binance crypto alternate.

Associated Studying

Current knowledge from Binance reveals a major shift in ETH funding charges from unfavorable to constructive. Constructive funding charges usually point out that merchants are opening or holding leveraged lengthy positions, reflecting expectations of additional upside.

Nevertheless, rising funding charges may elevate the chance of a short-term worth pullback if lengthy positions change into overextended. Data from CoinGlass reveals that 68.15% of liquidations over the previous 24 hours had been lengthy positions – highlighting this danger.

Taha additionally emphasised the function of a brief squeeze in Ethereum’s latest worth surge and the rise in funding charges. As ETH’s worth climbed, it retested the earlier short-squeeze zone round $2,500. He defined:

In that earlier occasion, quick positions had been forcibly closed by initiating aggressive market purchase orders to cowl their publicity, triggering a cascading impact generally known as a brief squeeze. This dynamic happens when merchants who had guess in opposition to ETH (shorts) are compelled to shut their positions by aggressively shopping for again the asset to restrict losses.

In the meantime, ETH inflows to Binance have additionally spiked. On-chain alternate knowledge means that 177,000 ETH was deposited into Binance over a three-day interval – an unusually excessive quantity.

Such a surge usually alerts elevated promoting stress or large-scale repositioning by main holders. Giant transfers of ETH to exchanges typically precede both potential sell-offs or liquidity provisioning.

In conclusion, Taha famous that whereas a short-term correction could also be probably, ETH’s breakout above $2,500 underscores the aggressive speculative exercise driving its latest worth motion. Merchants are suggested to carefully monitor funding charges and alternate flows for indicators of an impending retracement.

ETH Bulls Take The Cost

Current technical evaluation suggests ETH could also be gearing up for a breakout above the $2,800 resistance degree. The asset additionally lately formed a golden cross on the every day chart, fuelling hypothesis {that a} new all-time excessive (ATH) may very well be inside attain.

Associated Studying

That mentioned, ETH isn’t completely within the clear. Technical analyst Crypto Wave lately predicted that the cryptocurrency could revisit decrease ranges within the $1,700 to $1,950 vary. At press time, ETH trades at $2,429, down 0.4% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com