Ethereum is dominating the cryptocurrency market with extraordinary value energy, surging over 200% since April and positioning itself because the top-performing main asset within the house. The rally has fueled rising optimism amongst analysts, with many projecting that all-time highs may quickly be inside attain for bullish buyers. The mix of sturdy fundamentals, rising institutional participation, and a good authorized setting has created an ideal backdrop for Ethereum’s newest surge.

Probably the most putting developments supporting the rally is the historic drop in Ethereum’s provide on exchanges, now at its lowest ranges ever. This indicators robust long-term holding habits amongst buyers and reduces the quantity of ETH available on the market, amplifying the potential for upward value strikes. Institutional curiosity has been significantly notable, with large-scale purchases including sustained shopping for stress to the market.

Some analysts are actually warning of a doable “provide shock” — a situation the place quickly rising demand meets extraordinarily restricted provide, doubtlessly accelerating value good points even additional. With Ethereum’s community fundamentals strengthening and sentiment reaching new highs, the approaching weeks may show decisive in figuring out whether or not ETH pushes into uncharted territory and units recent all-time highs on this market cycle.

Ethereum Whale Accumulation Fuels Hypothesis Of Institutional Shopping for

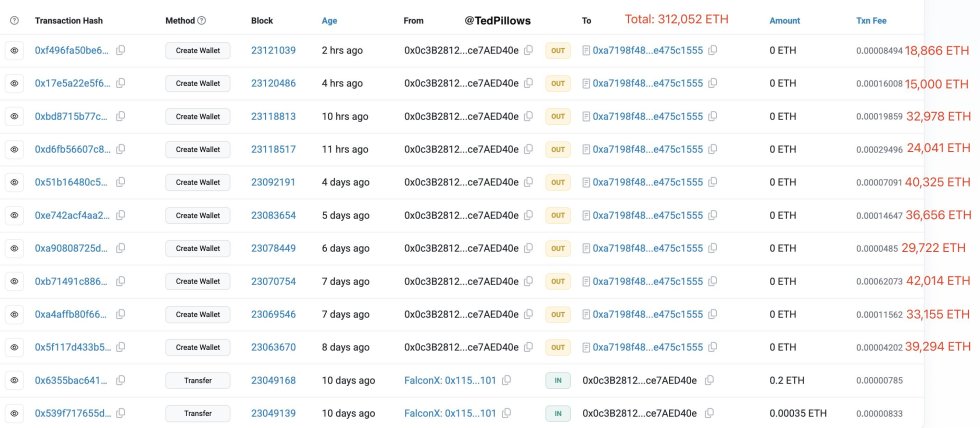

In response to prime crypto analyst Ted Pillows, a mysterious pockets has purchased an astounding $1.34 billion value of Ethereum over the previous eight days, marking one of many largest single accumulation streaks in current months. Pillows, who has been carefully monitoring the pockets’s transactions, suggests the size and consistency of those buys level towards a serious institutional participant or a extremely capitalized entity making a long-term wager on ETH.

Whereas the id behind the pockets stays unknown, the exercise has sparked widespread hypothesis throughout the crypto neighborhood. Some market watchers imagine it may very well be the results of over-the-counter (OTC) offers designed to attenuate market influence, whereas others suspect it might be a market maker agency strategically positioning forward of a serious transfer. The dearth of public disclosure leaves the precise motive unclear, however the sheer dimension of the purchases underscores rising high-level confidence in Ethereum’s outlook.

Many see the whale’s shopping for spree as a possible catalyst that would speed up this transfer, particularly with trade provide at historic lows and institutional demand surging. The approaching days may show pivotal for Ethereum’s value trajectory. If the market interprets these huge inflows as the beginning of a sustained institutional accumulation section, bullish momentum may intensify quickly.

ETH Value Evaluation: Testing Resistance Close to 2021 ATH

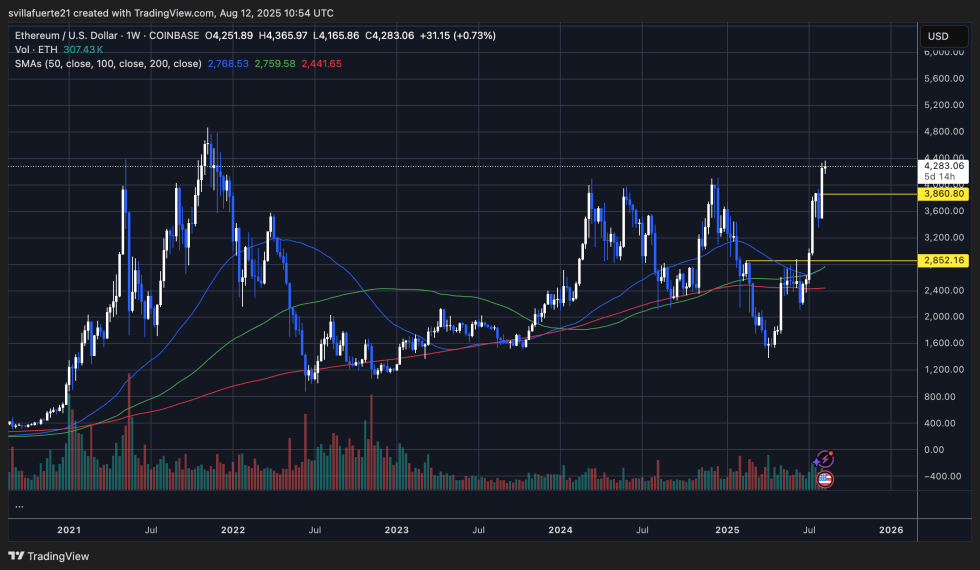

Ethereum (ETH) is buying and selling at $4,283, posting a 0.73% achieve on the weekly chart because it approaches a serious resistance space close to its 2021 all-time highs. This surge follows a pointy rally from the $2,852 help degree, which marked the breakout level for the present uptrend.

The chart exhibits ETH buying and selling effectively above its 50-week SMA ($2,768), 100-week SMA ($2,759), and 200-week SMA ($2,441), reflecting robust bullish momentum and a firmly established long-term uptrend. The breakout above $3,860 — now performing as rapid help — confirms market energy and will function a base for the subsequent leg larger.

Nonetheless, the $4,300–$4,400 zone has traditionally been a vital inflection level. A decisive shut above this vary would probably set off momentum shopping for, opening the trail towards uncharted territory and potential new all-time highs. Conversely, failure to interrupt via may see ETH retest $3,860 and even fall again towards $3,200 if promoting stress intensifies.

Quantity has picked up notably throughout this rally, signaling robust conviction amongst consumers. With fundamentals and institutional curiosity each strengthening, ETH’s means to beat this resistance may decide whether or not the subsequent section of the bull run accelerates within the coming weeks.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.