Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

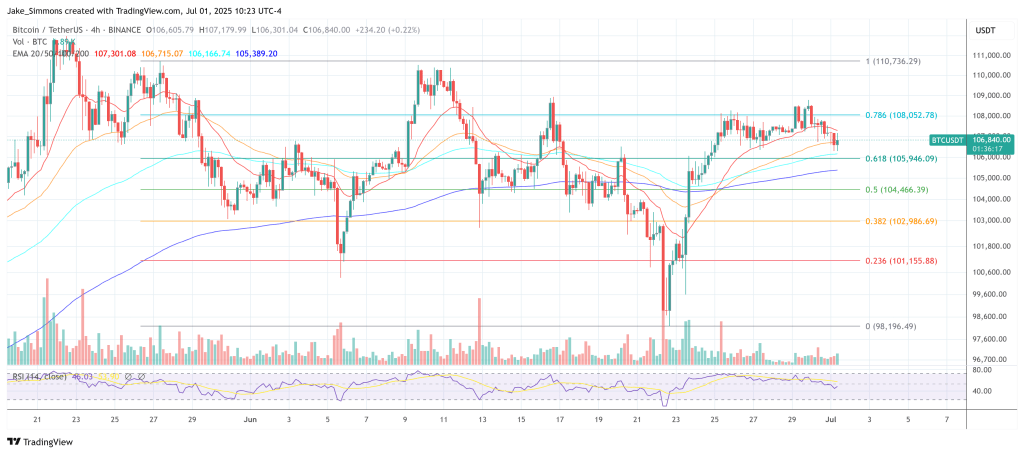

The newest Crypto Market Compass from Bitwise Europe lands like a klaxon: each main gauge of danger urge for food, liquidity and macro momentum is swinging in Bitcoin’s favor, and the agency argues the transfer might “present a major tailwind” for the benchmark asset. The examine notes that Bitcoin already rebounded from $101,000 to about $108,000 up to now week as merchants digested a potent cocktail of cooling inflation, thawing geopolitics and an more and more dovish Federal Reserve stance.

Good Storm Brewing For Bitcoin

Bitwise’s proprietary Cryptoasset Sentiment Index has surged to its most optimistic studying since Could—“now clearly sign[ing] a bullish sentiment once more,” the authors write. Behind that surge lies an unprecedented torrent of capital into exchange-traded merchandise: cumulative web inflows to international Bitcoin ETPs have reached a year-to-date file of $14.3 billion, with 5 consecutive periods final week including one other $2.2 billion—or roughly 20,763 BTC—to the pile. “Cumulative web inflows … sign potential upside alternative for the worth of Bitcoin,” Bitwise says, including that US spot ETFs at the moment are on a 14-day successful streak that might eclipse the 16-day file set shortly after launch in early 2024.

Associated Studying

Why are traders all of a sudden embracing danger? Bitwise factors to what it calls a “decline in macro uncertainty.” July might ship new US trade accords with Canada, whereas Washington and Tehran have struck a surprisingly conciliatory tone; former President Donald Trump has even floated lifting sanctions if Iran stays peaceable.

On high of that, Fed Chair Jerome Powell has tied the timing of a resumption of price cuts to progress on tariff talks—an alignment that leaves the door open to looser coverage inside weeks. The report sums up the temper: “The trifecta of declining geopolitical dangers, commerce coverage uncertainty and potential financial coverage stimulus ought to proceed to elevate market sentiment and supply a major tailwind for Bitcoin and different crypto belongings.”

*** 𝗡𝗘𝗪 ***

We’ve simply printed our newest 𝗕𝗶𝘁𝘄𝗶𝘀𝗲 𝗠𝗼𝗻𝘁𝗵𝗹𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗠𝗮𝗰𝗿𝗼 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿 report for 𝗝𝘂𝗹𝘆 𝟮𝟬𝟮𝟱!Listed below are the 𝗸𝗲𝘆 𝘁𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀 from the report that you have to know:

➡️ 𝗝𝘂𝗻𝗲’𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻… pic.twitter.com/UYBRwvRE6e

— André Dragosch, PhD⚡ (@Andre_Dragosch) July 1, 2025

On-chain indicators look equally primed. Whale wallets (1,000 BTC or extra) withdrew 8,740 BTC from exchanges final week, trade reserves sank to 2.898 million BTC—simply 14.6 % of provide—and web promoting stress on spot venues fell from $2.2 billion to solely $0.5 billion.

Associated Studying

Derivatives paint a extra nuanced image: futures open curiosity slid by 20,000 BTC, and bearish perpetual funding charges trace at lingering brief bias, however choices markets present merchants quietly standing down—put-call open curiosity fell to 0.59 whereas one-month implied volatilities eased towards 38%. Bitwise interprets the mix as “short-term consolidation” within the face of an intact longer-term uptrend.

Conventional markets are additionally thawing. Bitwise’s Cross-Asset Danger Urge for food (CARA) index jumped from 0.31 to 0.49, reinforcing proof that capital is rotating again into growth-sensitive trades. Some 70% of tracked altcoins beat Bitcoin final week, a breadth thrust traditionally related to early-cycle bull phases.

In its bottom-line evaluation, Bitwise stops in need of worth targets however leaves little doubt about route: so long as geopolitical détente, commerce breakthroughs and an accommodative Fed converge with relentless ETF inflows, “a decisive return in international danger urge for food” is more likely to preserve Bitcoin on an upward trajectory. Ought to US spot ETFs safe simply three extra periods of web inflows this week—surpassing their 2024 file—the agency suggests the market might uncover how rapidly a supply-constrained asset can react when the macro wind blows at its again.

At press time, BTC traded at $106,840.

Featured picture created with DALL.E, chart from TradingView.com