Bitcoin is at the moment trapped inside a decent value vary, bounded by the ascending channel’s decrease boundary at $78K and the 200-day shifting common at $83K. A breakout from this vary will possible decide the following important market development.

Technical Evaluation

By Shayan

The Day by day Chart

Bitcoin has been sustaining a bearish market construction, not too long ago experiencing elevated bearish momentum that pushed the worth under the essential $80K mark.

This breakdown triggered the numerous sell-side liquidity under this important juncture, resulting in a pointy bullish rebound, possible as a result of good cash executing massive purchase orders.

Moreover, the transfer induced a considerable lengthy liquidation, successfully cooling down the futures market. Regardless of the restoration, Bitcoin stays confined inside a decisive value vary, with $78K as a key help stage and the 200-day shifting common at $83K as an important resistance. A breakout from this vary will decide the following directional transfer.

The 4-Hour Chart

On the decrease timeframe, the liquidity hunt under $80K is obvious, as Bitcoin dipped into this liquidity zone earlier than staging a swift bullish rebound. Nonetheless, after breaking under the ascending channel, the worth has been forming a descending wedge sample, suggesting additional potential consolidation.

Within the brief to mid-term, Bitcoin is more likely to proceed shifting inside this wedge whereas staying above the $78K help. A breakout from this sample, both above the wedge or under the $78K mark, will possible lead to a major value transfer within the path of the breakout.

On-chain Evaluation

By Shayan

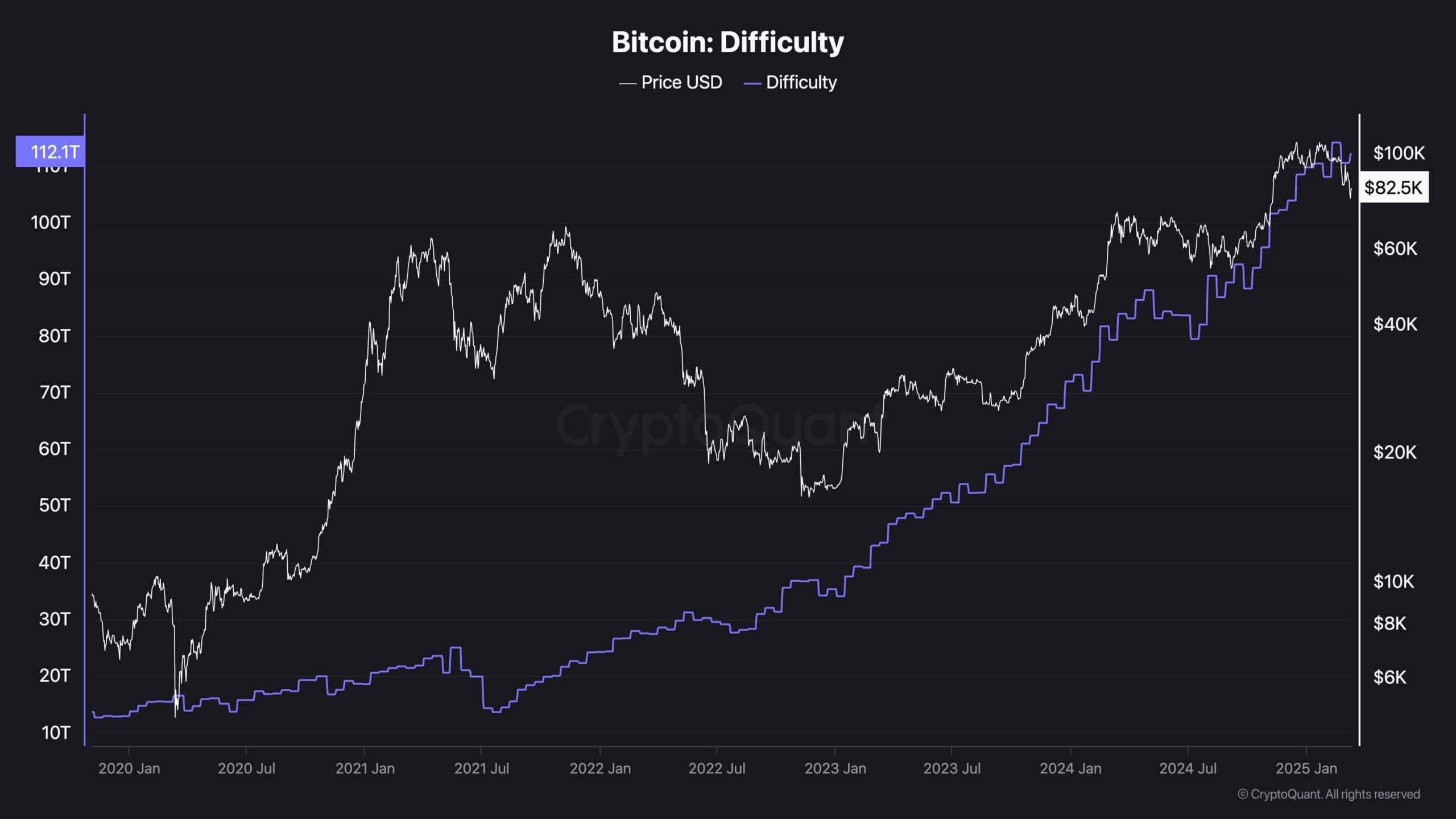

Bitcoin’s mining issue stays in an uptrend regardless of the continuing market correction. In the course of the prolonged correction section that started in March 2024, mining issue skilled a brief drop. Nonetheless, Bitcoin’s value rebounded sharply, contradicting bearish predictions. Though the market is now present process a 30% correction, mining issue continues to rise.

A decline in mining issue sometimes signifies miner capitulation, the place much less environment friendly mining rigs are shut down. Thus far, there are not any indicators of such behaviour. Nonetheless, if the correction extends additional, we might see mining issue lower as a result of miner capitulation.

Miners seem like sustaining a holding technique, which means that the broader uptrend stays intact. This section requires persistence fairly than untimely conclusions as market dynamics proceed to evolve.

The put up Bitcoin Price Analysis: Can BTC Reclaim $90K This Week? appeared first on CryptoPotato.