ETH continues its sturdy upward momentum, pushing deep into multi-month resistance zones. After breaking out of a chronic consolidation vary, the market has flipped key ranges into help, with value now hovering simply round $3,800.

Momentum stays bullish, however short-term exhaustion indicators are starting to floor because the rally stretches greater with out important retracements.

Technical Evaluation

By Shayan

The Day by day Chart

Ethereum has pushed aggressively by means of the $2,800 and $3,400 resistance ranges over the previous two weeks, exhibiting very sturdy bullish construction. The 100 and 200-day transferring averages are actually on the verge of constructing a bullish crossover close to the $2,500 mark, appearing as dynamic help throughout this impulse transfer.

The worth has now entered a serious provide zone between $3,700 and $4,100, an space containing a cluster of bearish order blocks. If patrons preserve management, the following main goal sits at $4,107, which is the final value excessive created in early 2024.

Nevertheless, the patrons ought to be cautious of potential profit-taking on this zone. That is particularly necessary if the worth begins to stall across the present resistance vary.

The 4-Hour Chart

On the 4H timeframe, ETH stays in a robust uptrend, however indicators of weakening momentum are rising. A bearish divergence has fashioned between the worth and RSI: whereas the worth made a brand new excessive round $3,780, the RSI did not comply with by means of.

This might be an early warning of a neighborhood prime forming. A clear break beneath $3,500 may set off a pullback into the $3,200 help zone, which is now structurally important.

Nonetheless, till that happens, ETH stays bullish on this timeframe. The development is supported by a wholesome construction of upper highs and better lows, and quantity has remained elevated. Merchants ought to hold an in depth eye on how ETH behaves within the $3,800–$4,100 zone. A breakout right here opens the door to a full continuation transfer, whereas rejection and bearish follow-through would sign a cooling-off interval.

Sentiment Evaluation

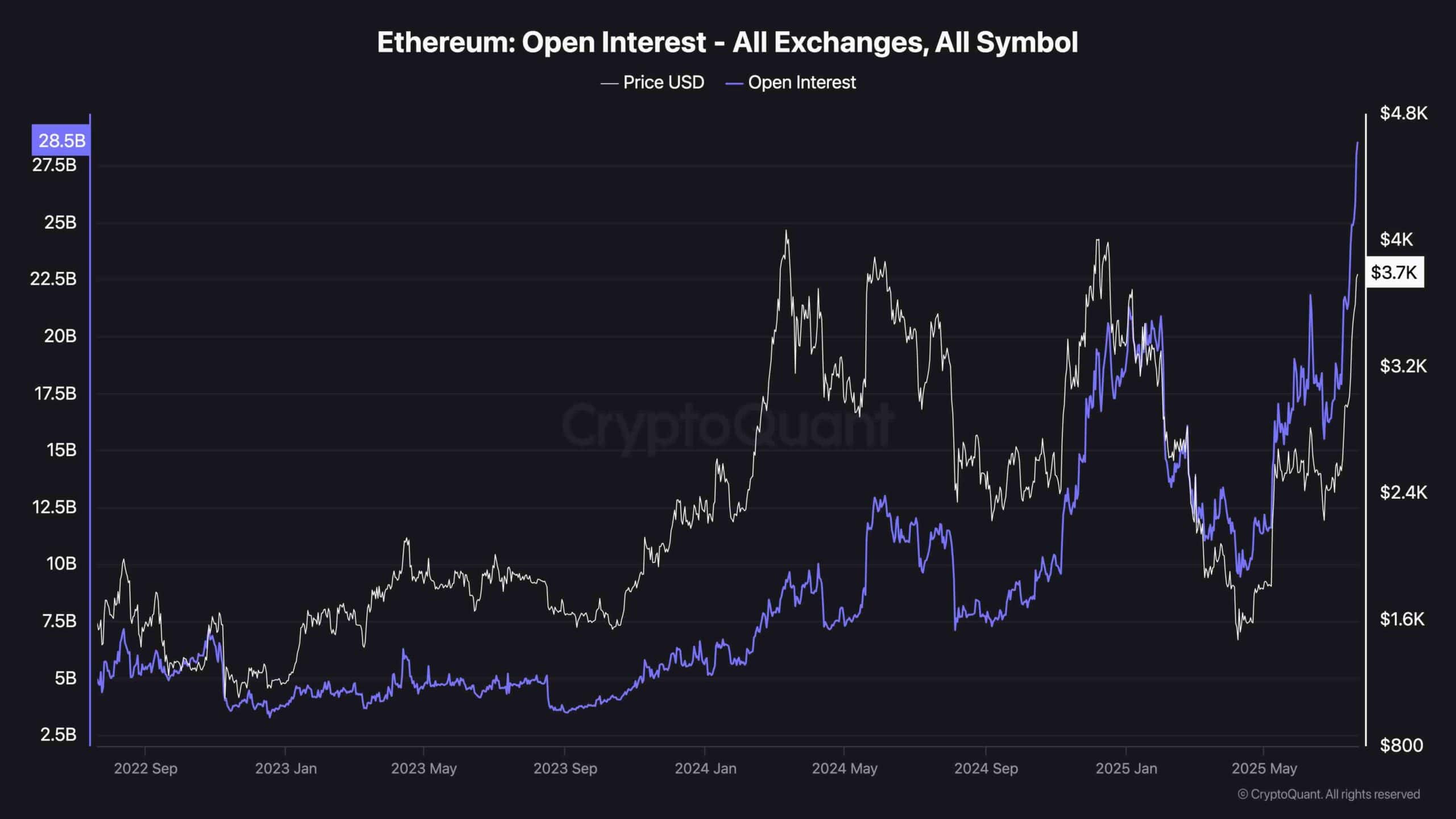

Ethereum Open Curiosity

The Open Curiosity chart paints a transparent image of rising market participation. OI has surged to its highest stage over the previous few years, now sitting above $28B.

What makes this spike notable is that it comes throughout a robust value breakout, indicating the rally is being pushed not simply by spot shopping for, but in addition closely by leveraged positions. This may be each a bullish and dangerous signal.

As OI climbs in line with value, it’s essential to observe for any indicators of lengthy liquidations or sudden deleveraging. If ETH stalls or rejects from resistance and open curiosity stays excessive, the market might be weak to a pointy flush. For now, nonetheless, this information confirms sturdy bullish sentiment and sustained speculative curiosity in ETH’s breakout.

The submit Ethereum Price Analysis: ETH Targets $4K Following 25% Weekly Gains appeared first on CryptoPotato.