Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bearish sentiment on X continues to develop, fueling a rising variety of crash forecasts. Amongst them is Dom (@traderview2), a broadly adopted crypto market analyst, who issued a stark warning on Wednesday: Bitcoin is approaching a structural tipping level that might set off a extreme breakdown if bulls fail to behave swiftly. “If this continues, it snaps,” Dom cautioned, referring to a wave of relentless promoting stress and thinning liquidity throughout main exchanges.

Time Is Ticking For Bitcoin

In an in depth post, Dom described present market circumstances as “very important,” noting that Bitcoin and the broader crypto area are at a second the place “it wants to save lots of itself or we’re going south.” The current weekly chart, he mentioned, displays a bearish “liquidity seize”—a transfer the place BTC pushed above the earlier weekly excessive solely to sharply reverse, a sample usually marking native tops.

That reversal has been accompanied by a three-touch declining power formation, signaling fading bullish momentum. “I feel time is ticking for bulls to save lots of this chart, because it must occur quickly IMO,” Dom added, underscoring the urgency of a bullish reclaim to invalidate the setup.

Associated Studying

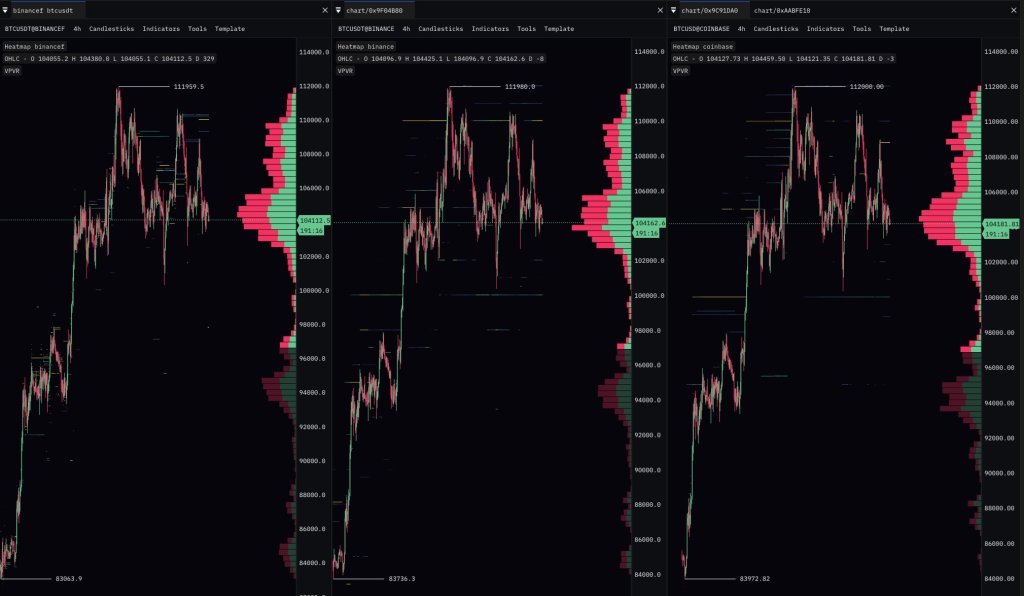

Beneath value motion, the structural basis seems more and more fragile. Dom pointed to alarmingly skinny order books throughout key spot markets—Binance, Bybit, Coinbase, OKX, and Kraken. Over the previous three weeks, roughly 38,000 BTC has been bought into the market, absorbed by passive bids.

Whereas consumers have held to date, the analyst warned that seen liquidity beneath present value ranges is nearly nonexistent. “There’s nearly no assist right down to 80ks (at the least as of now), not even commercial of assist,” he mentioned.

The identical bearish sample is enjoying out in perpetual futures markets. Platforms like Binance, Bybit, OKX, and Hyperliquid have seen constant taker-side promoting, forming what Dom described as a “relentless downtrend of market promoting.” With perp books additionally skinny, the stress could also be unsustainable except circumstances change shortly.

Drawing a parallel to Bitcoin’s February breakdown from the 90k degree, Dom famous, “We noticed the identical dynamic pre-90k breakdown.” The implication is obvious: with no shift in market habits, BTC could also be headed towards an analogous destiny.

Associated Studying

Seasonal tendencies are including weight to the bearish outlook. Dom highlighted that summer season months traditionally deliver weaker market participation and decrease liquidity—an setting that exacerbates draw back strikes and limits the affect of bullish efforts to regain management.

Regardless of the grim evaluation, Dom stays clear on what would invalidate his bearish stance: a restoration of the 108.5k degree. “If that degree regains, nice. I feel we are able to void these indicators,” he mentioned. “However for now, bearish outlook for me is the higher R/R on a risk-first foundation.”

In a separate reply, Dom acknowledged {that a} dip to the $96,000–$98,000 region, even with a wick into the $80,000’s, wouldn’t essentially break construction. “It certainly wouldn’t be irregular and I feel construction would nonetheless be okay,” he wrote, including that he would reassess the setup if such a transfer happens.

With order books thinning, taker movement intensifying, and no strong assist beneath, Dom’s message is blunt: time is operating out.

At press time, BTC traded at $104,694.

Featured picture created with DALL.E, chart from TradingView.com