Bitcoin is struggling to interrupt by means of the essential resistance on the 200-day shifting common. A profitable reclaim of this degree might pave the way in which for a rally towards the $90K area.

Technical Evaluation

By Shayan

The Day by day Chart

BTC has rebounded from the ascending wedge’s decrease boundary, aligning with the 0.618 Fibonacci retracement degree at $78K. Nevertheless, it now faces a major resistance zone close to the 200-day shifting common ($85K), a degree traditionally related to robust provide and promoting strain.

A breakout above this key resistance might set off a short-squeeze, doubtlessly propelling Bitcoin towards the $90K mark. Nevertheless, the presence of robust sellers at this degree means that additional consolidation is the extra possible short-term final result. If Bitcoin faces rejection, a retest of the ascending wedge’s decrease boundary ($78K) may very well be imminent.

The 4-Hour Chart

On the decrease timeframe, BTC has approached the higher boundary of a descending wedge at $85K. This sample usually indicators waning bearish momentum and a possible bullish reversal.

A profitable breakout above $85K might result in a rally towards $90K. Nevertheless, given present market circumstances and a scarcity of robust shopping for demand, Bitcoin is extra more likely to proceed consolidating throughout the wedge within the quick time period earlier than making a decisive transfer.

Sentiment Evaluation

By Shayan

Bitcoin’s worth stays caught in a spread, leaving traders questioning what’s stopping the market from persevering with its upward development. A more in-depth have a look at futures market metrics gives a possible rationalization.

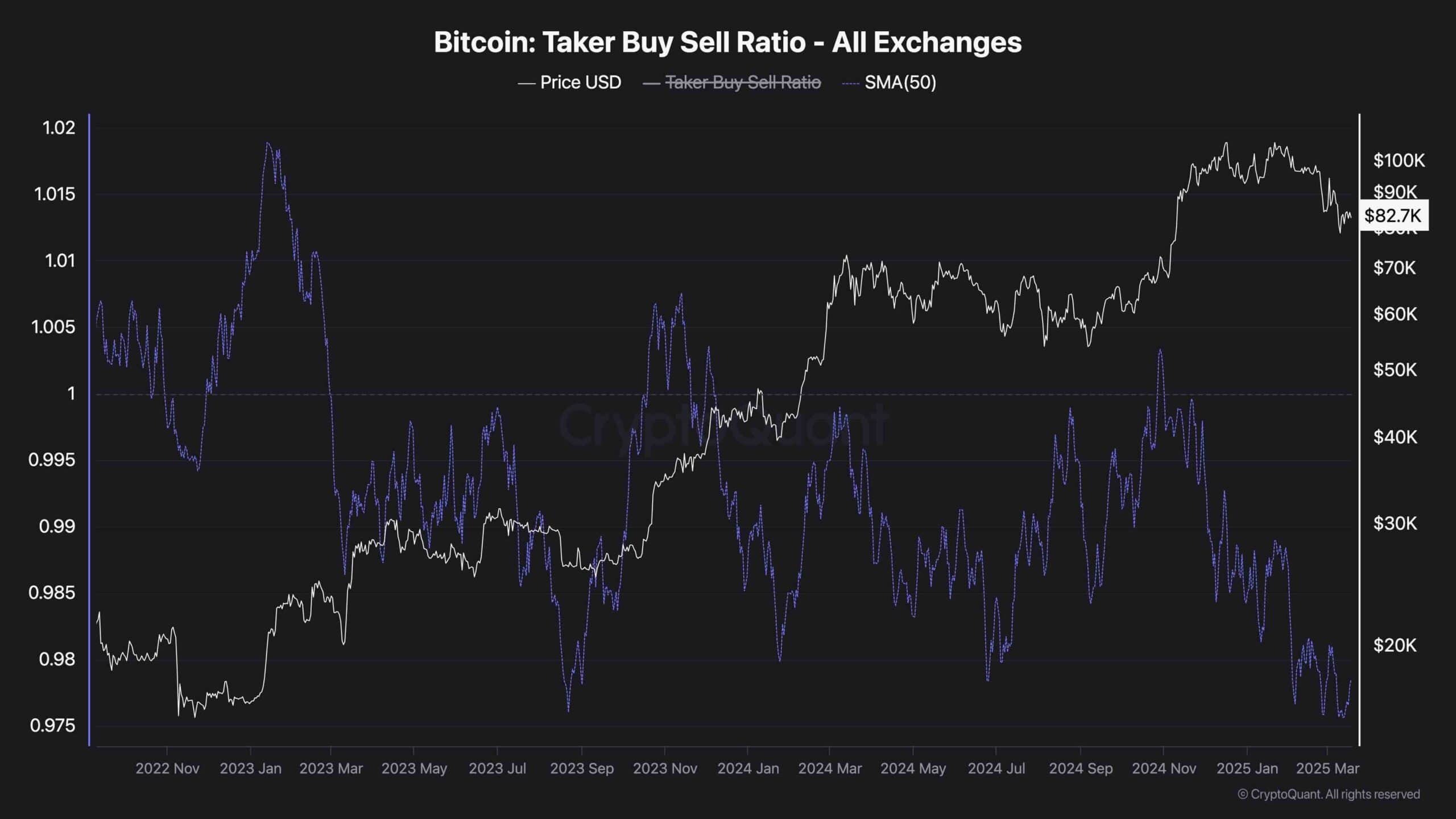

One key indicator, the Bitcoin taker buy-sell ratio, measures whether or not patrons or sellers are executing positions extra aggressively within the futures market. Aggressive orders seek advice from these positioned on the market worth, indicating the next urgency to purchase or promote.

Not too long ago, the 50-day shifting common of this metric has been trending downward after months of regular will increase. This shift means that sellers have regained management over the futures market, making use of important strain and certain inflicting Bitcoin’s current lack of bullish momentum.

If this development continues, Bitcoin might wrestle to interrupt out of its present consolidation section. Nevertheless, if patrons regain dominance, a reversal on this metric might sign renewed bullish momentum and a possible breakout to greater ranges.

The put up Bitcoin Price Analysis: Will $80K Hold, or Is Another Breakdown Ahead? appeared first on CryptoPotato.