Bitcoin’s (BTC) current volatility has unsettled buyers, as the biggest cryptocurrency by market cap slid by greater than 5 p.c during the last two weeks. Nevertheless, two key on-chain components point out that the BTC market construction is basically resilient.

Bitcoin Stays Sturdy Regardless of Volatility

Based on a CryptoQuant Quicktake submit by contributor XWIN Analysis Japan, two essential on-chain indicators counsel that regardless of the current stoop in value, the general market construction stays sturdy for the flagship cryptocurrency.

Associated Studying

The primary is Bitcoin’s Delta Cap – a long-term valuation mannequin derived from the distinction between Realized Cap and Common Cap – that has traditionally acted as a dependable flooring throughout main cycles.

In early August, BTC traded above this steadily rising line, suggesting that the market is constructing a stronger basis in comparison with earlier drawdowns. A rising Delta Cap additionally indicators capital inflows and long-term investor conviction, even throughout value corrections.

The CryptoQuant analyst shared the next chart exhibiting Delta Cap hovering round $739.4 billion. Though BTC is at the moment buying and selling beneath this line, a fast transfer to $120,000 would probably push the value again above it.

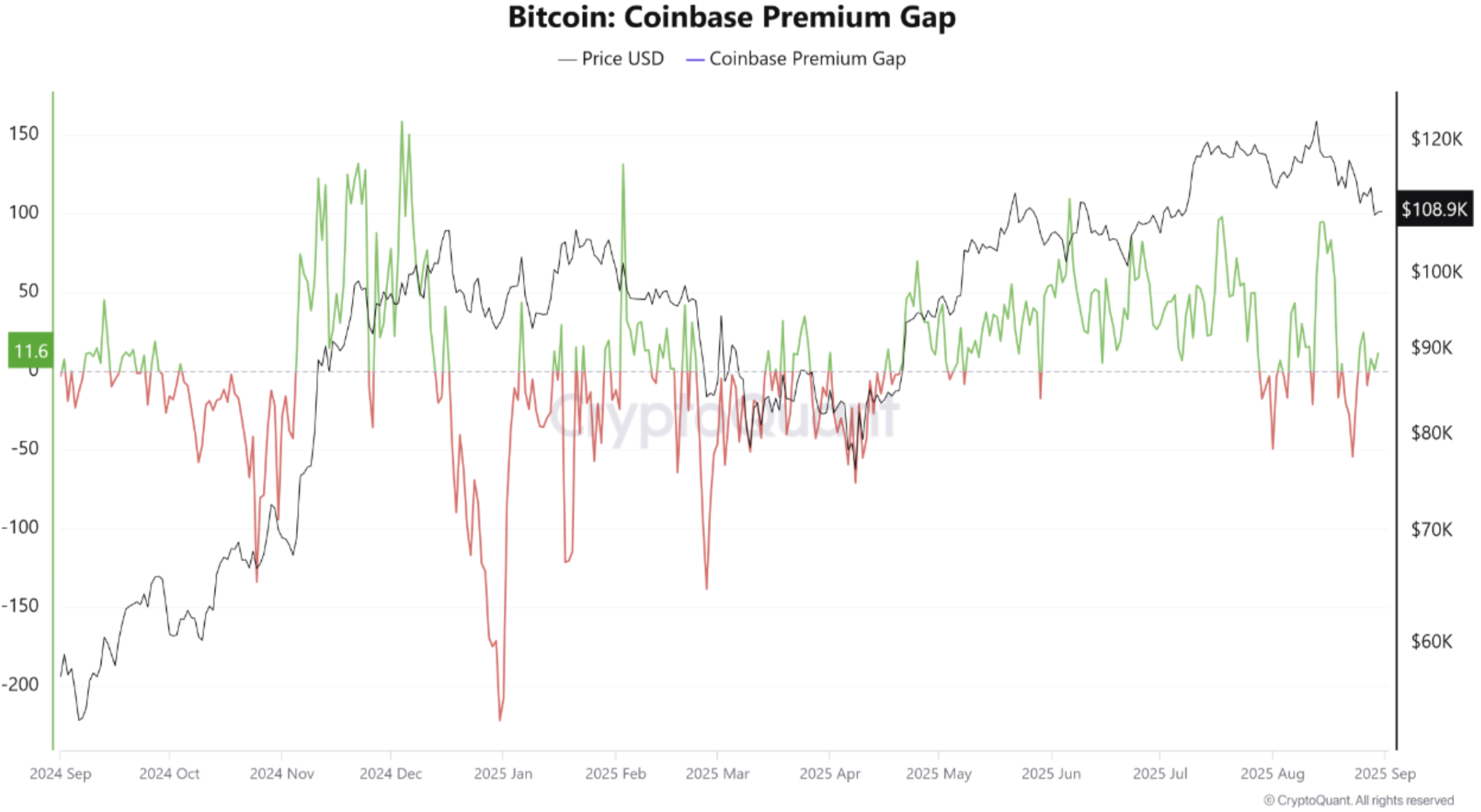

The second on-chain issue pointing towards resilience in BTC market construction is the Coinbase Premium Hole, which at the moment stands at +11.6. The excessive optimistic worth of the metric suggests stronger demand from US establishments, who’re accumulating BTC at a premium.

For the uninitiated, the Coinbase Premium Hole measures the value distinction of Bitcoin between US trade Coinbase and international exchanges like Binance. A optimistic hole means Bitcoin trades at a better value on Coinbase, typically signaling stronger US institutional shopping for demand.

Traditionally, sustained durations of optimistic premium have preceded main bullish phases, as institutional accumulation drives value discovery. The analyst concluded:

Collectively, these two metrics level towards a constructive setup: Bitcoin consolidating above $100K with sturdy institutional help and a long-term valuation flooring steadily rising. Corrections, slightly than being an indication of weak point, seem like alternatives for accumulation inside a strong structural uptrend.

Is BTC Out Of The Woods?

Though the 2 aforementioned on-chain indicators level towards power in BTC market construction, not all analysts are as optimistic. As an illustration, a fall beneath $105,000 would possibly send BTC all the way in which all the way down to $90,000.

Associated Studying

One other analyst lately warned that if BTC loses the help at $108,600 degree, then it may fall additional to $104,000. A failure to bounce from $104,000 may see BTC check the psychologically essential $100,000 degree.

That mentioned, Bitcoin’s rapidly rising illiquid provide on Binance might play a pivotal position in sending it to a contemporary all-time excessive (ATH). At press time, BTC trades at $109,289, up 0.9% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com