Ethereum’s value roller-coaster has drawn a dramatic wager from massive gamers. Whereas many smaller merchants are bracing for extra losses, a handful of huge accounts have damaged the floor and put tens of millions in an enormous present of power.

Ethereum Whale Bets Floor

In response to on-chain knowledge, one whale opened a protracted place price $101 million at an entry value of $2,247, utilizing 25x leverage. That guess paid off with roughly $950,000 in revenue, but it surely additionally value $2.5 million in charges. These numbers present simply how excessive the stakes have grow to be.

Excessive Charges Minimize Into Features

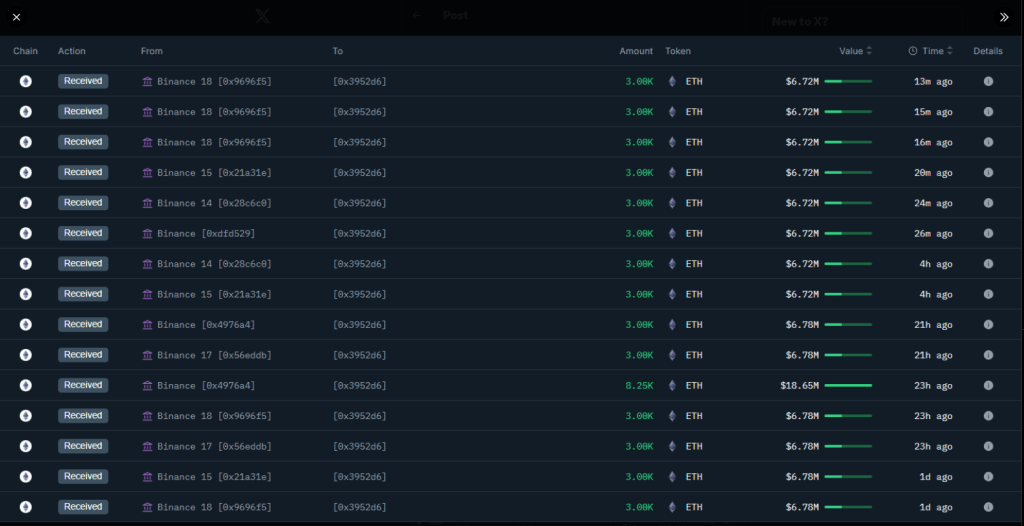

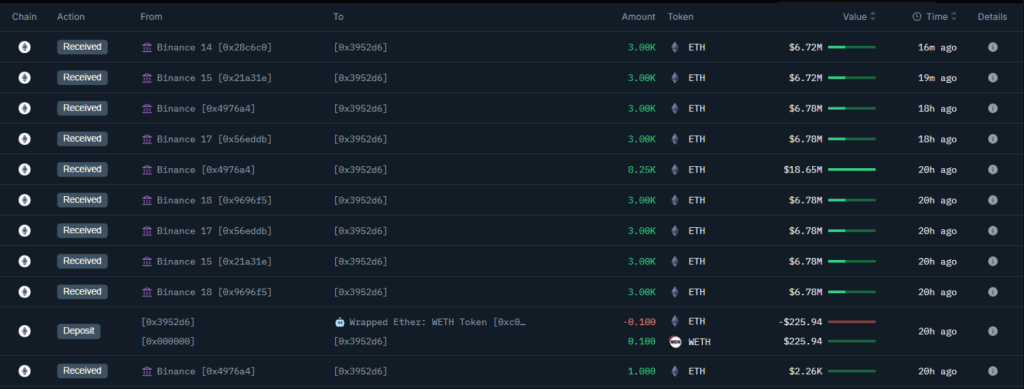

This whale additional withdrew 18,000 $ETH price $40.38M from #Binance.

Now, the whale holds 50,256 $ETH price $112.62M, presently down $2.24M

Handle: 0x3952d69643f7a87237c7fc8bb33f8453c0b45500 https://t.co/49vC0iqMZP pic.twitter.com/rF5cX2gsXZ

— Onchain Lens (@OnchainLens) June 23, 2025

Primarily based on stories from On-Chain Lens, one other whale moved over $40 million in Ether from Binance earlier than opening its personal leveraged commerce.

Mix the 2 wallets and also you’ve obtained about $112 million driving on an ETH bounce. But these $2.5 million in charges spotlight the hidden value of huge bets.

Center East Rigidity Hits Costs

ETH slipped to about $2,113 on Sunday, marking its lowest stage in 30 days. That drop got here after US military strikes on Iran’s nuclear websites.

United States President Donald Trump known as the operation a “spectacular success” and warned of extra motion if Iran didn’t again down. Merchants say the fallout from these strikes rattled international markets and fed crypto volatility.

Retail Merchants Watch Carefully

Retail merchants are likely to promote when costs drop. However these whales have the scope to climate downswings. Their massive purchases point out that they discover worth at present ranges. Quick merchants may not agree, nevertheless. They’re sitting in lots of brief positions, anticipating ETH to say no additional earlier than it is going to rise.

What The Whales See

Consultants say massive holders are likely to have decrease break-even factors. They’ll afford to attend months or years for a payoff. Some additionally use advanced methods throughout a number of markets. That makes their strikes onerous to learn from the skin. Nonetheless, while you see $112 million on the road, it’s a touch that smart money senses a shopping for window.

Dangers On Each Sides

Leveraged trades amplify features and losses equally. A 5% drop would set off a pressured sell-off on a 25x place. That would feed a pointy decline in ETH’s price. Then again, if the market turns up, these whales may pocket massive returns properly past what retail merchants see.

Traders might be watching each market swing. If geopolitical tensions cool and massive cash stays bullish, ETH may discover footing above $2,200. However one other shock—political or technical—may ship the value tumbling once more.

Featured picture from Imagen, chart from TradingView