Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

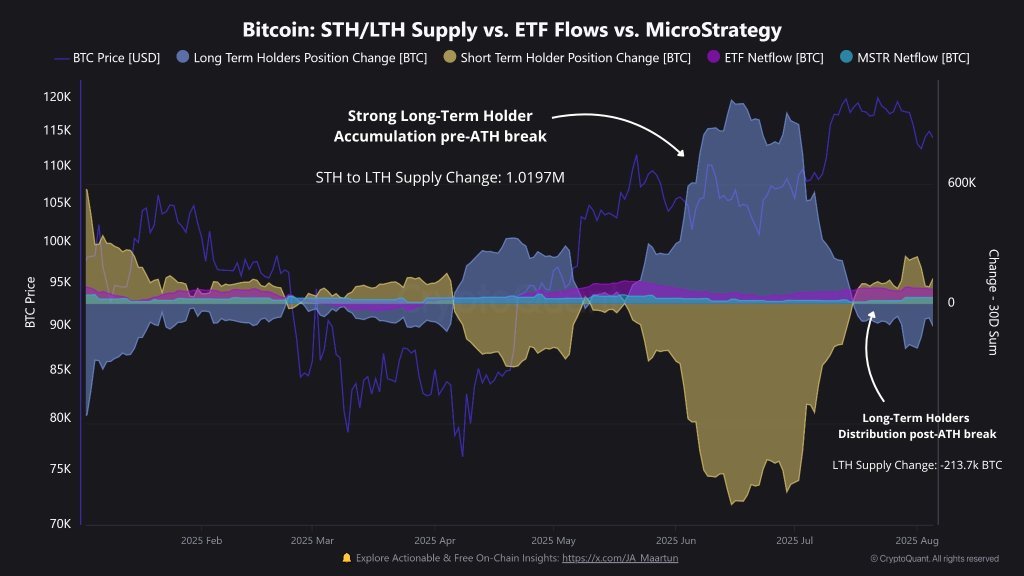

CryptoQuant analyst Maartunn used as we speak’s worth weak point to publish a granular, 10-part “Bitcoin Market Evaluation” on X that dissects the post-ATH panorama with on-chain element and a transparent technical line within the sand. “Bitcoin broke its all-time excessive, however right here’s the catch: long-term holders are [starting] to promote into the power,” he wrote, including that what issues now’s how the market digests that provide above and across the breakout zone. In his framing, the primary stress check is underway.

Is The Bitcoin Bull Run Over?

The thread anchors round one headline-grabbing datapoint: “the LTH promoting strain contains the 80,000 BTC bought by the Satoshi-era pockets.” That description is Maartunn’s interpretation of July’s extraordinary motion of eight “historic” wallets that shifted roughly 80,000 BTC after ~14 years of dormancy by way of Galaxy Digital.

Past the drama of this single entity, Maartunn argues that conduct throughout the holder spectrum is what’s driving the tape. “Retail is stepping in after the ATH,” he famous, describing a well-known sample of late-cycle enthusiasm that adopted Bitcoin’s push by means of $120,000 in mid-July. That surge set a brand new file close to $123,000 earlier than momentum pale; spot costs at the moment are revolving round $113,000–$115,000.

Associated Studying

The bid didn’t vanish fully. “Recent capital did assist the ATH-breakout consumers,” Maartunn wrote, pointing to balance-sheet demand “from companies like Technique and Metaplanet.” These purchases are verifiable. Strategy—the rebranded MicroStrategy—disclosed 21,021 BTC purchased between July 28 and Aug. 3 at a mean of ~$117,256, lifting its holdings to ~628,791 BTC. Tokyo-listed Metaplanet added 463 BTC on Aug. 4, taking treasury holdings to 17,595 BTC. Even so, these company flows “weren’t sufficient to carry Bitcoin across the ~$120k degree,” the analyst mentioned.

The place the thread turns extra cautionary is on short-term palms. “Quick-Time period Holders began to puke and promote at a loss,” Maartunn wrote, quantifying realized-loss waves of 52,230 BTC (July 15–18), 42,493 BTC (July 24–28), and 70,028 BTC “after July 31.” He referred to as the final episode notable “not simply [for] the scale, however the length,” arguing that extended STH loss-realization is a strain valve that sometimes wants time to exhaust. These are Maartunn’s on-chain tallies; they haven’t been individually printed by knowledge distributors in mixture kind.

The flows image from listed merchandise has begun to rhyme with that stress. “ETFs are additionally seeing outflows,” he noticed. A number of trackers affirm a downswing: CoinShares logged the primary internet weekly outflow in 15 weeks (-$223 million) with Bitcoin funds main at -$404 million, whereas each day tallies this week present US spot Bitcoin ETFs bleeding for a number of periods, together with about -$196 million on Tuesday. Framing differs by window, however the path is obvious: the bid from ETFs is wobbling on the margin.

Associated Studying

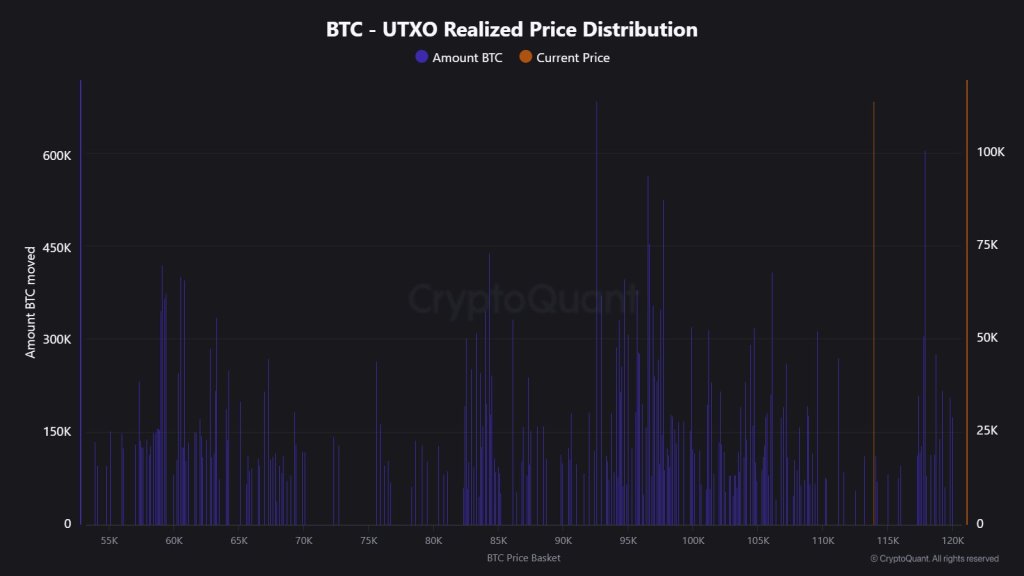

Technically, Maartunn fixes consideration on the previous breakout zone. “Bitcoin is discovering assist round its earlier ATH — roughly $112K,” he wrote, pointing to a confluence between chart construction and on-chain price-distribution. His on-chain map “backs it up,” flagging “robust assist within the $108K–$112K vary,” an space the place a big quantity of cash final modified palms.

Context issues. Bitcoin’s July all-time excessive sits round $123,000 on main benchmarks—an extension of 2025’s institutional-heavy advance—so calling $112,000 a “earlier ATH” refers back to the nearer-term breakout plateau that preceded worth discovery, not absolutely the file. That nuance is why Maartunn concludes with a conditional: “Up to now this cycle, we haven’t seen any earlier ATH break down… Till that modifications, this seems like a standard pullback. But when we do break beneath a former ATH ($112k), that’s an actual shift in market conduct.”

Within the close to time period, the credibility of that ~$108,000–$112,000 “shelf” will possible be determined by whether or not provide from profit-taking long-term holders, loss-realizing short-term holders, and ETF redemptions continues to outweigh balance-sheet demand and natural spot inflows. If the shelf holds, Maartunn’s base case is “a standard pullback” that bleeds off excesses from the ATH push. If it fails decisively, he argues, the cycle can be displaying its first significant breach of a previous breakout—an observable change in conduct moderately than a story flip of phrase.

At press time, BTC traded at $114,238.

Featured picture created with DALL.E, chart from TradingView.com