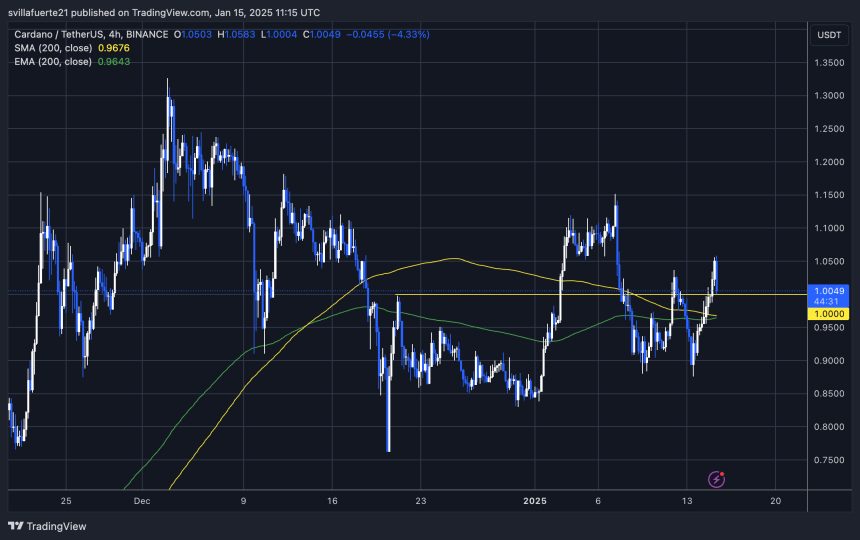

Cardano is at a pivotal second, striving to carry the $1 mark as a key help degree to maintain its upward momentum. The altcoin has skilled vital volatility in latest buying and selling classes, with a dramatic 15% drop adopted by a powerful restoration of over 20% inside simply 24 hours. This fast value motion has introduced renewed consideration to ADA, as traders assess its potential for additional positive factors.

Associated Studying

Prime analyst Ali Martinez has shared essential insights, revealing that whales have accrued 100 million Cardano (ADA) prior to now 48 hours. This vital shopping for exercise by massive holders underscores rising confidence in ADA’s long-term potential and its capacity to take care of its bullish trajectory.

Cardano’s makes an attempt to ascertain stability above $1, a psychological and technical degree that might act as a springboard for further rallies. Buyers are carefully watching this degree, as holding it as help may signify a powerful basis for ADA to problem greater resistance zones.

Cardano Finds Energy To Rise

After a latest sharp drop, Cardano (ADA) is displaying resilience, discovering the power to rise and eyeing a push above final 12 months’s excessive of $1.32. This restoration has sparked optimism amongst analysts and traders, lots of whom are calling for a major rally. Cardano is more and more considered as a powerful contender to develop into a market chief, pushed by its sturdy improvement ecosystem and increasing use circumstances.

Prime analyst Ali Martinez has shared compelling data highlighting rising curiosity from sensible cash traders. Posting on X, Martinez revealed a chart displaying that whales have accrued 100 million ADA over the previous 48 hours. This substantial buy underscores confidence amongst massive holders that present value ranges current a helpful shopping for alternative, setting the stage for additional upward momentum.

This surge in whale exercise aligns with broader expectations for Cardano to capitalize on its technological benefits and potential as a pacesetter within the blockchain house. The cryptocurrency’s capacity to draw vital capital from institutional and high-net-worth traders reinforces its potential to outperform within the coming months.

Associated Studying

Cardano’s subsequent problem will likely be reclaiming key resistance at $1.32. Efficiently breaking this degree would doubtless set off a considerable rally, doubtlessly propelling ADA into a brand new bullish section. The approaching days will likely be pivotal in figuring out whether or not Cardano can maintain this momentum and fulfill its promise of turning into a market frontrunner.

ADA Bulls Eye Key Ranges

Cardano (ADA) is at present buying and selling at $1 after briefly reaching $1.05 earlier within the session. The worth is consolidating and in search of help on the psychologically vital $1 degree. If this key help holds, the following goal for ADA is $1.15, a resistance degree that might open the doorways to additional positive factors.

Market sentiment round ADA stays cautiously optimistic. Because of this, holding the $1 mark would sign sturdy demand and set the stage for a possible surge as bullish momentum builds. A breakout above $1.15 may result in an prolonged rally, doubtlessly revisiting earlier highs and getting into a brand new bullish section.

Nonetheless, dropping the $1 help would recommend that demand is faltering. On this situation, ADA may see a drop to its subsequent main help degree round $0.91, placing extra stress on bulls to regain management.

Associated Studying

The approaching days will likely be essential for ADA because it checks its capacity to maintain present ranges. Due to this fact, merchants and traders are carefully expecting indicators of power or weak point that might dictate the altcoin’s short-term trajectory. Whether or not Cardano can keep its footing above $1 will decide whether or not the latest restoration evolves right into a sustained rally or one other interval of consolidation.

Featured picture from Dall-E, chart from TradingView