After reaching a file excessive of $123,200, Bitcoin is now consolidating across the $118,000 degree. Market members stay on alert as prime analyst Darkfost reported a serious improvement involving one of many oldest and most carefully watched wallets in crypto historical past. In keeping with the analyst, the remaining 40,000 BTC—valued at roughly $4.75 billion—nonetheless held by the 80K Satoshi-era whale have all moved.

The shift started final evening, signaling renewed exercise from the early Bitcoin holder. Till now, solely half of the whale’s holdings had been moved, whereas the remaining remained dormant. This newest switch marks the complete mobilization of all the 80,000 BTC as soon as managed by the entity. Whereas the motive behind the transfer stays unknown, the market is watching carefully for indicators of potential promoting or redistribution.

Bitcoin’s means to carry above key help ranges regardless of this high-stakes motion could mirror sturdy demand and investor confidence. Nonetheless, with $4.75 billion now in movement, merchants are bracing for potential volatility forward. The market is ready to see if this occasion will set off broader implications—or if it’s merely a strategic reshuffling from one of many ecosystem’s earliest whales.

Satoshi-Period BTC Consolidates Into Single Deal with

Darkfost highlighted a serious on-chain development that has captured the market’s consideration: Every of the 4 wallets, beforehand holding 10,000 BTC from the 80K whale, despatched their funds to a single vacation spot tackle bc1qs4nzm0je7wqfyfmqr4ht4upyzy57vc95nf4au0. This tackle now holds all the $4.75 billion stash, elevating new questions concerning the intent behind the transfer.

In keeping with Darkfost, whereas the sample differs from earlier sell-off precedents, the market should stay alert. “I assume these BTC may also find yourself hitting the market quickly,” he commented. This type of motion—particularly from dormant, high-value wallets—usually indicators large-scale positioning, which might precede both institutional gross sales or strategic long-term storage.

The timing coincides with rising bullish momentum throughout the crypto market. With Bitcoin consolidating above $118,000 following its $123,200 all-time excessive, merchants are eyeing a possible breakout. Including gas to this outlook, all three key crypto-related payments have been handed by the US Home this week, eradicating vital regulatory uncertainty and clearing a path for broader adoption.

Bitcoin Weekly Chart Indicators Recent Momentum

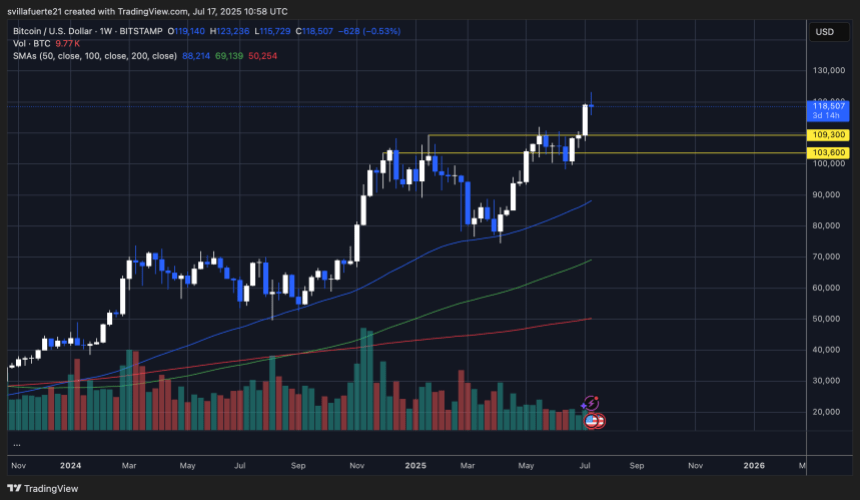

The weekly chart exhibits Bitcoin holding sturdy above $118,000 after surging to an all-time excessive of $123,200. This breakout follows a protracted consolidation slightly below the $110,000 resistance, which acted as a ceiling for a number of months. Now turned help, the $109,300 and $103,600 zones are crucial demand ranges, providing a agency basis for continuation if bulls preserve management.

The construction of the current weekly candles displays bullish dominance, characterised by sturdy our bodies and comparatively small higher wicks. This means managed profit-taking and rising confidence from patrons. In the meantime, quantity is choosing up, confirming participation within the breakout and hinting at the potential for sustained momentum within the coming weeks.

All main shifting averages—50-week ($88,214), 100-week ($69,139), and 200-week ($50,254)—are trending upward and stay nicely beneath present value ranges, reinforcing a long-term bullish pattern. As Bitcoin consolidates above former resistance, this zone could now function a launchpad for a transfer towards the subsequent psychological goal at $130,000.

Featured picture from Dall-E, chart from TradingView