Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a recent interview with Bloomberg, ARK Funding Administration Founder and CEO Cathie Wooden as soon as once more reaffirmed her bold value goal for Bitcoin, predicting it may soar to $1.5 million per coin by the yr 2030. Regardless of the current market volatility and a pronounced “risk-off” setting, Wooden stays steadfast in her conviction that the main cryptocurrency will proceed its long-term upward trajectory.

“Sure, it’s our view,” Wooden replied when requested whether or not she nonetheless expects Bitcoin to achieve her acknowledged value goal. “I feel proper now we’re in a risk-off interval typically. And for those who’ve been watching Bitcoin, it’s nearly been a frontrunner when it comes to danger on, danger off.”

Cathie Wooden Nonetheless Calls $1.5 Million Bitcoin By 2030

In keeping with Wooden, on-chain analytics point out that Bitcoin is at present “in the course of a bit of bit greater than midway via a four-year cycle”—a reference to BTC’s traditionally repetitive 4-year cycle. She emphasised that “we expect we’re nonetheless in a bull market” and expects “deregulation” in the USA to play a vital position in encouraging extra establishments to enter the asset class.

Wooden additional argued that institutional asset allocators “need to have a standpoint on this new asset class” and that incorporating Bitcoin into portfolios will doubtless enhance risk-adjusted returns.

Associated Studying

Amid a broader market sell-off, Wooden instructed a “rolling recession” situation may already be unfolding. She cited rising concern over job safety and an growing financial savings fee as proof: “We see the saving fee going up. We see the rate of cash coming down, and we do suppose we’ll see one or two unfavourable quarters.”

She maintained that such financial stress may compel the Federal Reserve to reverse course later this yr: “We wouldn’t be stunned to see two or three cuts. […] We predict inflation’s going to shock on the low aspect of expectations.”

Wooden pointed to declining gasoline costs, egg costs, and rents as alerts that inflation could also be cooling sooner than many anticipate, granting the Fed “extra levels of freedom within the second half of this yr.”

Turning to regulation, Wooden sounded notably optimistic concerning the “easing regulatory setting” round cryptocurrency. She highlighted the US Securities and Exchange Commission’s (SEC) method to meme cash, noting that by “declaring these meme cash not securities”, the regulators have basically mentioned, “Purchaser beware […] We predict most of them usually are not going to be price very a lot. […] What we expect will occur is […] there’s nothing like dropping cash for folks to study.”

Nonetheless, Wooden underscored that Bitcoin, Ethereum, and Solana are core belongings with “use circumstances […] multiplying” and more likely to stay integral within the crypto ecosystem, in stark distinction to the “hundreds of thousands of meme cash” she believes will ultimately lose their worth.

Associated Studying

Wooden additionally mentioned her funding thesis for Robinhood and Coinbase, revealing that ARK views each firms as frontrunners within the battle for digital pockets dominance. She in contrast digital wallets to bank cards, suggesting “most of us don’t have very many bank cards”—and, by extension, most customers is not going to maintain quite a lot of digital wallets.

Moreover, she drew consideration to the rise of tokenization, noting that BlackRock’s curiosity in tokenizing belongings is a sign that large-scale gamers envision a “difficult […] new world” in capital formation. She additionally cited rising markets as a key terrain the place stablecoins and Bitcoin already function backstops to guard buying energy from forex devaluation: “For those who go to rising markets […] they’re utilizing Bitcoin […] but in addition stablecoins, which is successfully the greenback as backstops to their buying energy and wealth.”

Cathie Wooden stays undeterred by short-term fluctuations or market jitters. Whereas reaffirming her high-profile bets on Tesla, Bitcoin, and disruptive applied sciences like synthetic intelligence, she reiterated her overarching thesis: innovation and blockchain-based platforms will proceed to drive deflationary forces and create new alternatives for development. “We have now been recognized for our Tesla name and our Bitcoin name. […] I might add in AI platforms as a service firm like Palantir.”

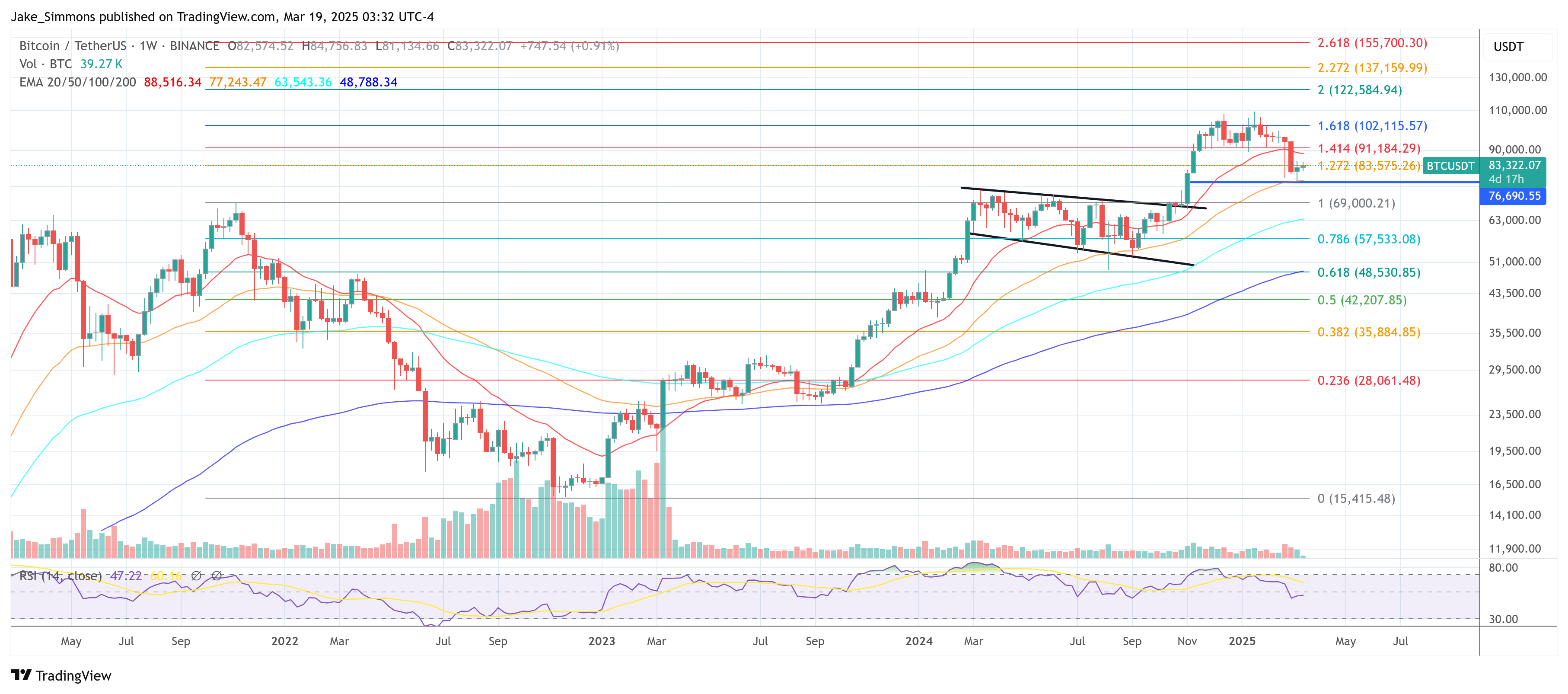

At press time, BTC traded at $83,322.

Featured picture from YouTube, chart from TradingView.com