Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

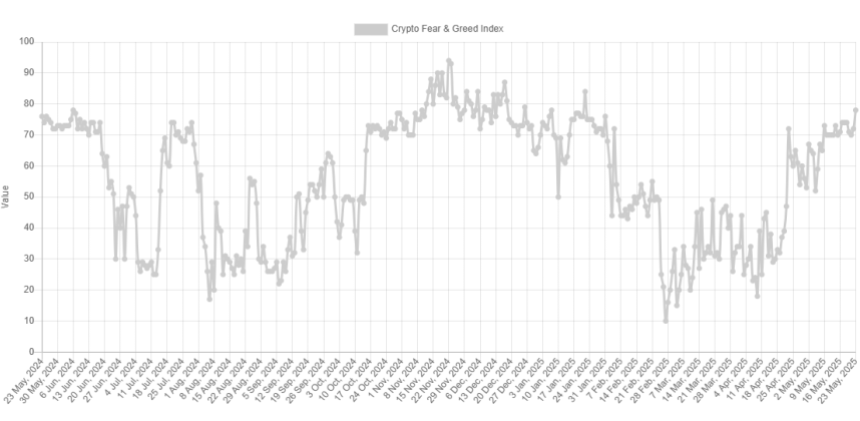

Information reveals the Bitcoin market sentiment has damaged into the acute greed territory following the cryptocurrency’s new excessive above $111,000.

Bitcoin Concern & Greed Index Has Shot Up Lately

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us concerning the sentiment held by the common dealer within the Bitcoin and wider cryptocurrency markets. The metric makes use of a numerical scale operating from 0-100 with a view to characterize the sentiment. All values above 53 characterize greed among the many traders, whereas these under 47 point out worry. The index mendacity between these two cutoffs implies a web impartial mentality.

Associated Studying

In addition to these three primary zones, there are additionally two ‘excessive’ areas known as the acute greed (above 75) and excessive worry (under 25). At current, the market sentiment is inside the previous of the 2, in keeping with the newest worth of the Concern & Greed Index.

Traditionally, the acute sentiments have held a lot significance for Bitcoin and different digital belongings, as they’ve been the place main tops and bottoms have tended to kind. The connection has been an inverse one, nonetheless, which means that an excessively bullish ambiance makes tops doubtless and an extra of despair bottoms.

Some merchants exploit this truth with a view to time their purchase and promote strikes. This buying and selling method is popularly generally known as contrarian investing. Warren Buffet’s well-known quote sums up the core concept: “be fearful when others are grasping, and grasping when others are fearful.”

With the Bitcoin sentiment now making a return into the acute greed area, it’s potential that followers of this philosophy could also be beginning to look towards the exit.

That mentioned, the Concern & Greed Index has a worth of ‘simply’ 78 in the mean time. For comparability, the December prime occurred at round 87 and the January one at 84. Earlier within the rally, the metric even hit a a lot larger peak of 94 in November.

As such, it’s potential that the present market is probably not fairly that overheated when it comes to sentiment simply but, assuming demand from the traders doesn’t let off. It solely stays to be seen, although, how Bitcoin and different cryptocurrencies would evolve underneath this excessive greed.

Talking of demand, whales have simply made a big quantity of withdrawals from the Binance platform, as CryptoQuant group analyst Maartunn has identified in an X post.

The indicator displayed within the chart is the “Exchange Netflow,” which tells us concerning the web quantity of Bitcoin that’s shifting into or out of the wallets related to a centralized alternate, which, on this case, is Binance.

Clearly, the Binance Alternate Netflow has noticed a big damaging worth, implying that the traders have shifted a notable quantity of cash out of the alternate. Extra particularly, web outflows for the platform have stood at 2,190 BTC or about $237 million.

Associated Studying

This might doubtlessly point out demand from the big-money traders for HODLing the cryptocurrency in self-custodial wallets.

BTC Worth

On the time of writing, Bitcoin is floating round $108,400, up over 4% within the final seven days.

Featured picture from Dall-E, CryptoQuant.com, Different.me, chart from TradingView.com