Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the chaos that was sparked by Israel’s assault on Iran, Bitcoin has climbed once more, shaking off the losses triggered by the conflict. Not solely has the value seen a rise from its final week’s lows, however there has additionally been a notable change within the cryptocurrency’s every day buying and selling quantity. This factors to continued curiosity regardless of world elements and will imply that the expectations of struggle are already getting priced in for the crypto market.

Bitcoin Sees Virtually 100% Leap In Quantity

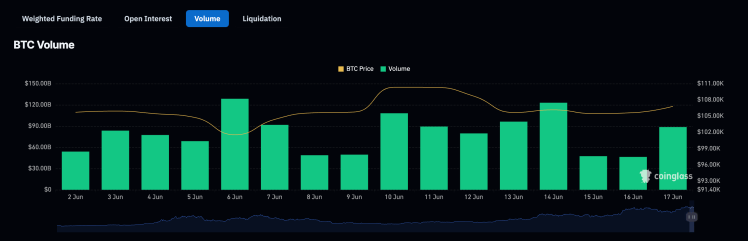

In line with knowledge from Coinglass, there was a flip within the tide for the Bitcoin trading volume after beginning out the brand new week in a sluggish pattern. Sunday and Monday had seen the Bitcoin every day buying and selling quantity come out beneath $50 billion. Nonetheless, because the Bitcoin value rose main as much as Tuesday, so did the buying and selling quantity.

Associated Studying

On the time of writing, the Bitcoin every day buying and selling quantity had already crossed $88 billion for Tuesday, resulting in an virtually 100% enhance within the buying and selling quantity throughout this time. This follows the pattern of excessive volatility coming with elevated volumes because the Bitcoin value swung wildly between $105,000 and $108,000.

The sharp leap in quantity comes because the Bitcoin open interest remains high at close to all-time highs whereas the remainder of the market struggles. Coinglass knowledge exhibits the present open curiosity at $71 billion, lower than $10 billion away from the $80 billion all-time excessive recorded in Might 2025.

In mild of altcoins persevering with to pattern low whereas Bitcoin stays near all-time highs, it means that a lot of the consideration within the crypto market is now being focused on Bitcoin. Because of this, the main asset continues to dictate the course of the market, with dominance remaining excessive above 64%.

How Struggle May Have an effect on This Pattern

The constructive developments surrounding Bitcoin are coming as there appears to be a cooldown in the conflict in the Middle East. However with so little time having handed, expectations are that the struggle might solely be beginning, with some calling it the beginning of ‘World Struggle 3.’

Associated Studying

The Kobeissi Letter has taken to X (previously Twitter) to address these World Struggle 3 predictions, revealing how the markets would react if there actually was a chance of this occurring. The very first thing was {that a} 50% likelihood of World Struggle 3 would’ve seen the S&P crash not 2%, however extra of a 30% crash. Gold can be $5,000/oz, and oil would go for $100/barrel.

Moreover, a 90% likelihood of World Struggle 3, as defined within the publish, would seemingly trigger the S&P to crash 50%, with the costs of gold and oil surging to $10,000/oz and $200/barrel, respectively. Given Bitcoin’s correlation with the inventory market to date, there isn’t any doubt that such a crash would have carried over, triggering disastrous losses for the crypto market.

Given these, The Kobeissi Letter explains that the markets are saying the possibilities of World Struggle 3 are slim. Right now, they anticipate a decision to the battle. “Futures throughout the board this morning noticed de-escalation coming,” the publish learn.

Featured picture from Dall.E, chart from TradingView.com