With Bitcoin’s value hovering round $120,000, hypothesis about the place we’re within the present cycle is intensifying. The information, notably when mapped towards earlier cycles, means that this bull market might high out throughout the subsequent three months. However does this maintain true, or are there causes to consider this time really is completely different?

The 100-Day Countdown

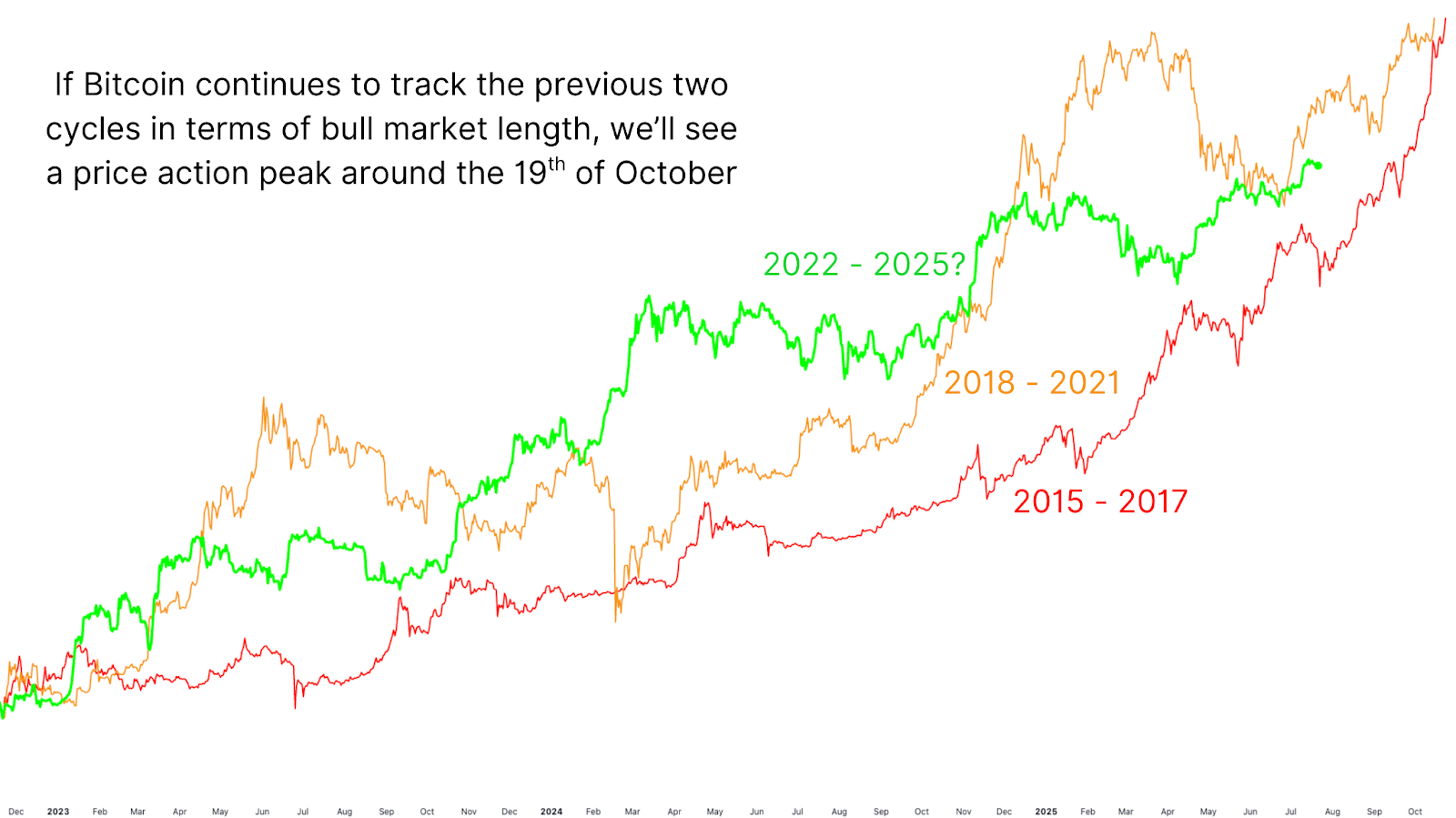

Viewing the Bitcoin Growth Since Cycle Low chart, we are able to see that we’re presently round 975 days into the continuing cycle. For comparability, the 2017 bull market topped out 1,068 days after its cycle started, whereas the 2021 cycle peaked at 1,059 days. That locations us probably beneath 100 days from a peak if we’re following historic precedent.

A deeper look into TradingView overlays, aligning each the 2017 and 2021 cycles with the present value motion, each earlier cycles entered their parabolic “banana zone” round this identical timeframe, leading to explosive price will increase. Averaging the timing between the 2 would point out a possible peak round October nineteenth.

Is This Time Totally different?

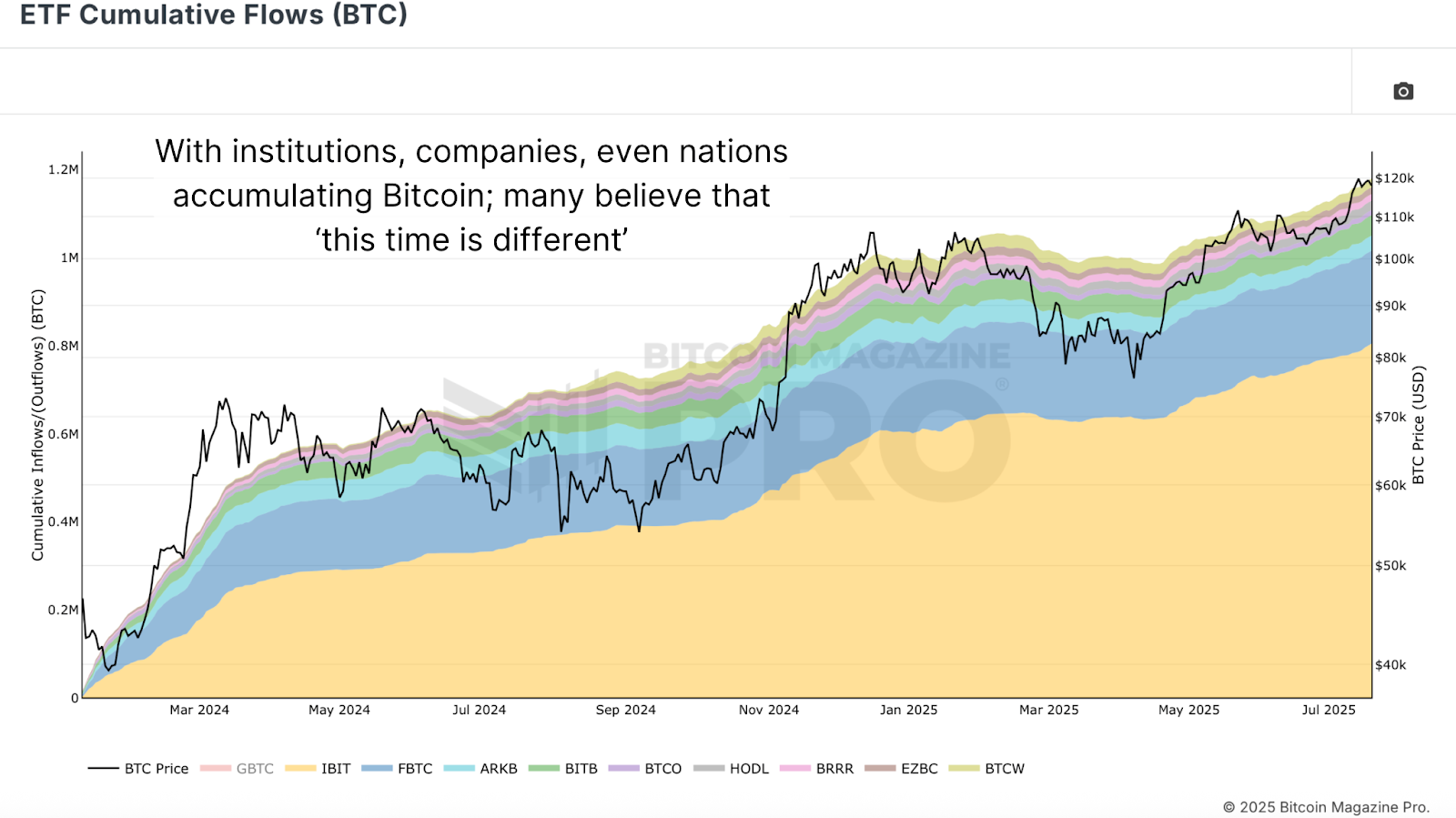

One main counterpoint to this historic view is the magnitude of latest Bitcoin ETF Cumulative Flows. Since January 2024, over 1.2 million BTC have been absorbed by ETFs, with a very good portion of that unlikely to return to the market any time quickly. This has dramatically altered the supply-demand stability.

Along with ETFs, Bitcoin treasury firms are sitting on over 870,000 BTC, with that quantity rising day by day. Sovereign holders additionally account for over 500,000 BTC, and we might nonetheless see nationwide strategic reserves that might additional tighten provide. Whenever you add in cash held for over 10 years which may be misplaced (presently round 3.3 million complete, so we’ll spherical right down to a really conservative 1.5 million), the potential non-circulating provide exceeds 4 million BTC, or over 20% of the full circulating provide.

Many argue that this cycle is exclusive as a result of ETF inflows and institutional adoption, however realistically, this sentiment has echoed in each earlier cycle, but every cycle has in the end adopted an analogous trajectory. Whereas present fundamentals are undeniably stronger, assuming a supercycle with out onerous information stays speculative. Till confirmed in any other case, historical past means that our conventional 4 yr cycles ought to stay our base case.

October Peak?

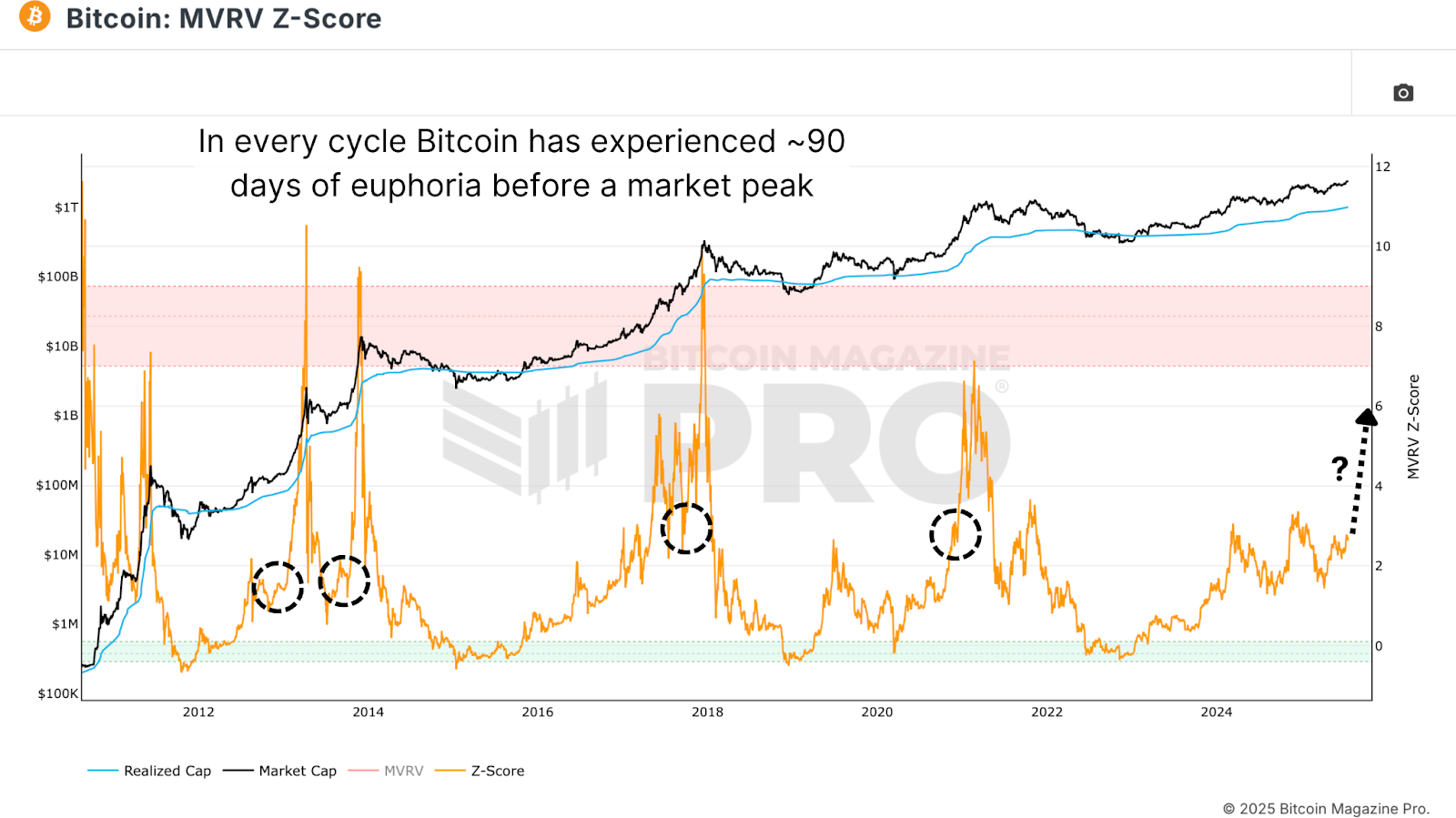

Let’s assume for a second that the cycle does certainly high in October. Is such a pointy transfer even possible? Completely. When Bitcoin crossed $10,000 in 2017, it doubled in simply two weeks. Even this cycle, Bitcoin rallied near 100% in beneath 100 days main as much as its $100,000 milestone. Following the ETF approval, BTC surged 80% in simply 50 days. As soon as momentum builds, Bitcoin’s parabolic potential turns into actuality quick, and when wanting on the MVRV Z-Score, we are able to see the on-chain information backs this up with related runups from related information ranges in direction of market peaks.

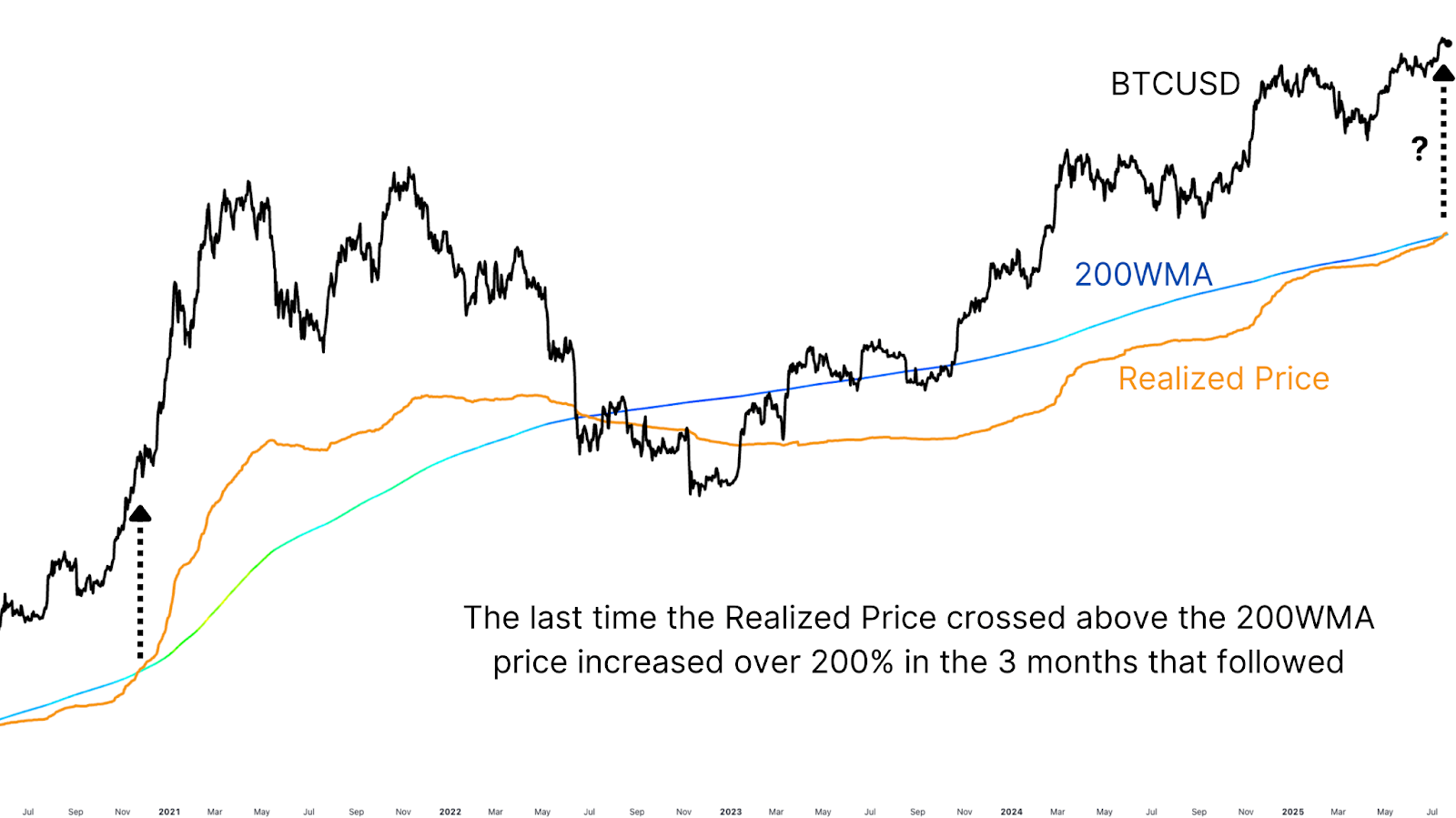

Zooming out additional, the 200-Week Moving Average just lately surpassed $50,000 for the primary time ever. Extra importantly, Bitcoin’s realized value has crossed above the 200-week MA, a uncommon occasion that solely occurred as soon as earlier than, in November 2020. Again then, BTC rallied by 212% in 90 days.

If we comply with even half that trajectory, a 105% achieve from present ranges would place BTC close to $250,000, once more, proper round mid-October. Whereas it’s dangerous to base projections on a single historic occasion, it’s attention-grabbing that that is as soon as once more occurring at a really related stage of the cycle.

Conclusion

Each cycle carries whispers that “this time is completely different”. And whereas this cycle has loads of causes to consider that might be true, ETF inflows, institutional dominance, sovereign accumulation, and many others, the information nonetheless factors towards a cycle high someday in This fall 2025. Might we blow previous that and enter a real supercycle? Possibly, and I’d like to be confirmed fallacious! However we’ll want proof earlier than assuming this narrative. For now, the historic cycle blueprint stays our most dependable information.

For a extra in-depth look into this subject, take a look at a latest YouTube video right here: Why This Bitcoin Bull Market Might Have Less Than 100 Days Left

💡 Liked this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra professional market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to professional evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.