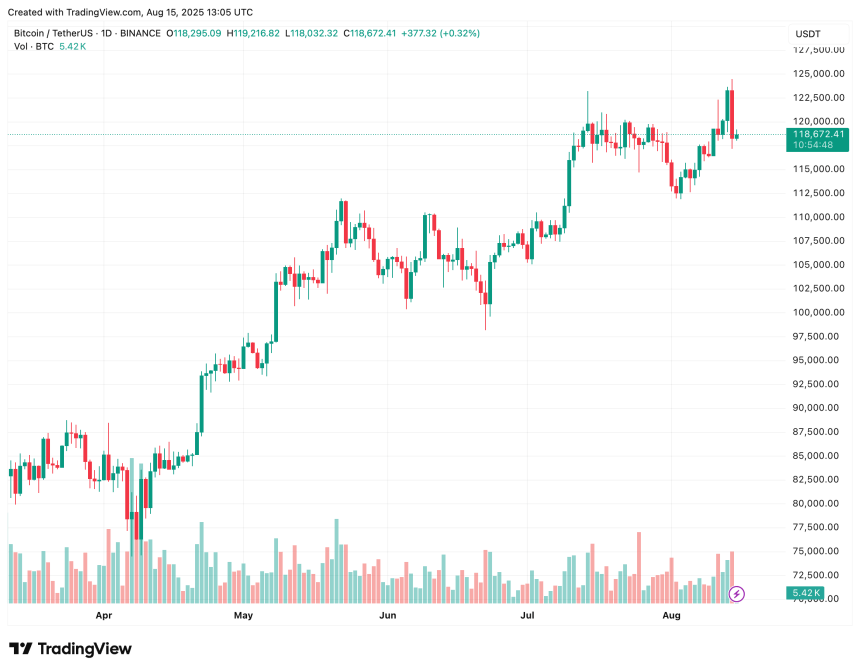

Bitcoin (BTC) staged a gentle rebound from yesterday’s inflation-driven drop to $117,180, climbing again towards $119,000 on the time of writing. A declining leverage ratio suggests the highest cryptocurrency’s bullish momentum may persist, retaining it within the operating for a brand new all-time excessive (ATH) within the close to time period.

Bitcoin Leverage Ratio Falls, Bulls Rejoice

In line with a CryptoQuant Quicktake put up by contributor Arab Chain, Bitcoin’s leverage ratio throughout all cryptocurrency exchanges has sharply declined from its late-July and early-August peak of 0.27.

Associated Studying

Notably, the ratio dropped to 0.25 in early August earlier than a modest rebound. In distinction, the interval from Could to late July noticed each the value and leverage ratio climb in tandem, signaling an inflow of merchants opening bigger positions.

In distinction, this time leverage has fallen and not using a comparable drop in worth – an indication that danger has eased for the reason that current uptrend. Arab Chain notes that this can be the results of high-risk positions being liquidated or merchants exiting the market amid volatility.

With BTC holding round $119,000, the decrease leverage ratio is a bullish signal, suggesting that the most recent worth positive aspects are fueled extra by real liquidity than speculative extra.

A continued decline in leverage may additional scale back the probability of a pointy correction. Conversely, a sudden spike in leverage alongside a worth rally would increase the chance of a pullback. The analyst added:

If leverage stays at reasonable or low ranges whereas the value stays steady, this might present a steady base for a brand new uptrend. An estimated leverage ratio (ELR) holding between 0.24–0.25, accompanied by a gradual worth break above 120K, may point out a spot-supported upside and a potential extension towards the July highs, with reasonable funding and slowly rising open curiosity.

Nevertheless, a fast leap within the leverage ratio above 0.27 earlier than or throughout a take a look at of $120,000–$124,000 may sign excessive liquidation danger and the potential for a pointy downward “shakeout.”

On-Chain Knowledge Factors To Potential Promoting Stress

Whereas decrease leverage is encouraging for Bitcoin bulls, on-chain knowledge – notably rising alternate reserves and whale transfers – hints at potential promoting stress forward.

Associated Studying

As an example, Binance’s BTC reserves have just lately surged to 579,000, elevating considerations of profit-taking after Bitcoin’s current rally to a recent ATH. Likewise, extra BTC miners are moving their holdings to Binance, doubtlessly getting ready to promote.

Including to the warning, some analysts warn of a potential pullback to $110,000 to fill excellent truthful worth gaps. At press time, BTC trades at $118,672, down 0.1% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com