Earlier as we speak, Bitcoin (BTC) briefly fell beneath $115,000 – hitting a low of $114,116 – triggering panic promoting throughout main crypto exchanges, together with Binance. Sharp shifts in a number of key metrics, resembling open curiosity and web taker quantity, affirm the depth of the sell-off.

Bitcoin Decline Wipes Out $500 Million In Open Curiosity

Based on a Quicktake publish on CryptoQuant by contributor Amr Taha, BTC’s drop beneath $115,000 led to a pointy decline in open curiosity on Binance, which fell from $14 billion to below $13.5 billion.

Associated Studying

The next chart exhibits Binance open curiosity declining by practically 4% in a single day – a transfer sometimes related to liquidation occasions. Supporting this, data from CoinGlass exhibits $760 million in liquidations over the previous 24 hours.

To clarify, such large-scale liquidation occasions sometimes happen when leveraged merchants face compelled place closures – lengthy or brief – on account of margin calls. The sharp BTC drop resulted within the liquidation of roughly 183,514 merchants in simply 24 hours.

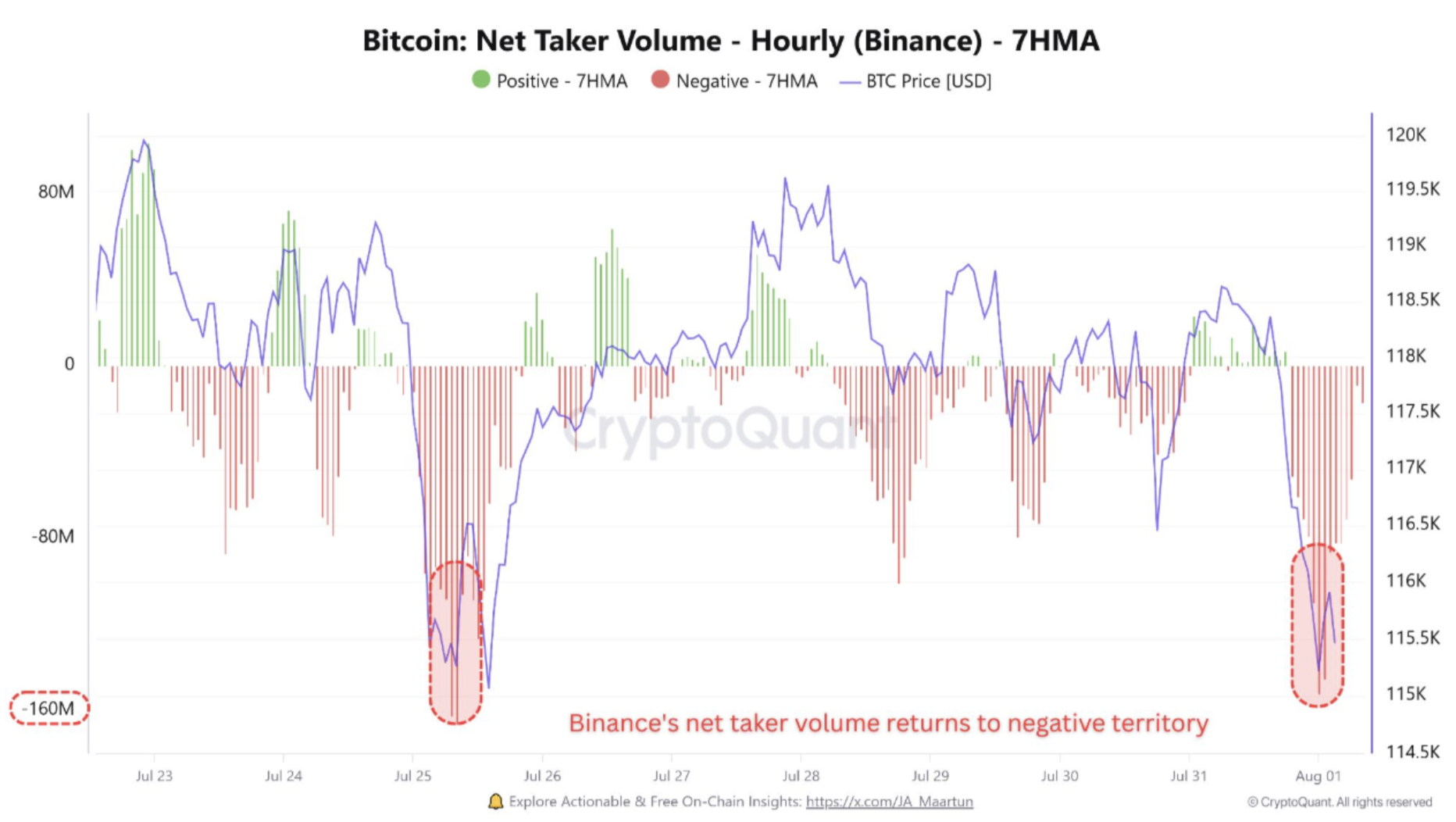

Along with falling open curiosity and widespread lengthy liquidations, Binance’s web taker quantity additionally factors to rising bearish sentiment. The metric plunged to -$160 million, underscoring aggressive promoting stress.

For context, Binance web taker quantity measures the distinction between market purchase and promote orders initiated by takers. A optimistic worth suggests dominant shopping for exercise (bullish), whereas a adverse worth displays dominant promoting exercise (bearish).

Binance web taker quantity dropping into adverse territory additional reinforces bearish stress on BTC. Since this web promoting coincided with the decline in open curiosity, it signifies that many derivatives merchants are panic-closing late lengthy positions.

Will BTC Make Restoration?

Regardless of the falling value, shrinking open curiosity, and adverse web taker quantity, Taha means that these bearish indicators might paradoxically set the stage for a short-term rebound.

Associated Studying

Bitcoin’s promoting stress could also be nearing exhaustion, whereas brief curiosity continues to rise. This mix might set off a market rebalancing section, doubtlessly paving the way in which for value stabilization – or perhaps a brief squeeze-driven bounce.

Nevertheless, on-chain information factors to continued bearish momentum. The increasing share of latest traders amongst BTC holders might result in overheated market situations within the close to time period.

On the identical time, change reserves are rising, which might contribute to extra promoting stress. Lengthy-term BTC holders additionally seem like selling in important volumes, suggesting potential rally exhaustion.

That stated, BTC might nonetheless stay on observe for its year-end goal of $180,000 – however provided that it holds key support at $110,000. At press time, Bitcoin is buying and selling at $115,310, down 2.1% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com