Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is going through an important take a look at because it struggles to interrupt above key resistance ranges whereas holding simply above important help. The market stays caught in a decent vary, reflecting rising indecisiveness amongst merchants and buyers. Uncertainty has turn out to be the brand new regular, with macro circumstances and political developments persevering with to cloud sentiment.

Associated Studying

US President Donald Trump has added additional volatility to the combination, unsettling monetary markets with unpredictable insurance policies and newly imposed tariffs. His erratic habits has solely intensified the delicate temper, pushing threat property like Bitcoin into deeper consolidation.

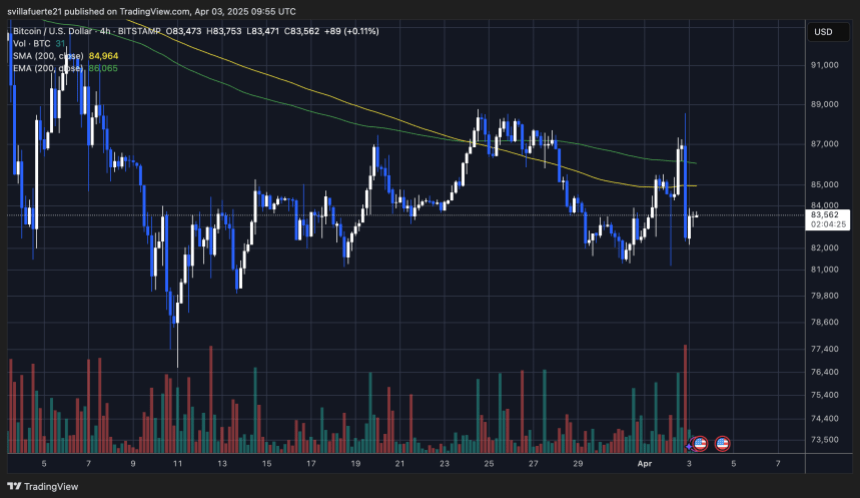

Regardless of transient rallies, Bitcoin has as soon as once more failed to interrupt above descending resistance, based on crypto analyst Carl Runefelt. This rejection, paired with declining buying and selling quantity, is an indication that consumers could also be shedding energy. Runefelt warns that if quantity continues to dry up and BTC stays caught under key ranges, the bearish goal of $78,600 stays a powerful chance.

Whereas bulls are defending support zones for now, the shortage of momentum is elevating crimson flags. Except Bitcoin can reclaim greater floor quickly, the chances of a deeper correction will proceed to develop — making the approaching days essential for figuring out the market’s subsequent course.

Bitcoin Down 25% from January ATH As Bears Tighten Grip

Bitcoin is now down 25% from its January all-time excessive, and bulls are struggling to regain management. After repeated makes an attempt to reverse the pattern, BTC continues to carry above the $81,000 stage — a key help zone — however has didn’t reclaim the $86,000 mark, which is critical to substantiate any severe restoration. The lack to push greater has weakened market confidence, and bulls now discover themselves in a tough place.

Macroeconomic uncertainty and fears surrounding escalating commerce wars, particularly below U.S. President Donald Trump’s unpredictable insurance policies, have added to market volatility. These components proceed to favor the bears, and the stress on high-risk property like Bitcoin stays intense. With broader monetary markets below stress, bullish sentiment within the crypto house is fading shortly.

Panic is starting to set in for some buyers as promoting stress exhibits no signal of slowing. Nevertheless, there’s nonetheless a sliver of optimism amongst market watchers who consider {that a} bounce might observe as soon as key resistance ranges are reclaimed.

Runefelt recently shared insights pointing to BTC’s failure to interrupt above descending resistance — a bearish signal. He additionally famous that buying and selling quantity continues to say no, an indication that market participation is scaling down. This lack of quantity typically precedes giant strikes, and on this case, the bearish goal of $78,600 stays firmly on the desk if bulls fail to reclaim momentum.

For now, the market stays on edge. Bitcoin’s potential to carry above $81K and try a transfer previous $86K can be important in figuring out whether or not a restoration is feasible — or if the following leg down is about to start.

Associated Studying

Technical Particulars: Key Ranges To Maintain

Bitcoin is at the moment buying and selling at $83,500 after a number of days of uneven, unstable worth motion that has left merchants unsure in regards to the market’s subsequent course. The latest swings between key ranges have highlighted the indecision amongst each bulls and bears, with neither facet in a position to take full management. For bulls, the fast problem is to reclaim the $85,000 stage, which aligns with the 4-hour 200-day shifting common (MA). A profitable transfer above this mark can be an encouraging sign of short-term energy.

Past that, the following key stage is $86,000, which is the place the 4-hour exponential shifting common (EMA) sits. Reclaiming this zone would assist shift momentum again in favor of the bulls and probably set the stage for a restoration try towards $90,000.

Associated Studying

Nevertheless, essentially the most important stage within the quick time period is help at $81,000. This worth zone has acted as a powerful flooring in latest weeks, and shedding it could seemingly set off additional draw back stress. As macro uncertainty and market-wide volatility proceed, bulls should defend this help whereas working to reclaim the MAs above. The approaching periods can be essential in defining whether or not Bitcoin can get better—or slide deeper into correction territory.

Featured picture from Dall-E, chart from TradingView