Before crypto became a thing, Wyoming was better known for its miners, cowboys, and ranching. Then Bitcoin, meme coins, and Ethereum exploded. Now, instead of fighting tech like New York, they opened their arms wide for crypto.

Fast-forward, and in 2025, especially after President Donald Trump took over, Wyoming showed all other states how

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

Bitcoin

0.02%

Bitcoin

BTC

Price

$90,618.18

0.02% /24h

Volume in 24h

$9.95B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

and crypto laws should be drafted. Wyoming was the first to build a comprehensive legal “bridge” between traditional law and digital assets. Rather than operating in a legal gray area, crypto companies in Wyoming have specific statutes that protect them.

After the idea was first floated in 2023, Wyoming have now opened public access to Frontier Stable Token (FRNT), the first stablecoin issued by a US state.

I'm pleased to announce the official launch of the Frontier Stable Token (FRNT$) this morning. pic.twitter.com/ruc7enIt0h

— Governor Mark Gordon (@GovernorGordon) January 7, 2026

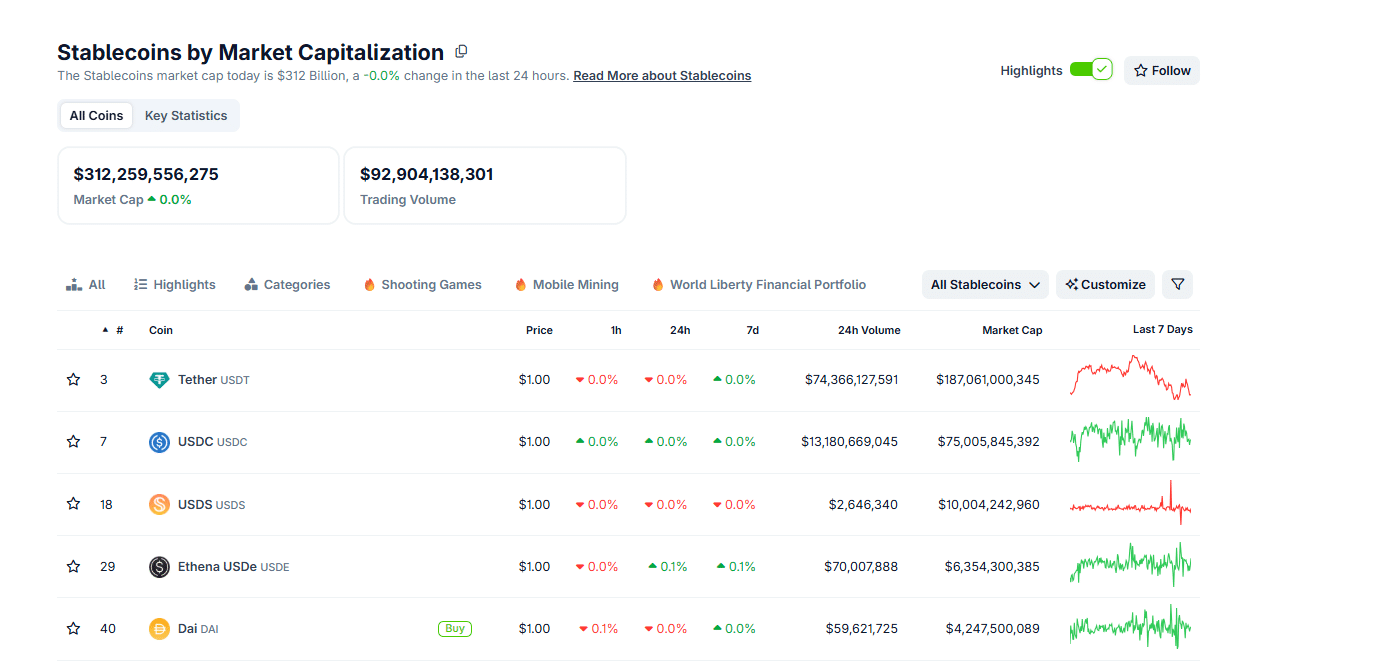

The interoperable token launched quietly, but it enters a stablecoin market already above $312bn, where trust and transparency drive adoption.

(Source: Coingecko)

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2026

Wyoming and FRNT: What You Need To Know

FRNT is a stablecoin, which means it aims to stay pegged to the U.S. dollar. Think of it like a digital dollar bill that moves on blockchains instead of through banks.

Therefore, by default, FRNT trades at $1.

Wyoming backs every FRNT with cash and short-term US Treasuries. State law even requires extra reserves on top.

Reserves will be managed by Franklin Templeton, which is an investment giant with over $1T of assets under its control.

However, custody will lie solely on the Fiduciary Trust Company International, an affiliate of Franklin Templeton.

At all time, the reserves will have a +2% buffer. That means FRNT will be overcollateralized.

You can buy FRNT on Kraken or through Rain, a Visa-linked crypto card service.

It runs on Solana and can “bridge” to Ethereum, Avalanche, Arbitrum, and other networks. Bridging means moving the same token between blockchains without selling it.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Why now? Why FRNT?

Stablecoin issuers rake in billions in profits.

Tether, which has minted over $187Bn of USDT, raked in over $10Bn in profits by Q3 2025.

The number is expected to rise thanks to the increased yields by the end of the year.

Profits earned by stablecoin issuers like Tether stem from treasury yields.

Wyoming wants to earn a yield as well.

However, how profits will be spent is totally different.

Unlike Circle, which distributes its revenue to Coinbase, which in turn is funneled to COIN shareholders, Wyoming will use all its profits from FRNT to fund education in the state. After operational costs, proceeds will go directly to the Wyoming School Foundation Program.

For taxpayers, that acts like a tiny rebate built into the system.

Later, the goal is to use FRNT profits to lower tax burdens on Wyoming citizens.

DISCOVER:

- 16+ New and Upcoming Binance Listings in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Wyoming State-Backed Stablecoin FRNT Is Live: Yield to Fund Education appeared first on 99Bitcoins.