Ethereum has been the undisputed chief of the crypto market in current weeks, driving momentum each in value motion and underlying fundamentals. From topping open curiosity charts to main in whale accumulation and community exercise, ETH has constantly set the tone for broader market sentiment. Its position because the engine of capital rotation from Bitcoin to altcoins has solely bolstered this dominance, making Ethereum the asset to observe because the market enters a brand new stage.

Nevertheless, the current retrace has launched warning. After surging to new highs, ETH has pulled again to check decrease demand ranges, sparking concern amongst merchants who fear that momentum could also be fading. Regardless of this, on-chain information means that the basics stay firmly intact.

Key insights from Lookonchain reveal that the Bitcoin OG who lately bought 641,508 ETH, value $2.94 billion, is again in motion. After a short pause, this whale has resumed accumulation, signaling confidence in Ethereum’s long-term trajectory. For a lot of, such aggressive shopping for serves as a counterweight to the short-term volatility, highlighting how massive gamers proceed to see alternative whilst costs waver.

OG Whale Shopping for As Ethereum Holds Key Ranges

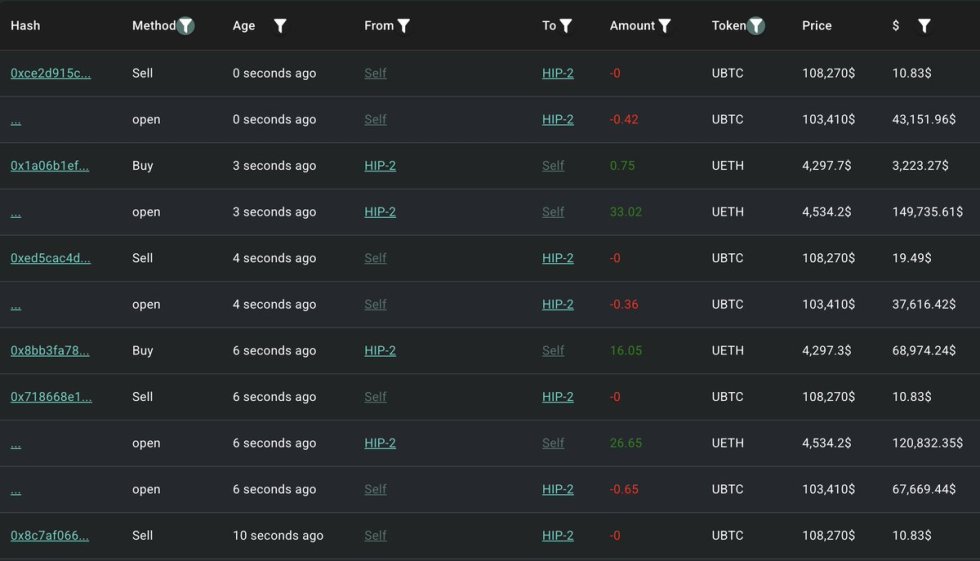

Based on Lookonchain, following a two-day break, the whale deposited 1,000 BTC (value $108.27 million) to Hyperliquid, changing it into ETH spot. This newest move reinforces the development of aggressive whale accumulation, an element that continues to assist the bullish outlook for Ethereum whilst value motion exhibits indicators of weak spot.

The timing of this accumulation is especially notable. Ethereum lately retraced sharply after reaching recent highs, testing vital demand ranges which have sparked concern amongst merchants. Some analysts warn that ETH could possibly be susceptible if these zones fail to carry, with the broader market sentiment leaning bearish. Nevertheless, the whale’s constant purchases recommend that main gamers see the retrace as a possibility reasonably than a reversal, including weight to the argument that fundamentals stay sturdy.

On this context, the approaching weeks will likely be decisive. If Ethereum manages to consolidate above assist and push larger, it might affirm the continuation of the uptrend and validate the whale’s confidence-driven shopping for. Conversely, failure to carry demand zones may prolong the correction. For now, the return of large-scale accumulation highlights that Ethereum’s long-term trajectory stays bullish regardless of short-term volatility.

ETH Assessments Key Demand Degree

Ethereum is buying and selling close to $4,370 after a 3% each day decline, cooling off from its current push to highs above $4,750. The each day chart exhibits ETH consolidating after a steep rally that started in mid-July, when value broke out of an extended consolidation section close to $2,700 and surged greater than 70% in only a few weeks.

The retrace comes as ETH exams short-term demand. Value stays properly above the 50-day shifting common at $3,941, which is now serving as dynamic assist. The 100-day ($3,244) and 200-day ($2,662) averages are trending upward, confirming that the broader market construction continues to be bullish. Holding above $4,200 is vital to take care of momentum, as this zone aligns with current breakout ranges and will present a basis for the subsequent leg larger.

Resistance stays close to $4,750–$4,800, the place sellers stepped in over the past rally try. A decisive break above this zone would seemingly open the door to new all-time highs, whereas failure to carry above $4,200 may set off a deeper pullback towards $3,900.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.