Key Takeaways

- BlackRock’s iShares Bitcoin Belief confronted its largest single-day outflow of over $430 million.

- US-listed spot Bitcoin ETFs collectively skilled $616 million in outflows amid Bitcoin’s value decline.

Share this text

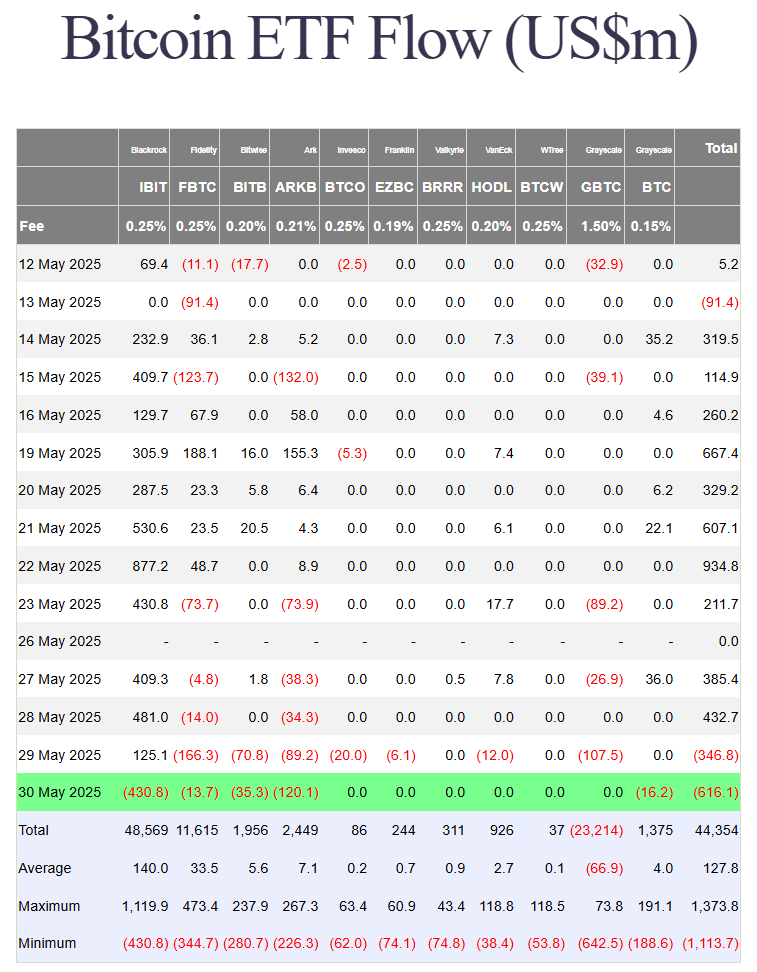

BlackRock’s iShares Bitcoin Belief (IBIT) noticed over $430 million in outflows after markets closed Friday, snapping a week-long influx streak that had lasted since April 10. It was the ETF’s largest single-day web outflow since launch, according to Farside Traders.

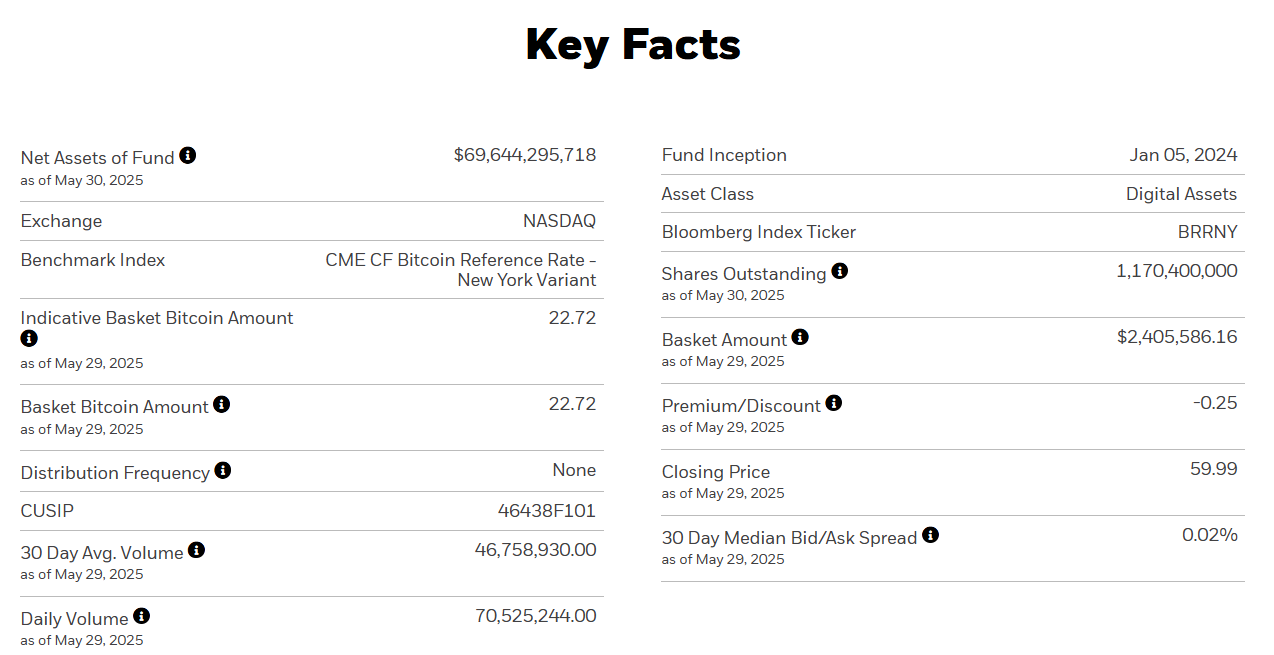

IBIT continues to dominate the worldwide Bitcoin ETF market, regardless of its current pullback. The fund has introduced in round $48 billion in new capital since launch, with property below administration nearing $70 billion.

Different competing Bitcoin ETFs additionally posted losses on the ultimate buying and selling day of Might.

Constancy’s FBTC noticed outflows of roughly $14 million, Grayscale’s GBTC misplaced round $16 million, Bitwise’s BITB shed $35 million, and Ark Make investments’s ARKB recorded the main outflow at $120 million.

General, US-listed spot Bitcoin ETFs misplaced about $616 million on Friday, persevering with their slide after $346 million in outflows on Thursday.

The return of unfavourable ETF flows coincided with renewed promoting stress on Bitcoin. After reaching a weekly excessive of $110,000, the asset slipped under $105,000 on Thursday, then edged nearer to $103,000 by Saturday.

On the time of writing, Bitcoin was hovering round $103,700, per TradingView data.

Share this text