Based on latest experiences, XRP slid about 15% after peaking at $3.66 on July 18, wiping out roughly $2.4 billion in open futures positions. That sharp drop has merchants debating whether or not to hunker down or scoop up XRP close to the $2.60 mark.

Rally Pushed By Large Bets

XRP’s surge from $2.17 on July 1 to $3.66 by July 18 was powered by a surge in open curiosity that peaked at $11.2 billion in greenback phrases. Which means numerous merchants had massive positions driving the upswing.

Since then, open curiosity has fallen to $8.8 billion, a 20% drop in US greenback worth. In XRP items, contracts fell 10% to 2.80 billion. Liquidations of roughly $325 million over the 2 weeks ending July 25 present a few of these large bets had been worn out.

Futures Merchants Maintain Regular

Annualized futures premiums for month-to-month XRP contracts have stayed in a 6% to eight% vary. That means merchants aren’t panicking even after the worth dipped beneath $3.

Brief‑time period swings didn’t spark a rush into bullish bets when XRP briefly rose previous $3.60, slowing the chance of extra compelled exits. The calm premium ranges trace that skilled gamers stay cautious however not overly involved.

Rising chatter a few US spot ETF for XRP has added to the combo. Ether merchandise crossed $18 billion in property beneath administration, so some count on the same enhance if a spot‑XRP ETF wins approval.

However approvals can take many months, and nothing is definite. Rumors about banks or a tie‑up with SWIFT have popped up on-line with out proof. Merchants know that hype solely lasts so lengthy when there’s no actual deal.

On‑Ledger Exercise Trails Friends

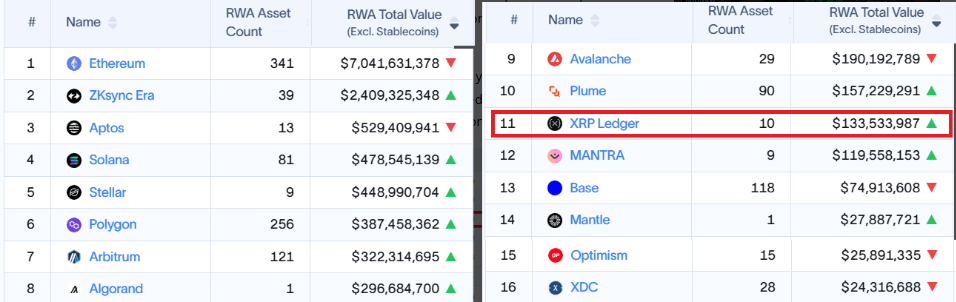

DeFi use on the XRP Ledger continues to be small. Based on RWA.xyz information, simply $134 million of tokenized property sit on the community, in contrast with $190 million on Avalanche.

Decentralized alternate quantity barely makes the highest 50 chains. DefiLlama reveals Sui recorded $13 billion in 30‑day DEX buying and selling, and Sei dealt with $1.43 billion. These gaps present that XRP’s on‑chain instruments haven’t drawn the identical crowd as rival networks.

Trying forward, clear progress in actual‑world use might assist XRP get away of its present $3.00–$3.15 vary. For now, merchants are watching each value motion and on‑chain metrics.

It could take contemporary catalysts past ETF hopes to drive sustained features. Till then, the market might keep uneven and reactive to any large swings in open curiosity.

Featured picture from Meta, chart from TradingView