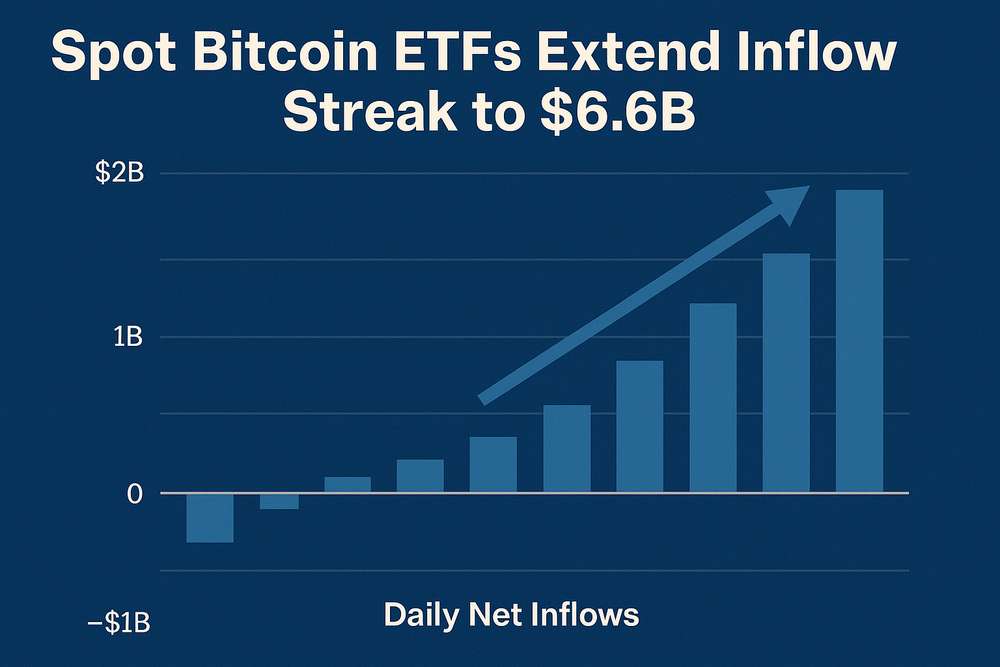

Spot Bitcoin ETFs recorded $363 million in each day inflows, extending their unprecedented influx streak to 12 consecutive days and bringing the overall accumulation to $6.6 billion. This sustained demand highlights strong institutional confidence as Bitcoin continues buying and selling close to all-time highs.

The constant inflows since early July characterize the longest optimistic streak because the ETFs launched in January 2024. Market analysts attribute this momentum to rising institutional adoption and favorable macroeconomic situations for digital property.

Bitcoin’s value trajectory stays strongly correlated with ETF flows, with the cryptocurrency buying and selling round $117,700 after lately hitting $123,000. The 25% year-to-date acquire displays deepening market maturity.

BlackRock’s IBIT Dominance

BlackRock’s iShares Bitcoin Belief (IBIT) continues to steer the market, turning into the quickest ETF in historical past to succeed in $80 billion in property below administration. The fund now holds over $83 billion in Bitcoin, capturing the lion’s share of current inflows.

Final week alone, IBIT attracted $1.35 billion throughout two buying and selling classes, demonstrating its place as the popular institutional automobile. This dominance represents a big shift in conventional finance’s strategy to cryptocurrency publicity.

ETF Market Enlargement

The broader spot Bitcoin ETF market now approaches $154 billion in complete property, in accordance with current knowledge. July has been significantly explosive with over $4 billion in internet inflows – the strongest month-to-month efficiency since launch.

Latest each day influx patterns present outstanding consistency:

| Date | Inflows (Tens of millions) |

|---|---|

| July 17 | $490.1 |

| July 16 | $755.2 |

| July 11 | $1,000+ |

This progress trajectory suggests institutional portfolios are more and more allocating to Bitcoin as a strategic asset class. A number of conventional finance giants now take part within the ecosystem by means of these regulated merchandise.

Market Impression and Outlook

The sustained ETF demand creates structural shopping for strain that analysts consider might propel Bitcoin towards $140,000 in coming months. The institutional participation marks a elementary shift from earlier market cycles dominated by retail traders.

Market construction seems more and more resilient, with ETF flows performing as a stabilizing drive throughout volatility. The constant inflows counsel deep-pocketed traders view present ranges as an accumulation zone regardless of current value appreciation.

As famous in a current CryptoBriefing analysis, the ETF inflows coincide with elevated whale exercise on-chain. This alignment between conventional and crypto-native traders creates a strong demand catalyst.

Regulatory readability round these funding autos continues to draw pension funds and endowments beforehand hesitant to enter the crypto area. The SEC’s approval of spot ETFs stays a watershed second for institutional adoption.

Set up Coin Push cell app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

The ETF-driven capital inflow essentially reshapes Bitcoin’s market dynamics, making a extra steady basis for long-term progress. This institutional endorsement indicators cryptocurrency’s maturation right into a authentic asset class inside international finance.

- Spot Bitcoin ETF

- Change-traded funds that maintain precise Bitcoin, permitting traders to achieve publicity with out straight buying the cryptocurrency. These monitor Bitcoin’s spot value in real-time.

- Belongings Below Administration (AUM)

- The whole market worth of property an funding automobile manages on behalf of shoppers. Greater AUM usually signifies higher investor confidence and fund stability.

- Institutional Demand

- Funding exercise from skilled entities like hedge funds, endowments, and asset managers. Their participation typically indicators market maturity and brings vital capital.

- Inflows

- Capital shifting into an funding product throughout a particular interval. Sustained inflows point out optimistic investor sentiment and shopping for strain.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your personal analysis earlier than making any funding selections.

Be happy to “borrow” this text — simply don’t neglect to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic primarily based in Amsterdam, the place he follows each twist and switch on the planet of cryptocurrencies and Web3.