Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In his August 5 “Macro Monday” livestream, crypto analyst Josh Olszewicz delivered a overview of the market’s late-summer state, arguing that whereas Bitcoin’s value motion has gone quiet, the broader cycle stays intact. “We’re on this pocket of seasonal weak spot for August and September that we sometimes see most years,” he defined, pointing to seasonality charts displaying that traditionally, Bitcoin underperforms on this time window. “It’s a excessive chance that August and September is a big nothing burger,” he added.

Is The Bitcoin Bull Run Over?

At day 978 of the present cycle, the query many traders are asking, Olszewicz famous, is straightforward however existential: is the cycle already over? Will it finish this 12 months? Or is there extra upside forward? His reply leaned cautiously optimistic. “I’m within the ‘most likely not over but, might proceed’ camp,” he said. “However we must see what occurs in This autumn. In the end, that’s going to find out it.”

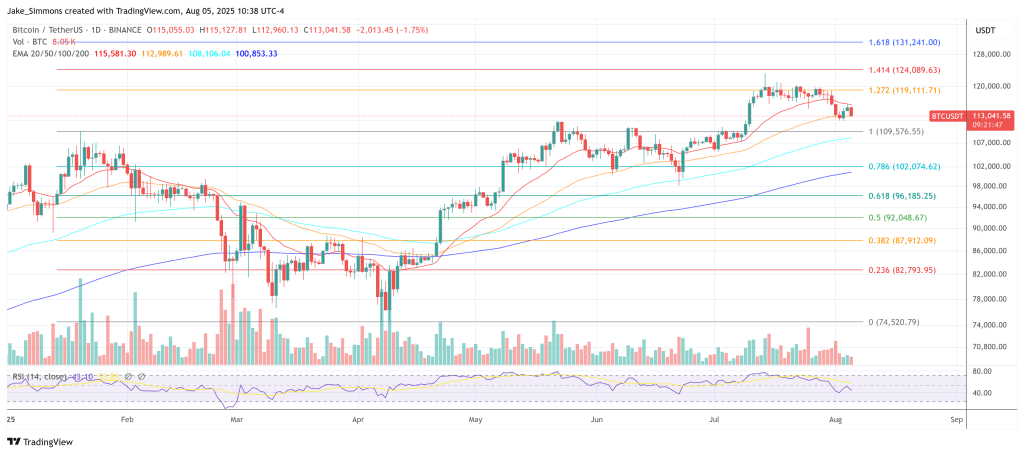

From a technical standpoint, the analyst sees no motive to declare the highest is in. “Technicals nonetheless look effective. Worth nonetheless appears to be like okay. We had a pullback. All that’s effective,” he stated, emphasizing that Bitcoin has not but exhibited the standard parabolic advance related to main tops. Nor produce other macro or on-chain metrics proven indicators of terminal overheating. “We don’t produce other metrics screaming from the rooftop saying it’s time but.”

Associated Studying

Nonetheless, the short-term setup is underwhelming. After a cup-and-handle breakout that briefly pushed value towards the $122,000–$123,000 area, momentum pale. Olszewicz doubts such levels can be reclaimed quickly: “Within the subsequent two weeks we’ll know if we are able to begin to creep again in the direction of $120,000, which is asking loads admittedly for August.” The wildcard, he stated, is ETF flows. “Will we see ETF flows for any motive? Then will we see treasury companies persevering with to purchase? These are the marginal patrons proper now.”

He prompt that ETF buyers might return as a consequence of a mixture of underweight positioning, opportunistic dip-buying, and month-to-month rebalancing dynamics. Nonetheless, he stays impartial general. “Only a normal softening of any bullishness we could have had,” he stated. “Now it’d be a special story if that is October and we’re seeing this. That’s not regular.”

An extra motive for warning is the collapse in futures foundation throughout main property. “Premium is all the way in which all the way down to beneath 7% on BTC. It’s beneath 8% on ETH. And I feel SOL is a bit more illiquid, however even SOL is method down—15% from 35%,” he famous. That contraction in futures premiums, sometimes an indication of speculative demand drying up, displays a broader risk-off temper. “Not lots of bullish sentiment, not lots of craziness,” Olszewicz noticed.

Associated Studying

On-chain threat metrics affirm the pattern. “There’s a decline right here in threat urge for food,” he stated, referring to metrics like unrealized revenue versus MVRV. He added that if Bitcoin had been to enter a parabolic advance, “you will notice this metric shoot up… However what’s it going to take?”

This autumn Or Bust

He floated a number of prospects: charge cuts, weakening Fed independence, or maybe simply seasonal power and macro chaos in This autumn. However for now, he suggested merchants to “take it simple on the 50X leverage,” particularly those that’ve already made important good points this cycle. “Do I have to put threat again on? Do I have to be as dangerous as I used to be earlier?” he requested rhetorically. “Or does it make extra sense to be much less dangerous right here?”

From a macroeconomic perspective, the image is combined. Inflation knowledge from Trueflation stays low—presently at 1.65%—however Olszewicz warned that new submit–August 1 tariffs could elevate costs within the months forward. “We’re including inflationary pressures with tariffs, little question about it,” he stated, although the impact will take time to seem within the knowledge. In the meantime, core PCE is headed within the improper path, and the Atlanta Fed’s GDPNow mannequin is printing 2.1% progress for Q3—hardly recessionary, however not strong both.

Labor market knowledge continues to cloud the outlook. “If we account for a non-collapsing labor pressure participation, we might be as excessive as 4.9% on the precise unemployment charge,” Olszewicz warned. “And we’re persevering with to see a degradation in job availability for manufacturing,” notably in “Heartland Rust Belt forms of jobs.”

Liquidity dynamics are additionally in flux. He drew consideration to the draining of the Fed’s reverse repo facility—as soon as a $2 trillion reservoir of sidelined capital—which has supported threat property by means of 2023 and 2024. “As this will get drained nearer to completion, there’s a possible chance for liquidity hiccups and a liquidity intervention by the Fed,” he stated. Importantly, this has stored general US liquidity flat, offsetting quantitative tightening. “Regardless of QT, the drain of the reverse repo has offset QT, and US liquidity by this metric has been mainly flat since 2022.”

What modified the sport, Olszewicz stated, was not liquidity per se, however the launch of spot Bitcoin ETFs. “That has actually been, in my view, an enormous distinction maker,” he defined. “We received ETF approvals right here, ETF began buying and selling right here, and the remainder is historical past so far as flows are involved.”

In conclusion, Olszewicz emphasised that whereas the broader threat urge for food has declined and value motion stays uninteresting, there is no such thing as a proof but that the Bitcoin cycle has topped. “The cycle’s most likely not over,” he stated. “It’s simply sleeping—and This autumn will finally decide whether or not it wakes up.”

At press time, BTC traded at $113,041.

Featured picture created with DALL.E, chart from TradingView.com