The on-chain analytics agency Glassnode has identified how $136,000 may very well be the subsequent value degree of significance for Bitcoin, if present momentum continues.

This Bitcoin Brief-Time period Holder Price Foundation Degree Is Located At $136,000

In a brand new thread on X, Glassnode has mentioned what just a few completely different on-chain indicators recommend concerning the place Bitcoin is within the present cycle. The primary metric shared by the analytics agency is the Short-Term Holder (STH) Cost Basis, which measures the common acquisition value of the traders who bought their cash throughout the previous 155 days.

Associated Studying

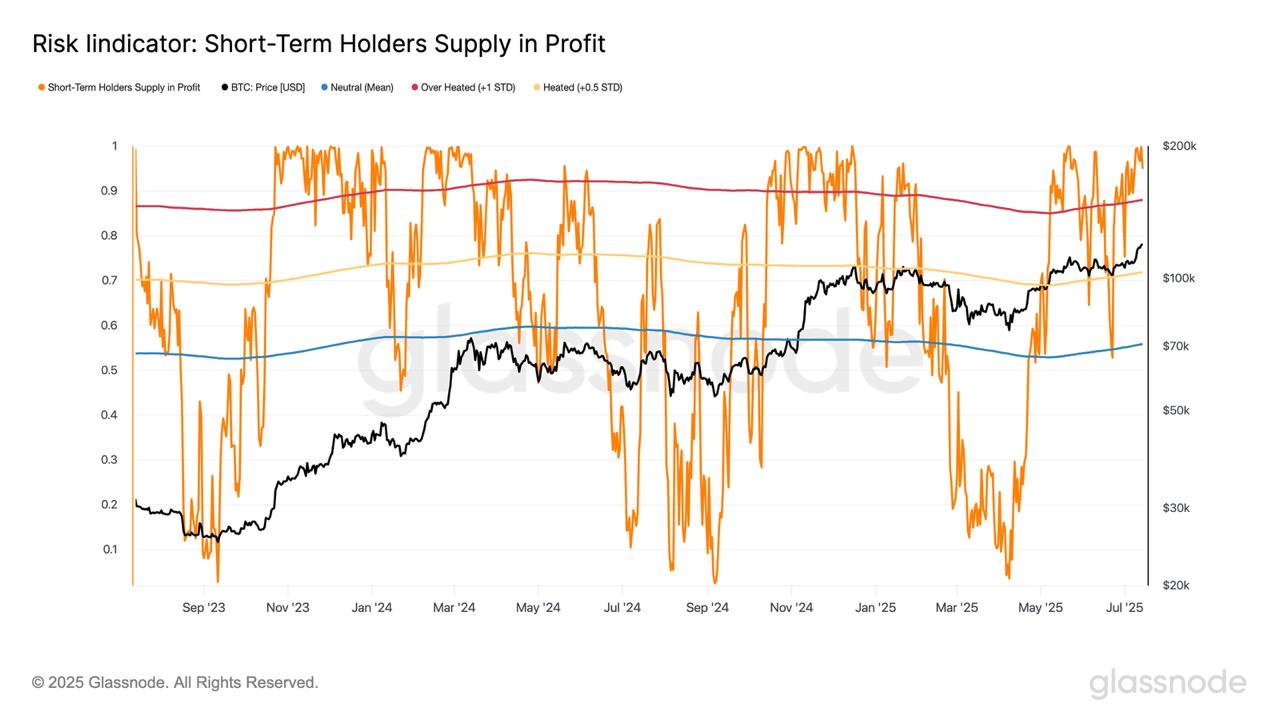

Under is a chart displaying the development on this metric during the last couple of years.

As displayed within the graph, the Bitcoin value broke above the STH Price Foundation earlier within the 12 months and has since remained above the road, indicating the STHs as a complete have been in a state of internet revenue.

In the identical chart, the analytics agency has additionally marked just a few different ranges, every comparable to a selected commonplace deviation (SD) from the STH Price Foundation. With the current value surge to a brand new all-time high (ATH) above $123,000, BTC was in a position to breach the +1 SD degree, which has traditionally corresponded to heated market circumstances.

After the pullback, although, the coin has returned beneath the mark, however nonetheless stays near it. “If this momentum continues, the subsequent key degree is $136k (2 +std), a zone that has traditionally marked elevated profit-taking and native market peaks,” explains Glassnode.

Whereas Bitcoin remains to be not overheated from the attitude of the STH Price Foundation mannequin, different indicators paint a distinct image. The STH Supply In Profit, an indicator monitoring the proportion of the cohort’s provide that’s sitting on some achieve, has lately surged far above the 88% threshold that has separated high-risk euphoric phases.

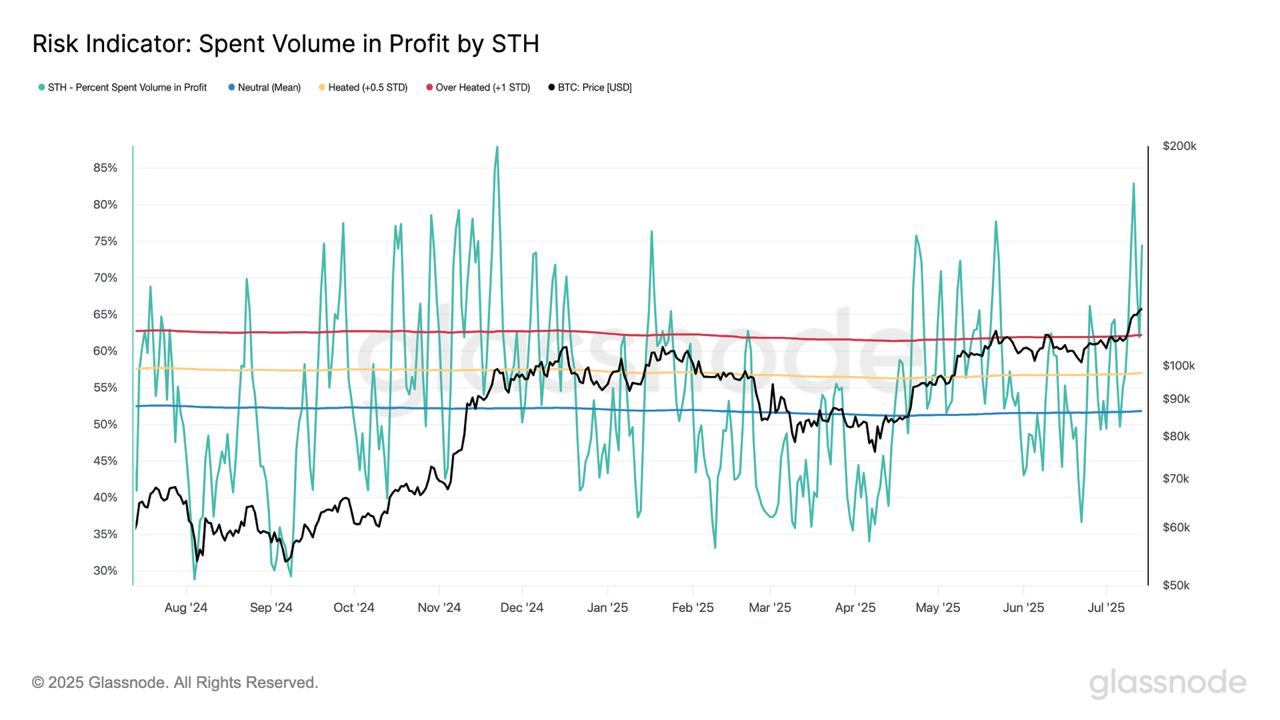

One other metric, measuring the proportion of STH quantity that’s resulting in revenue realization, additionally equally noticed a soar considerably above the historic overheated cutoff of 62%.

“Such spikes typically happen a number of instances in bull markets, however repeated alerts at these ranges usually precede native tops and warrant warning,” notes the analytics agency.

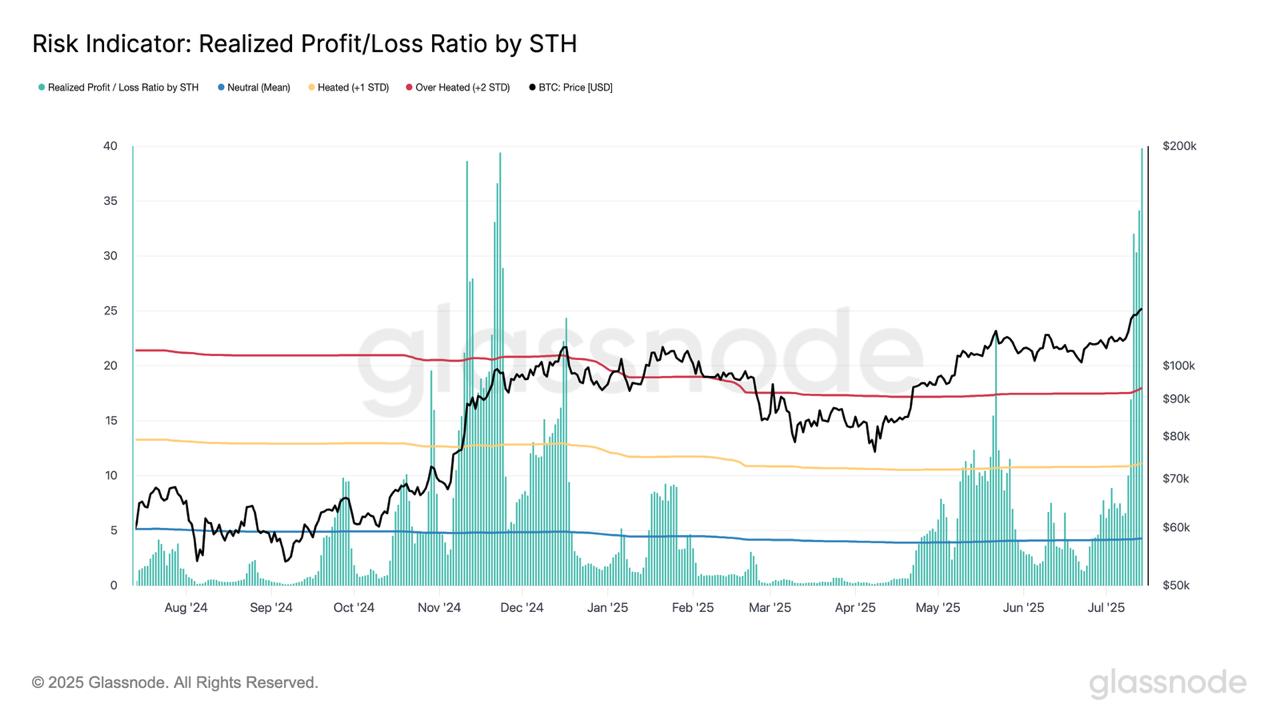

Throughout this spike of profit-taking, the ratio between the revenue and loss being realized by the Bitcoin STHs spiked to a 7-day exponential shifting common (EMA) worth of 39.8.

This can be a worth that’s, as soon as once more, excessive by historic requirements. That mentioned, spikes like this have usually occurred a number of instances over the course of a cycle, earlier than a high is lastly attained.

Associated Studying

“Traditionally, cycle tops observe with a lag, leaving room for additional upside,” says Glassnode. “Nevertheless, danger is elevated and the market turns into more and more delicate to exterior shocks. The present pullback aligns with this sample.”

BTC Worth

On the time of writing, Bitcoin is floating round $118,800, up greater than 8% within the final seven days.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com