Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

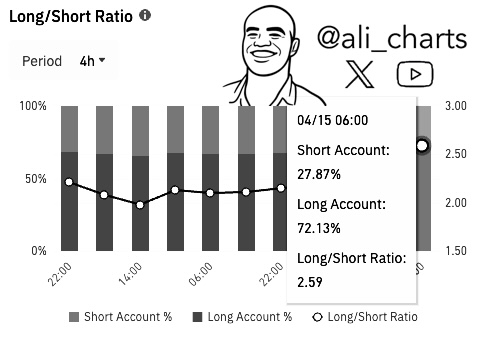

A contemporary snapshot of Binance’s futures market information exhibits Dogecoin attracting a remarkably bullish stance amongst merchants. In response to a chart shared by Ali Martinez (@ali_charts) on X, 72.13% of Binance customers with open Dogecoin positions are at the moment lengthy, leaving solely 27.87% on the brief aspect. “72.13% of merchants on Binance with open Dogecoin DOGE positions are at the moment lengthy!” Martinez wrote, underscoring simply how skewed sentiment is towards an upward worth transfer.

What Does This Imply For Dogecoin Value?

What does such a powerful majority of longs really imply for Dogecoin’s outlook? In lots of instances, a pronounced imbalance like this hints that almost all market contributors anticipate the worth to maintain climbing, at the least within the brief time period. When so many merchants are betting on good points, it usually displays optimism—and even pleasure—concerning the token’s momentum. Dogecoin has repeatedly proven its capacity to encourage fervor amongst retail buyers and huge speculators alike, so spikes in bullish curiosity are hardly stunning.

Associated Studying

This sort of information will be interpreted as a possible signal of energy for Dogecoin. If the market aligns behind a bullish narrative, continued shopping for stress might materialize, and costs can push increased. Nevertheless, it’s not at all times that simple. When an enormous chunk of the market tilts to at least one aspect, it raises the chance {that a} sudden drop would possibly set off a wave of compelled liquidations amongst these lengthy positions. If the broader crypto market wavers—or if Dogecoin faces any surprising hurdles—merchants who jumped in anticipating a fast revenue might find yourself speeding for the exits, amplifying downward strikes.

Nonetheless, the determine “72.13%” is unambiguously excessive, which is sufficient to catch anybody’s consideration. An extended/brief ratio that elevated doesn’t assure a continued rally; as an alternative, it paints an image of present-day sentiment amongst a selected subset of merchants. It’s one snapshot in time, drawn from the exercise of one of many world’s busiest crypto exchanges. Even so, it’s a stable reminder that, at this second, numerous Dogecoin merchants on Binance consider the trail of least resistance is to the upside.

Associated Studying

In fact, market circumstances can shift swiftly. Some merchants will preserve an in depth eye on general liquidity, the habits of Bitcoin, and any tariff news from US President Donald Trump. Dogecoin is understood for abrupt worth surges, spurred by social media buzz or endorsements from influential figures, so even information as decisive as this lengthy/brief ratio doesn’t absolutely predict what comes subsequent. Nevertheless it does give us an insider’s view of how Binance contributors are positioning themselves and, in doing so, units the stage for Dogecoin’s near-term intrigue.

For now, the sheer dominance of lengthy positions appears to say: merchants stay bullish and are keen to again that sentiment with open contracts. It could possibly be an indication of confidence in Dogecoin’s resilience, or it could possibly be a setup for surprising volatility if sentiment flips. Whichever approach it unfolds, Martinez’s chart shines a lightweight on how enthusiasm for this meme-inspired asset continues to run excessive in sure corners of the crypto market.

At press time, Dogecoin was buying and selling just under its multi-year trendline, following a rejection on the 0.786 Fibonacci retracement degree round $0.167. A renewed drop towards the crimson assist zone close to $0.14 could possibly be on the desk if DOGE closes under the trendline. On the flip aspect, the 0.786 Fib stays essentially the most vital resistance degree, adopted by a possible channel check close to $0.18.

Featured picture created with DALL.E, chart from TradingView.com