HODLing bitcoin is so easy, but it’s some of the troublesome and difficult issues to do.

HODLing bitcoin is a alternative. You must get up every single day and select to proceed HODLing BTC. When you’ve each motive to promote bitcoin, it’s important to proceed HOLDing. That is the place most individuals fail.

The nervousness of dropping cash kicks in. The worry of being fallacious turns into a cloud over your head and also you begin to surprise in the event you’re losing your time and ruining your future by HOLDing bitcoin.

It actually isn’t for the weak, so I perceive why so many individuals couldn’t fathom holding onto an asset this unstable, this early into its existence. It is sensible why most individuals weren’t able to go all in on bitcoin, however those that did had been extremely rewarded for his or her efforts.

This American HODL thread sums up HODLing bitcoin completely.

Right here’s a narrative for $106,600 per Bitcoin.

6 years in the past in 2018 I stacked money all yr figuring out I’d rebuy bitcoin on the “backside”.

We spent 3 months or so consolidating round $6,600.

I received impatient and was like fuck it that is my second and deployed half my stack.…

— AMERICAN HODL 🇺🇸 (@americanhodl8) December 17, 2024

I bear in mind what it was like again in 2018 when the value of bitcoin dropped by 50%. Solely on the time, I used to be a younger faculty pupil working in bodily remedy. I used to be able to tackle as a lot threat as potential as a result of taking good care of myself was my solely duty, so that big drop didn’t have an effect on me mentally an excessive amount of. However for American HODL, in addition to many different Bitcoiners who had wives and kids to handle, the stakes right here had been raised considerably.

Many Bitcoiners need the value to drop decrease, to allow them to accumulate cheaper BTC. However for a lot of Bitcoiners who’ve already accrued bitcoin at cheaper costs, it may be soul crushing to observe the value of bitcoin drop by 70-80% within the bear markets. Bitcoiners, in any case, are on this for wealth preservation and to extend their buying energy. So when bitcoin dramatically drops in worth, many really feel prefer it’s a punch within the intestine. Dropping cash sucks.

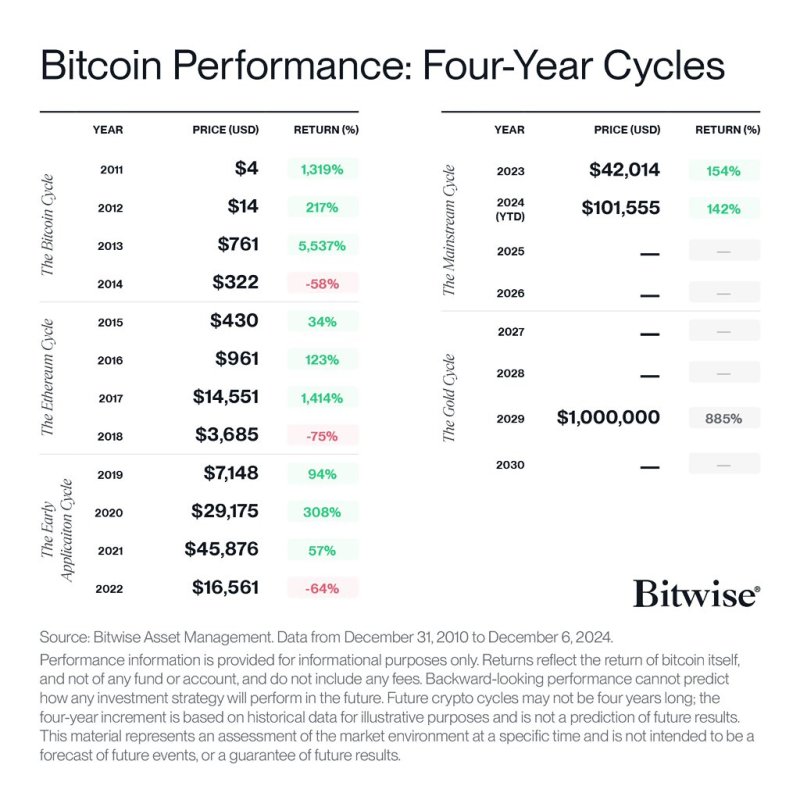

Nevertheless, in the event you can stand up to the brutal bear markets, the bull markets reward those that sheltered the storm, those that put within the effort to grasp this asset and why it has these intense drops and rises. Traditionally, the value of bitcoin rises for 3 years in a row, then dumps for one yr.

HODLing bitcoin isn’t straightforward. It’s regular and human to really feel the despair of the bear market and the euphoria of the bull. So when bitcoin inevitably dumps sooner or later after the bull market, be ready to HODL.

Don’t put your self able the place you can not stand up to a 70-80% correction.

Perceive the asset you bought into and notice that is regular and all the things is OK. If you are able to do that, you’ll make it out of the bear market alive, and be in prime place to reap the benefits of the following bull market.

This text is a Take. Opinions expressed are totally the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.