Knowledge exhibits the Correlation between Bitcoin and S&P 500 has declined to zero not too long ago, an indication that BTC is not hooked up to the inventory market.

Bitcoin Correlation To S&P 500 Has Witnessed A Plunge Lately

In a brand new post on X, the market intelligence platform IntoTheBlock has mentioned in regards to the development within the Correlation between Bitcoin and S&P 500. The “Correlation” right here refers to an indicator that retains observe of how tied collectively the costs of any two given property are.

When the worth of this metric is constructive, it means the value of one of many property is reacting to actions within the different by touring in the identical path. The nearer is the indicator to 1, the stronger is that this relationship.

Then again, the metric being underneath the zero mark implies that whereas there’s additionally some correlation current between the property on this case, it’s a destructive one. This implies that the charts are transferring in the wrong way to one another. For this zone, the intense level is -1, similar to the tightest relationship.

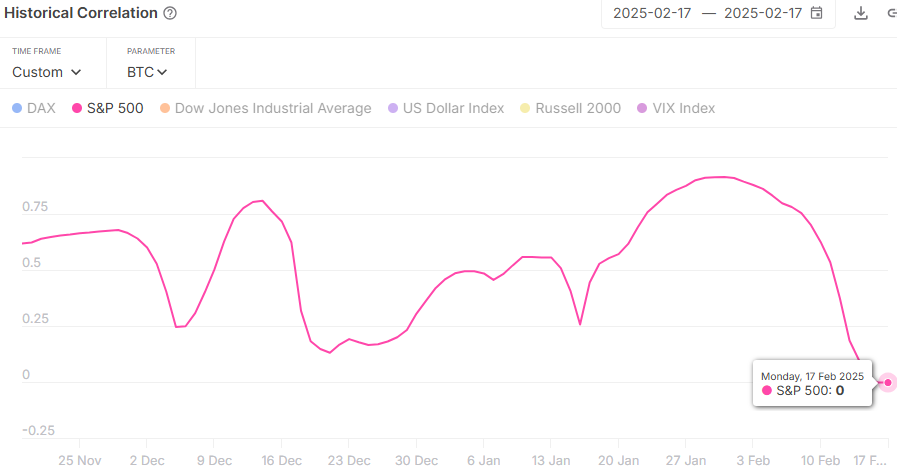

Now, right here is the chart for the Correlation shared by the analytics agency, which exhibits the development within the metric’s worth for Bitcoin and S&P 500 over the previous few months:

As displayed within the above graph, the Correlation between Bitcoin and S&P 500 rose near the 1 mark throughout January, which implies the costs of the 2 have been exhibiting a powerful constructive relationship.

Since peaking initially of this month, although, the indicator has noticed a pointy downward trajectory, and its worth has in the present day come down to precisely zero. Such a price implies there isn’t any correlation in any respect current between the property. In statistics, the variables are mentioned to be impartial on this situation.

The Correlation is usually a helpful indicator to look at for when an investor desires to diversify their holdings. Property which have an in depth relationship is probably not price investing in on the identical time, however ones which have a low worth of the metric could make for sensible diversification choices. As it’s at present, the S&P 500 may present one thing totally different to Bitcoin buyers and vice versa.

“The final time we noticed such a low correlation was on November fifth, 2024, simply earlier than Bitcoin soared previous the 100k mark,” notes IntoTheBlock. With BTC free from the stock market as soon as extra, it’s doable that the cryptocurrency may present a giant transfer this time as effectively. It solely stays to be seen, nonetheless, how lengthy the coin can avoid the affect of conventional property.

BTC Worth

Bitcoin has continued its latest development of consolidation throughout the previous few days as its value continues to be locked across the $96,000 stage.