On-chain knowledge exhibits the Bitcoin community exercise has just lately declined into the bear market zone. Right here’s what this might imply for the asset.

CryptoQuant’s Bitcoin Community Exercise Index Is Flashing A Bear Market Sign

As identified by an analyst in a CryptoQuant Quicktake post, the Bitcoin Community Exercise Index has just lately been contained in the bear part. The “Community Exercise Index” right here refers to an indicator from CryptoQuant that basically tracks the quantity of exercise that the BTC community is witnessing.

The metric makes use of the info of various activity-related indicators just like the transaction count and daily active addresses as a way to decide the scenario on the blockchain.

Right here is the chart shared by the quant that exhibits the development within the index and its numerous shifting averages (MAs) over the cryptocurrency’s historical past:

As displayed within the above graph, the Bitcoin Community Exercise Index reached a peak final yr, however since December, the metric has been sharply shifting down, implying the demand for utilizing the community has been waning. Typically, a surge in person exercise is what offers the gas that any transfer within the asset’s value must be sustainable, so a rise within the Community Exercise Index could also be thought-about constructive, whereas a lower a foul signal.

Not too long ago, the development within the community exercise has developed in such a fashion that the index has entered into what’s thought-about as a “bear part.” From the chart, it’s seen that this pink sign has maintained even after the most recent restoration rally.

The sign has traditionally come alongside bear markets for Bitcoin (arriving earlier than the worth low is in), however there was one notable exception: the second half of the bull run in 2021.

The Community Exercise Index signaled a bear part throughout this rally, which means that, from the attitude of chain utilization, this run was at all times unlikely to final. This can be one of many explanation why the worth couldn’t attain a a lot larger high than the Might 2021 one throughout this bull run.

Nonetheless, Bitcoin was nonetheless capable of witness a notable interval of bullish momentum again then regardless of the Community Exercise Index sign. Thus, whereas the most recent pink sign from the metric can point out the presence of a bear market, it may additionally simply be a sign for a shopping for alternative.

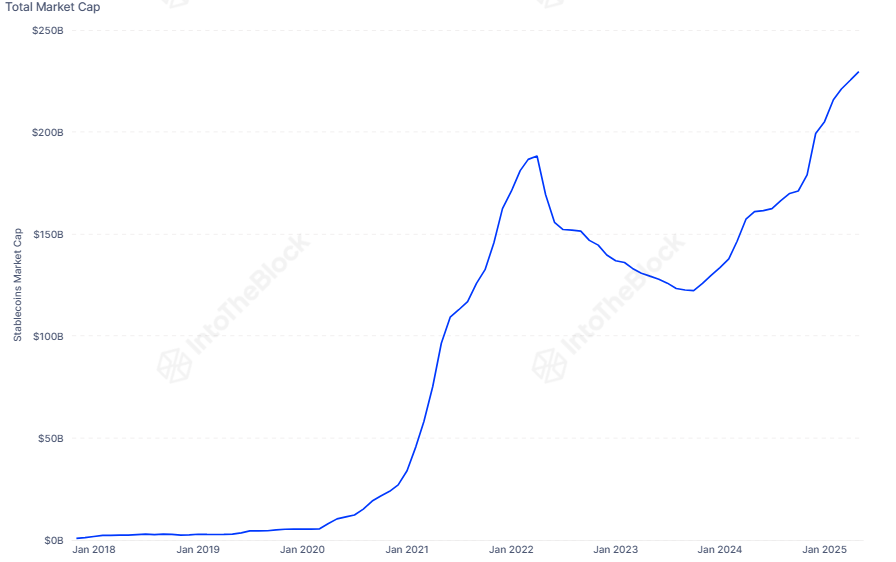

In another information, the mixed market cap of the stablecoins has simply reached a brand new all-time excessive (ATH), because the market intelligence platform IntoTheBlock has shared in an X post.

The capital saved within the type of stablecoins might discover its method into different cryptocurrencies like Bitcoin, so an increase of their market cap may be checked out as a bullish signal for the sector as an entire.

BTC Value

On the time of writing, Bitcoin is buying and selling round $93,800, down round 1% within the final week.