Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Avalanche (AVAX) has been one of many standout performers in current weeks, surging greater than 53% since March 11 as bulls try to kickstart a broader restoration rally. The sturdy rebound follows a brutal correction during which AVAX misplaced over 72% of its worth since mid-December 2024, triggering widespread capitulation and worry throughout the market. Now, with value motion displaying indicators of power, buyers are cautiously optimistic — however uncertainty stays.

Associated Studying

Whereas the current rally has introduced some reduction, many analysts consider the market could also be coming into a consolidation section. AVAX is presently struggling to carry above the $22 mark, a key resistance degree that might decide whether or not the uptrend continues or stalls. A number of technical indicators are flashing warning as momentum begins to gradual.

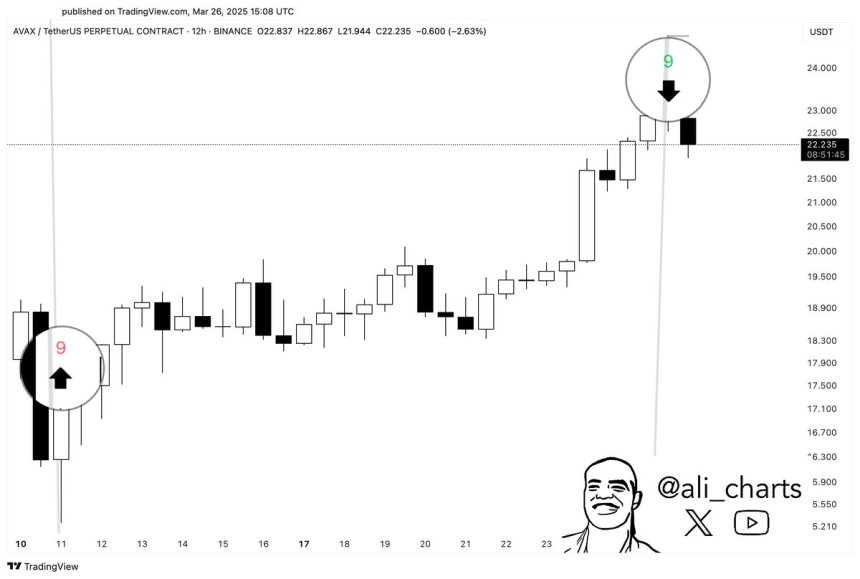

Prime analyst Ali Martinez shared insights on X, mentioning that the TD Sequential indicator is now presenting a recent promote sign. This implies that AVAX could also be due for a short-term pullback or a interval of sideways motion. With the broader market nonetheless beneath strain, merchants are watching carefully to see whether or not Avalanche can keep its features or lose momentum.

Avalanche Wakes Up However Faces Critical Dangers

Avalanche is displaying indicators of life after enduring months of intense promoting strain. Like many altcoins, AVAX has been closely impacted by macroeconomic volatility, dropping over 70% of its worth since mid-December 2024. Now, as bullish momentum begins to return throughout choose altcoins, Avalanche is trying to stage a restoration rally. The current 53% surge since March 11 has revived hopes that AVAX might be prepared to interrupt out — however headwinds nonetheless stay.

The broader market setting continues to be formed by uncertainty. Commerce conflict fears and unstable macroeconomic indicators have saved strain on threat belongings, together with cryptocurrencies. Many buyers stay cautious and are nonetheless offloading positions close to present ranges, involved in regards to the long-term path of the market. Whereas momentum is returning to some sectors, the trail for Avalanche is way from clear.

Prime analyst Ali Martinez lately highlighted a technical development utilizing the TD Sequential indicator. After precisely calling the current backside and a 50% rally in AVAX, the indicator is now flashing a promote sign. This implies that Avalanche might be due for a short-term retrace or interval of consolidation earlier than any additional transfer greater.

The $22 degree stays a vital resistance zone for AVAX. A short lived cooldown right here could also be wholesome — giving bulls time to regroup earlier than trying a breakout. If AVAX can maintain key assist and reset after the present rally, it may construct a stronger basis for a decisive push above $22 within the weeks forward. For now, all eyes are on value motion as Avalanche balances between correction and continuation in a market nonetheless clouded by uncertainty.

Associated Studying

AVAX Struggles Under $22 As Bulls Purpose For $30 Breakout

Avalanche (AVAX) is presently buying and selling at $21.80 after briefly reaching $23.40 simply two days in the past. The current pullback displays cooling momentum as bulls wrestle to keep up strain close to short-term resistance. Nonetheless, the development stays intact — for now. To maintain the restoration rally, bulls should defend present ranges and push towards reclaiming the $30 mark, which aligns with the 200-day shifting common (MA) and 200-day exponential shifting common (EMA). A profitable breakout above this zone could be a robust bullish sign and will mark the start of a bigger uptrend.

Nonetheless, failure to carry above $20 within the coming days could be a warning signal. A breakdown beneath this degree may set off elevated promoting strain and ship AVAX again towards the $17 zone — a key assist space from earlier consolidations. As Avalanche continues to commerce inside a risky vary, the following few periods will probably be essential in figuring out short-term path.

Associated Studying

With the market nonetheless beneath macroeconomic strain, bulls should act rapidly to keep up momentum. A decisive transfer above $30 stays the goal, however holding the $20 degree is simply as essential to keep away from a deeper retrace and renewed bearish sentiment.

Featured picture from Dall-E, chart from TradingView