Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin value motion in June has displayed wholesome swings from a low of about $100,500 to as excessive as $111,000. Whereas it has lacked the impulsive momentum seen in previous cycles for extra bullish swings, the premier cryptocurrency has managed to keep up its valuation above $100,000.

Over the previous week, BTC has displayed relative value stability, with modest bullish motion at intervals. The cryptocurrency continued to trade within a tight range for many of the week, mirroring a mixture of optimism and warning amongst market individuals.

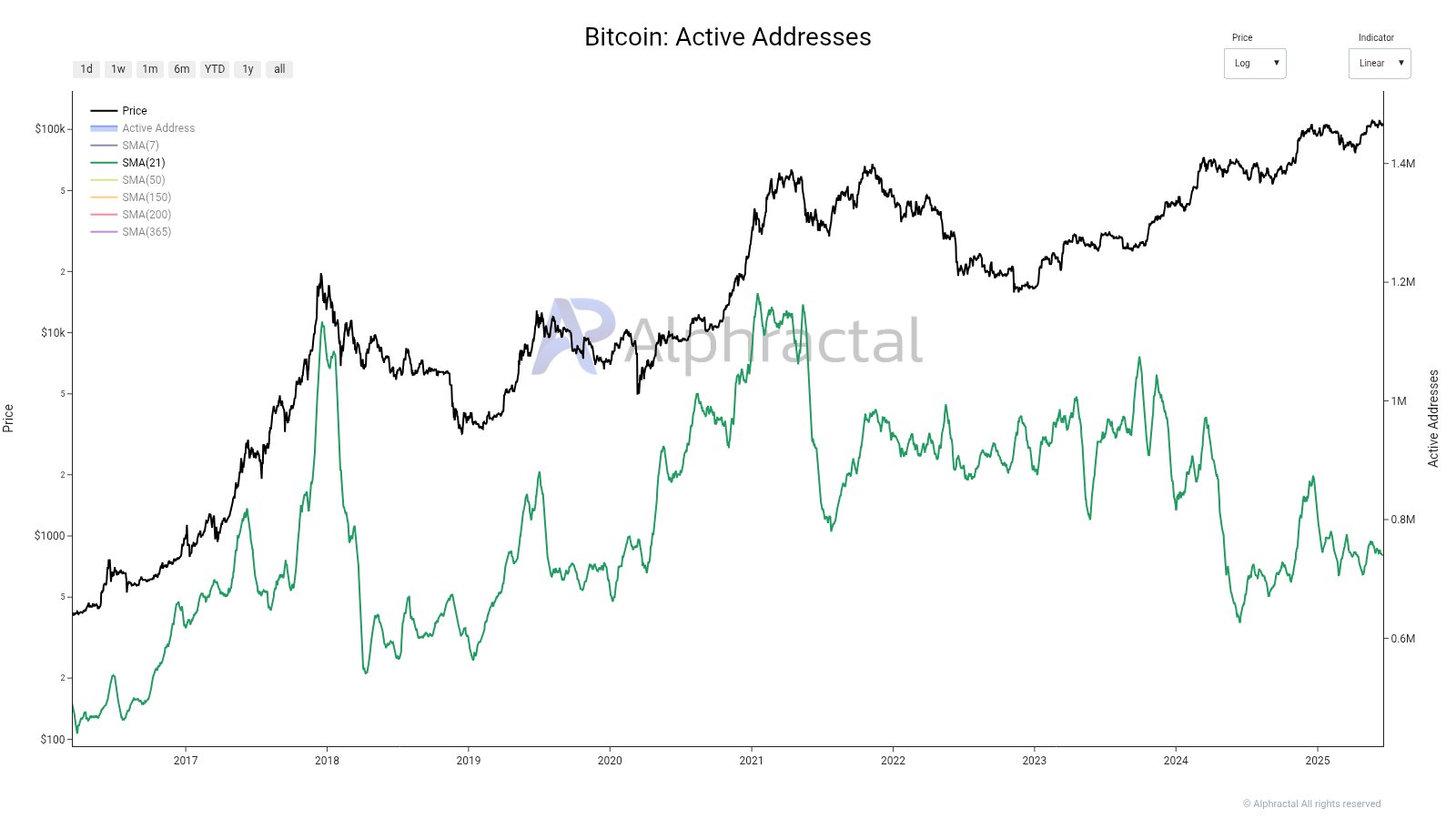

Energetic Addresses Mirror 2020 Ranges

In a June 20 publish on social media platform X, on-chain analytics agency Alphractal published its current findings on the Bitcoin energetic addresses, revealing that the flagship cryptocurrency doesn’t present a sign of market euphoria.

Associated Studying

The related on-chain indicator right here is the Energetic Addresses metric, which measures the variety of distinctive addresses which might be energetic on the Bitcoin community inside a selected timeframe. To be clear, an handle is “energetic” whether it is receiving and sending Bitcoin throughout a specific interval.

The chart shared by Alphractal exhibits that energetic addresses are on the identical degree as in 2020. The analytics agency identified that as of 2020, the market was dealing with political uncertainty, coping with a world pandemic, and widespread social worry, as the results on market engagement are what’s at the moment being witnessed.

Within the publish on X, Alphractal highlighted two doable causes for this seeming lack of enthusiasm seen in traders. Firstly, the market intelligence agency famous that traders may need grow to be disillusioned with all that’s at the moment taking place within the crypto market, no matter Bitcoin’s worth comfortably being above $100,000.

However, Alphractal put ahead the likelihood that this relative inactivity could possibly be a results of a robust long-term conviction within the flagship cryptocurrency as a retailer of worth. Nonetheless, this second reasoning was instantly put down by Alphractal as readings from two different indicators — the on-chain quantity and spot quantity — are each low, indicating little world curiosity within the cryptocurrency.

As Bitcoin nonetheless prevails above $100,000, this could possibly be a robust indication, Alphractal defined, “that solely essentially the most resilient are benefiting from the long-awaited $100k per BTC.”

Bitcoin Value At A Look

As of this writing, Bitcoin is valued at about $103,290, reflecting an over 1% value decline previously 24 hours. In keeping with knowledge from CoinGecko, the value of BTC has fallen by about 2.4% in worth over the previous seven days.

Associated Studying

Featured picture from iStock, chart from TradingView