From the start, Bitcoin’s rise has been nothing in need of legendary. Priced at simply $0.07 on August 17, 2010, it has skyrocketed $100,000+ into 2025, creating wealth, rewriting funding playbooks, and cementing its place as a cornerstone of the longer term monetary system.

Bitcoin Journal Professional knowledge reveals that out of 5,442 whole days since Bitcoin first started buying and selling, 5,441 have been worthwhile when in comparison with at this time’s worth, a rare 99.98% success charge. For many who believed early and held by the volatility, the reward has been historic.

The evaluation of Bitcoin’s day by day worth historical past additionally reveals that over 80 % of all buying and selling days have been worthwhile, which means the present worth is increased than the value on these days. This stage of consistency has grow to be a key cause why so many long run traders proceed to hodl with confidence.

Since 2013, the worldwide provide of cash (M2) has grown from about $61 trillion to over $102 trillion. Throughout that very same interval, Bitcoin’s worth jumped from round $113 to greater than $118,000 at its peak. This pattern exhibits a powerful connection between the rise in international cash provide and the rise in Bitcoin’s worth, supporting the concept Bitcoin acts as a hedge in opposition to inflation and a dependable retailer of worth.

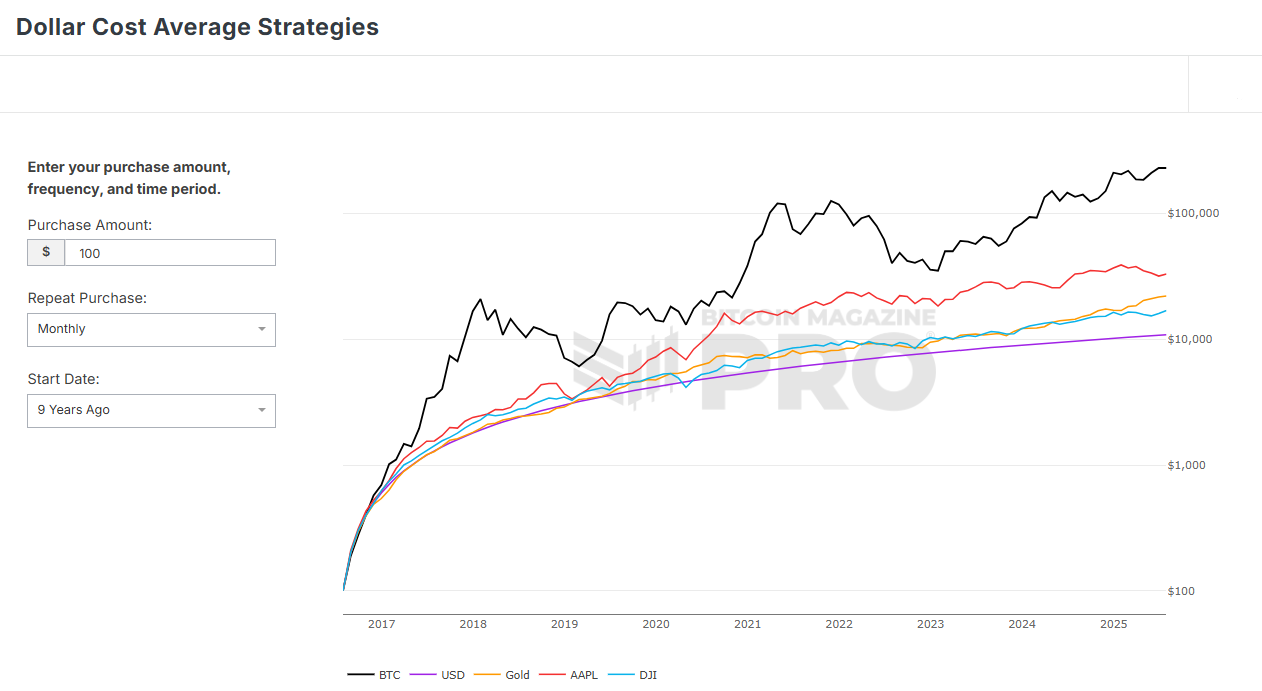

In keeping with Bitcoin Magazine Pro, in the event you had greenback price averaged (DCA) $100 a month into Bitcoin over the previous 9 years, you’d be sitting on over $230,670 at this time, from only a $10,900 whole funding, with a return of over 2,016%.

Compared, gold had returns of 103% which might have turned the funding of $10,900 into $22,152, Apple inventory of 204% into $33,081, and Dow Jones Industrial (DJI) 56% into 16,993. Bitcoin simply surpasses the returns of conventional belongings like gold, Apple inventory, or the DJI.

The Greenback Value Common Methods software from Bitcoin Journal Professional helps customers discover Bitcoin investments throughout totally different timeframes. By evaluating Bitcoin’s efficiency to belongings just like the US greenback, gold, Apple inventory, and the DJI, the software highlights Bitcoin’s potential as a number one retailer of worth inside a diversified funding portfolio. These concerned with view Bitcoin Journal Professional knowledge can achieve this here.